As President Trump prepared to sign the tax reform bill Congress sent to his desk Wednesday, agriculture industry representatives voiced support for what they hope will bring lower tax liabilities and a simplified process for tax management.

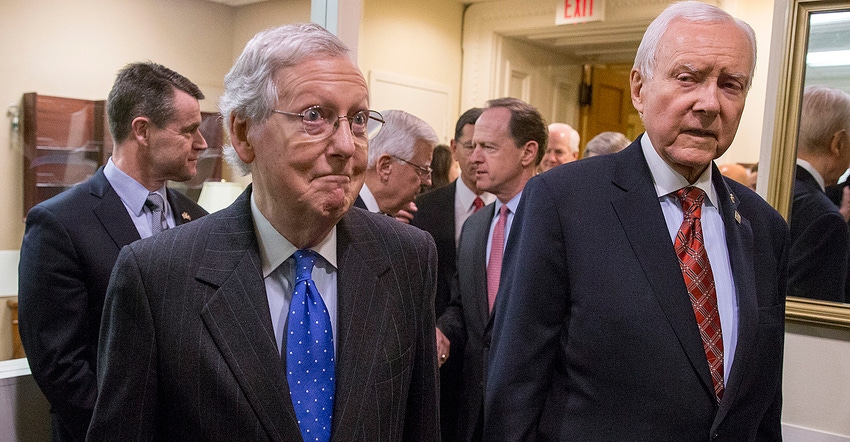

National Cotton Council (NCC) President/CEO Gary Adams expressed appreciation to Senate Majority Leader Mitch McConnell (R-KY) and House Speaker Paul Ryan (R-WI).

“As you know, many family farms are structured as pass-through entities, and we appreciate the provisions to specifically provide tax relief for these entities as well as a provision for cooperatives and their members given the loss of Section 199,” Adams stated in his letter. “The lowering of individual tax rates will further help alleviate the tax burden on farm families.”

American Farm Bureau Federation President Zippy Duvall said the tax reform will be a boon to most farmers and ranchers and includes “many changes to the tax code, most notably lower individual tax rates, that will benefit farmers and ranchers. Ninety-four percent of farmers and ranchers pay taxes as individuals, and those rates are coming down. The bill also maintains all of the important deductions and credits that farmers rely on. So, thanks to a lot of hard work by Congress and the administration, farmers will have both lower rates and all the tools they’ve always had to manage their businesses.

Business income deduction

“Starting next year, farmers and ranchers will also be able to take a 20 percent deduction off their business income. Most of the provisions in this tax bill are temporary, lasting for only seven years, so Farm Bureau will now focus on making those important tax deductions, lower rates and the estate tax exemption permanent.”

Richard Thorpe, president of the Texas and Southwestern Cattle Raisers Association (TSCRA) said the changes “were long overdue. The Tax Cuts and Jobs Act contains numerous provisions that will benefit ranching families and landowners as they continue their tireless work to provide the safest and most affordable food supply in the world. Unfortunately, many of these provisions will expire in a few short years.

“Like most sectors of the U.S. economy, ranching families are most successful when they have predictability. Despite the efforts of Congress, long-term and permanent tax reform remains elusive, especially as it relates to the death tax.

“TSCRA will continue its work to relieve the tax burden placed on ranching families and landowners so future generations can focus on what they do best and not worry about taxes, like the death tax, once and for all.”

‘Once in a generation’

U.S. Secretary of Agriculture Sonny Perdue hailed the legislation as a “once-in-a-generation reform of the federal tax code, and it comes just in time to be an eagerly awaited Christmas present for taxpayers. Most family farms are run as small businesses, and they should be able to keep more of what they earn to reinvest in their operations and take care of their families. Simplifying the tax code and easing the burden on citizens will free them up to make choices for themselves, create jobs, and boost the overall American economy.”

More help needed

Adams said cotton farmers will still need help as Congress begins to mark up the 2018 farm bill. U.S. cotton producers continue to face low prices and high input costs while lacking an adequate farm bill safety net, he said. As a result, many family cotton farms and other cotton businesses have been lost in recent years.

“We look forward to working with Congress, both in the near term and through the upcoming farm bill debate,” Adams stated, “to provide cotton farming families with the necessary policy improvements to withstand the unique challenges of cotton production and marketing. This tax reform bill will certainly be welcome news for our industry, yet there is still critically important work to do for the cotton industry by strengthening and improving the current farm bill to address the challenges facing our farm families today.”

House Agriculture Committee Chairman K. Michael Conaway (TX-11) praised House passage of the Tax Cuts and Jobs Act, H.R. 1 (115). “Congress has delivered the fairer, simpler tax code that American families and small businesses deserve,” he said. “This historic tax relief package both simplifies our broken system and sets the economy on a course to stimulate growth and create jobs.”

Caveats

Not everything in the bill will benefit agriculture, according to K·Coe Isom, a national ag accounting and business advisory firm. The House-Senate tax bill provides near-term benefits to many ag producers, but rate reductions and estate tax changes beneficial to ag are temporary, says Doug Claussen, principal and CPA with K·Coe Isom.

“The core of this bill is a 21 percent flat rate for C corporations,” Claussen said. “Most farm businesses are not structured as C corps and won’t benefit from this rate unless they restructure. For farms that are structured as C corps, those in the 15 percent tax bracket, would actually see a tax increase from this flat rate. Most farmers, however, are sole proprietors or structured as pass-through entities. These farmers should see some benefits from the deduction for business and pass-through income, immediate expensing of capital purchases, and to some degree from reductions in individual rates.”

The bill also includes a 20 percent deduction on business and pass-through income and flattens and reduces individual rates, but by a much smaller amount. Finally, the bill effectively repeals the alternative minimum tax for many farmers and will allow for immediate expensing of most capital purchases.

Limitations

In addition to positive changes for agriculture, the tax bill also repeals or limits a number of provisions important for farmers:

The bill limits the ability of farmers to carry back losses only two years rather than the current 5 years.

The bill limits the ability of larger farmers to deduct business interest expense.

The bill repeals the Domestic Production Activities Deduction (DPAD/Sec. 199) deduction used by many farmers and cooperatives.

The bill eliminates the use of like-kind exchanges for personal property.

“One key concern among agriculture is that the benefits of this bill – lower rates, bonus depreciation for immediate expensing, increased limits for estate taxes – these are all temporary. The individual rates and estate tax changes expire at the end of 2025 while the bonus depreciation begins phasing out in 2022 and fully expires in 2027. The loss and limitations on deductions currently used by farmers, however, are permanent,” said Claussen. “Farmers could see their taxes increase in the future if rate reductions or enhanced expensing provisions are allowed to expire.

“The tax code didn’t get much simpler – in some respects this bill actually raises new questions for farmers, Claussen said. “We believe that many ag businesses will do just fine with these changes but we’ll need to think carefully to tailor solutions for each individual ag business we serve.”

About the Author(s)

You May Also Like