May 21, 2018

Data show cow-calf producers nationally are holding 4% fewer replacement heifers than a year ago. Heifers expected to calve in 2018 are down 5% from 2017. Iowa producers are holding 11% fewer replacement heifers than in 2017.

At first glance, producers holding fewer heifers might indicate cow herd contraction. But liquidation won’t be occurring until the number of older cows that producers cull exceeds the number of replacement heifers they add to the herd. That’s likely not happening yet.

One reason is high replacement heifer retention rates over the last few years suggest the beef cow herd is relatively young. This will help keep the culling rate down over the next couple of years.

Most likely holding fewer heifers merely suggests expansion is slowing.

Other cattle inventory statistics also suggest expansion is slowing, or possibly even reversing in some regions. But firm replacement heifer prices suggest cow herd growth continues.

More heifers on feed

In the April Cattle on Feed report, USDA’s National Ag Statistics Service provided the quarterly count of the total number of steers and heifers on feed for feedlots with 1,000-head capacity or more. Compared to April 1, 2017, the number of heifers on feed was up 14% in the U.S. Heifers comprised 36% of the total on-feed inventory. In Iowa, the heifer count rose 18% year over year and tallied 27% of the inventory. The April 1 quarterly breakdown shows that the number of steers on feed was 4% higher year over year in the U.S. and 8% higher in Iowa.

This rise in heifer placements mainly reflects a recovery from low levels in recent years when producers were aggressively retaining heifers for breeding. Heifers on feed nationally began to climb sharply in mid-2017, with higher quarterly inventories on July 1 (up 11%) and Oct. 1 (up 13%), as well as Jan. 1, 2018 (up 16%) and now in April. Heifers on feed in Iowa only began to increase in earnest in 2018, up 21% on Jan. 1 and up almost that much in April.

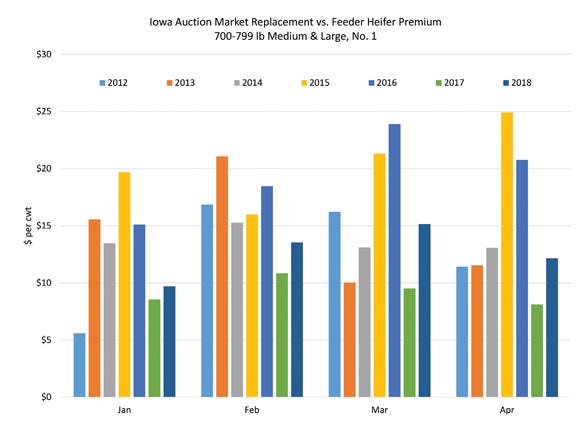

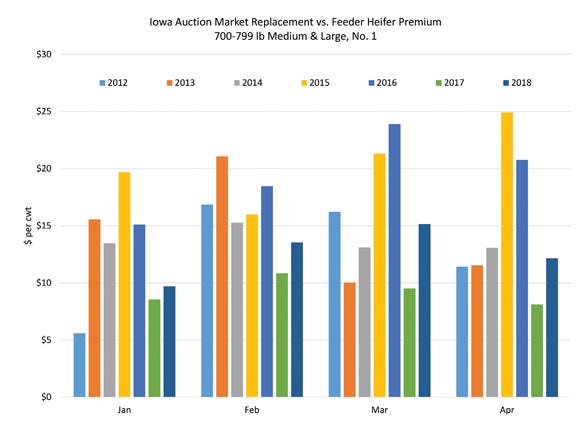

The data included 700- to 799-pound, medium and large, No. 1 open replacement heifers. The prices for January through April are 9% higher than a year ago. This could limit heifer slaughter later this year as decisions about retaining breeding stock become more important.

This is the highest number of heifers on feed in the U.S. since April 2012. In Iowa, the number ties the total in April 2013. Although these numbers are greater than they have been in the last couple of years, nationally they are still lower than some historical levels. Higher herd inventories and a larger calf crop translate to more heifers available, even while producers may still be expanding. Or if contracting, they may be contracting slower than previously thought.

Heifer slaughter rising

Higher heifer slaughter resulting from more heifers in feedlots provides another clue on the status of herd expansion in 2018. The 5% year-to-date rise in heifer slaughter follows a year with the biggest annual rise (up 12%) in heifer slaughter since 1976. Although, the 2017 total heifer slaughter was nowhere near a record. Sharply higher heifer slaughter runs are all but certain for the first seven months of 2018.

However, interpreting heifer slaughter numbers from August to the end of the year will be a bit tricky. That’s because the rise in heifer slaughter will appear to slow dramatically. Last year saw sizable gains in heifer slaughter in August and beyond. This year’s percentage gain will be compared to last year’s higher base. From August onward, relatively small percentage hikes in slaughter could still translate into a sizable hike in heifer slaughter numbers.

Regional differences

The other component of herd inventory change is beef cow slaughter. Beef cow slaughter for the year to date is up 10% from one year ago. Some regional year-over-year comparisons stand out. The Pacific Northwest, while not a prominent region for beef cow slaughter (5% of the U.S. total in 2017), has quadrupled its volume of beef cow slaughter so far in 2018. The western Corn has upped beef cow slaughter by 6%.

The Southern Plains processed 9% more beef cows than in January through April of 2017. This region is especially worth monitoring in upcoming months given the drought conditions that have developed in western parts of this area and the inherent difficulties in avoiding additional beef herd liquidation.

Both heifer slaughter and beef cow slaughter patterns thus far are consistent with the idea of small but continued beef cow herd expansion nationally in 2018.

Feeder heifers enter cow herds

USDA’s Ag Market News Service tracks where heifers sold at auctions are going. It has identified numerous examples of heifers being purchased at feeder cattle auctions to be placed in cow-calf operations.

Open replacement heifers often bring roughly $10 to $20 per cwt more compared to feeder heifers, resulting in higher values of $75 to $150 per head. For example, Iowa auction data for April included 700- to 799-pound, medium and large, No. 1 open replacement heifers valued at $137.56 per cwt or $1,032 per head — some $12 per cwt or $91 per head more than comparable feeder heifers.

While open replacement heifer prices are down from the heights experienced in 2014-16, January through April prices are 9% higher than a year ago and could be a factor limiting heifer slaughter later this year as decisions about breeding stock retention become more important.

Every market has buyers and sellers. The current heifer market is a seller’s market. Some producers are taking advantage of the market and capturing higher values for their replacement quality heifers.

Schulz is the Iowa State University Extension livestock economist.

About the Author(s)

You May Also Like