May 7, 2018

By Scott Brown

USDA recently released its twice-per-year look at international beef markets, and projections for 2018 show the largest growth in world beef production since 2006.

While the U.S. is contributing a large share to the 2.4% world growth, countries outside of the U.S. are projected to increase output by 1.6% this year, the largest increase for all non-U.S. countries since 2013 and the third-largest since 2007.

With U.S. domestic markets already flooded with large supplies of beef, pork and chicken, there is a lot of pressure on U.S. meat export sales to remain strong. More beef supplies worldwide make that objective more difficult. However, delving deeper into the data provides additional insights into the opportunities that lie ahead.

The competitors

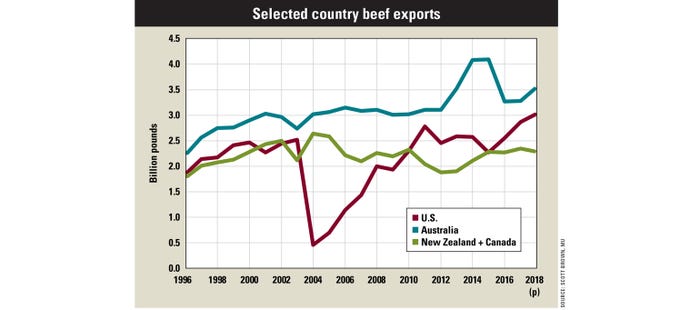

The two biggest markets for U.S. beef exports, Japan and South Korea, have accounted for about 45% of total shipments since 2016. Mexico and Canada account for another 25% to 30%. In these markets, our biggest competitor by far is Australia, with New Zealand and Canada also involved but at a lesser extent.

While the combined beef output of Canada and New Zealand is expected to fall slightly from 2017, Australian beef output is pegged to jump by 6.1%, due in part to unfavorable pasture conditions that will send more animals to slaughter instead of into rebuilding the herd. Australia’s beef exports are projected to grow by nearly 275 million pounds in 2018.

Staying in the game

Strong demand for beef from U.S. consumers has kept beef prices at reasonable levels despite growing supplies. The same scrutiny will be placed on beef demand in Japan and South Korea to soak up growing world beef output. These two nations are projected to combine for more than 3 billion pounds of beef imports this year, up from just under 2.5 billion pounds in 2015 and a 24% increase in just three years.

With the same factors at play around the world that have been the impetus for U.S. beef industry growth (increasing consumer taste for higher-quality beef, stable feed prices and a growing economy), export competition will continue to intensify in the coming years. To this point, growing demand from major consuming countries has allowed for these additional supplies to enter the market without severely compromising price, but further production growth will continue to pressure markets.

U.S. success in export markets will continue to depend in part on our ability to differentiate our beef products from those of our competitors.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

You May Also Like