September 19, 2019

For decades, the U.S. beef industry has been turning out more pounds of beef per animal in the herd. And for decades, the packing industry operated on squeaky-tight margins because the industry had too much slaughter capacity for the number of animals needed to meet demand for beef.

Several beef packing plants were shuttered or scaled down in the 2000s and early 2010s. Producers launched the expansion phase of the current cattle cycle in 2014. Excess shackle space no longer exists. The current tight labor supply also means operational capacity is smaller than physical capacity. On Aug. 9, a fire took down Tyson Foods’ beef packing facility in Holcomb, Kan., which threw an entirely new wrench into the market.

The Holcomb plant handled about 5% to 6% of all U.S. cattle slaughter. The cattle slaughtered were almost all fed cattle. Taking that much capacity offline overnight provides an interesting case study in both the national and regional cattle price discovery and price determination processes. Those impacts are considerably different than they would have been back when the industry had excess shackle space.

Price discovery vs. determination

Price determination is the interaction of the broad forces of supply and demand, which determine the market price level. Price discovery is the process of buyers and sellers arriving at a transaction price for a given quality and quantity of a product at a given time and place.

If you’re thinking a basis relationship, you’re right. Futures provide a price determination mechanism for the overall market — so do the national or regional average cash prices. A host of local conditions help discover local prices. Those conditions vary from location to location.

So far in 2019, supply-and-demand price determination signals are rather positive. Through July (the most current data available at the time of this writing), commercial beef production was up 1.1% compared to the first seven months of 2018.

The 5-Area average negotiated live FOB fed cattle prices (USDA AMS LM_CT180 report) had also been higher by 0.7%, or 84 cents per cwt. Through July, all fresh retail beef prices were 9 cents per pound, or 1.5% higher compared to the same period last year. Willingness of consumers to pay more for beef, even though more beef is available, reflects solid retail demand.

Beef exports have been relatively strong, too. Through July, beef plus beef variety meat exports were down 1.6% from a year ago in volume, but were only down fractionally from 2018’s record value pace. Export volume was up 1.1% year over year in July, while value was still only slightly lower.

Price ratio to capacity matters

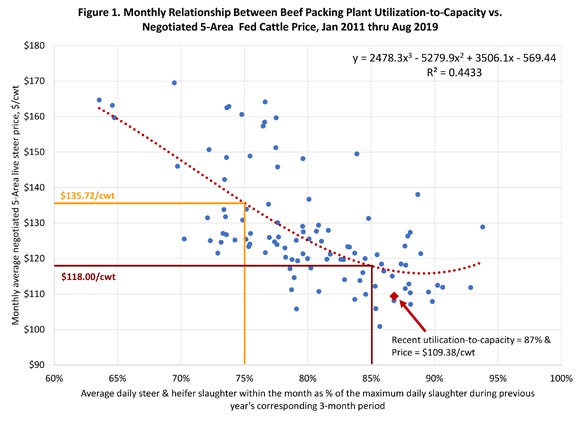

Figure 1 is the fitted relationship between beef packing capacity-utilization and fed cattle price.

Source: USDA-AMS; calculations by Lee Schulz

The values are for the average across the entire fed cattle industry, i.e., U.S. capacity and 5-Area prices. Here, I’m using the utilization-to-capacity measure that I have found to be the best fit: current month’s daily average steer and heifer slaughter divided by the maximum month’s daily maximum steer and heifer slaughter during the quarter of the prior year.

For example, the utilization-capacity ratio for August 2019 is the daily average steer and heifer slaughter in August 2019 divided by the maximum month’s daily maximum between the three months of June, July and August 2018.

So that if June 2018 had the highest level of daily slaughter compared to July or August 2018, then the ratio is the August 2019 daily steer and heifer slaughter divided by the June 2018 daily steer and heifer slaughter. This is an imperfect measure; we do not know the true U.S. fed cattle slaughter capacity, but it serves as a barometer, which can accurately capture trends and deviations from trend.

The fitted line in Figure 1 shows that at a lower industry average utilization-to-capacity level, the price of fed cattle is higher, and at higher industry average utilization-to-capacity level, the price of fed cattle is lower. The August 2019 level of utilization-to-capacity is 87% versus a fed cattle price of $109.38 per cwt. Clearly, this most recent point is below the computed trend line in the data. At 87% utilization-to-capacity, the predicted price from this simple model suggests a price of $116.48 per cwt.

Because many other factors impact the cattle market, one should be careful in associating too much causality between the utilization-to-capacity value and the level of fed cattle prices. Still, the data suggest that the Holcomb plant going down likely depressed prices more than would have occurred back when plant utilization rates nationwide had been lower.

Back then the price impact may have been little more than the extra costs to ship cattle to another plant. Most of that impact could have been confined to the area near where the plant went down.

Rising slaughter creates a squeeze

The significance of the Aug. 9 fire and the market’s reaction to it are likely being further amplified by the growing supply of finished cattle both nationwide and in Kansas. U.S. cattle on feed in feedlots with 1,000 or more head was record large for the Aug. 1 time period at 11.11 million head, 19,000 head more than a year ago. Cattle on feed in Kansas as of Aug. 1 stood at 2.34 million head, which was also an August record and represented 21.1% of the U.S. total.

We tend to look at slaughter capacity on a national basis and judge that against cattle numbers because those data are readily available. However, any sound analysis concerning changes in packing capacity and impact on prices might be best done on a more granular level.

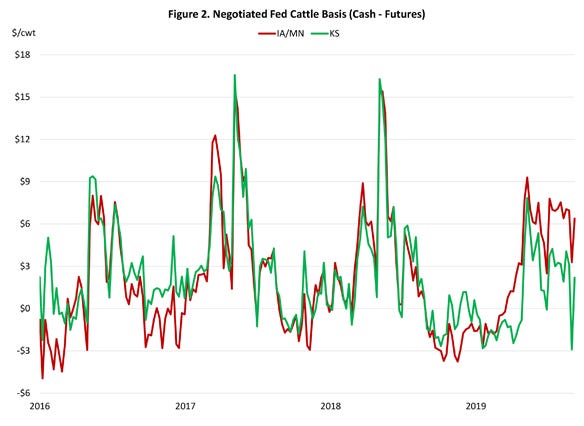

Local cash markets may have a different supply-and-demand situation than the broader market, i.e., futures market, which subsequently influences the cash price received resulting in the basis value (cash minus futures). Basis values can vary widely from state to state.

Local conditions help determine prices

Figure 2 depicts weekly negotiated fed cattle basis for Iowa-Minnesota and Kansas since 2016. For the month of August, the 2016-18 average basis for Iowa-Minnesota was $1.36 per cwt and for Kansas $2.09 per cwt. In both Iowa-Minnesota and Kansas, cash prices are greater than futures on average in the month of August.

Sources: USDA-AMS and CME group

In 2019, August basis values were $6.25 per cwt and $1.87 per cwt, respectively. The observed August basis level this year for Kansas was only slightly lower than expected based on historical averages, while for Iowa-Minnesota fed cattle, basis was almost five times the expected or recent average for basis. Local fed cattle markets are still reflecting the strong beef demand situation; however, the Kansas market is reflecting a situation where supply is closer to packing capacity than it once was.

When demand is strong, or expanding, and when supplies relative to packing capacity are small, or declining, price discovery problems are generally not a major concern. However, one of these conditions has temporarily changed. Beef demand is strong, but fed cattle supplies are large and expanding, and packing plant capacity has been constrained for the time being.

This has been one factor leading to lower fed cattle prices and has heightened price discovery concerns. But this situation should be relatively short-lived as the packing plant damaged by fire expects to be back on line in a couple of months.

Packers seek to operate efficiently

Packers strive to operate at a utilization rate where the number of cattle equals the operating capacity of the facility. Deviations in either direction help determine fed cattle price movement.

Too few cattle coming boosts fixed cost per head slaughtered. Importantly, packers may also have beef contracts to fulfill. Both factors provide incentives for packers to bid up to secure enough cattle to keep utilization level from dropping further. The higher price incentivizes more cattle production (heavier cattle short-term and more head longer-term).

Too many cattle coming forces packers to pay overtime. Supplies in cold storage build. Both boost processing cost per head. Higher costs lead packers to offer lower prices. If this persists long term, the price of beef eventually weakens to incentivize more beef consumption.

Anything that pushes packer costs higher eventually squeezes somebody. If the cost increase is from overutilization, producers feel the bind of lower prices. If the cost hike is from underutilization, higher beef prices pinch consumers in the pocketbook.

Schulz is the Iowa State University Extension livestock economist. Email [email protected].

About the Author(s)

You May Also Like