August 4, 2022

The University of Nebraska-Lincoln’s Nebraska Farm Real Estate Market Survey and Report 2021-22 provides insight into recent trends on the market value of agricultural land, and cash rental rates across the state. Each year, the special feature section covers topics on new or emerging issues related to the agricultural land industry in Nebraska. These topics reflect interest expressed by panel members and readership of the Nebraska Farm Real Estate Market Highlights Reports. The special feature section in 2022 evaluates changes made to cropland leases to account for higher input expenses, use of flexible lease arrangements across the state and considerations for these contractual arrangements.

Costs on the rise

Agricultural operators in 2022 faced rising input expenses for seed, fertilizer and chemicals necessary for the production of crops. Elevated commodity prices with heightened input expense provided the motivation for operators to reconsider the selected lease arrangement used on rented cropland. Higher input expenses, coupled with dry growing conditions, also raised the financial risk imposed on agricultural operators. Depending upon the selected lease type, risk may be mitigated between the landlord and tenant or remain solely with the tenant.

The three most commonly used cropland lease arrangements across Nebraska are as follows.

Crop share. The landowner receives a percentage of the actual crop yield as payment for leasing the agricultural land to the tenant.

Cash lease. The landowner receives an agreed-upon cash payment for leasing the agricultural land to the tenant.

Cash lease with flexible provision (flex lease). The landowner and tenant set a base cash rental rate, which can flex based upon actual crop yields, prices or a combination of the two. Final cash payment made to the landlord for leasing the land to the tenant may have premiums or discounts made to the base rental rate, depending upon the agreement between the two parties.

Depending upon the selected lease arrangement, the division of income, expenses and risk will vary between the landlord and tenant in 2022. These parties may also have different risk preferences, financial capacities or direct knowledge of productions systems. To account for these factors or constraints, panel members reported on changes made to cropland lease selection across Nebraska in 2022.

Survey says

Panel members reported roughly an equal split between changing (48%) and not changing (52%) the leasing arrangement. Respondents indicated that when changing the lease arrangement, switching to a flex lease accounted for 23% of the changes, while the remaining 25% of leases were either switched to a crop share, cash rent or some other change. Switching to cash rent (14%) and crop share (8%) were the second- and third-most common adjustments.

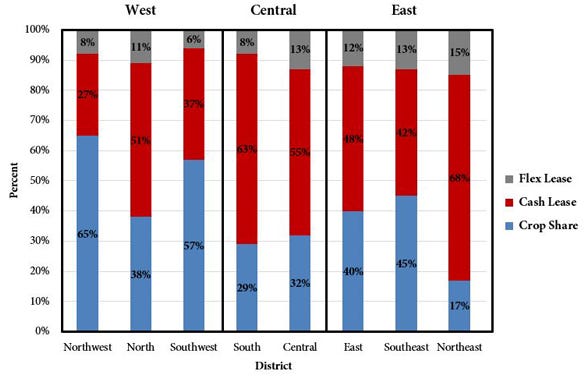

The decision to switch to either cash rent, flex lease or crop share impacts the mitigation of price and yield risk between the landlord and tenant. The risk associated with price or yield may vary based upon the district of the state. Figure 1 summarizes the estimated distribution among crop share, cash lease and flex leases indicated by respondents across Nebraska in 2022.

Cash leases and crop share comprise 88% of rental arrangements at 51% and 37% each across the state (Figure 1) while flex leases account for about 12% of the leases. Districts in western Nebraska have a higher portion of crop share — such as the Northwest and Southwest at 65% and 57% — than other regions, which have a higher proportion of cash leases. The

Northeast and Central districts reported the highest use of flex leases at 15% and 13%.

Factors for flexing cash lease payments

Flex lease arrangements mitigate risk between the landlord and tenant. The flex factor used in the design of lease arrangements of this type tends to focus on the element of risk posing concern in the rental contract. Panel members reported crop revenue (43%) as the most common factor for flexing a lease, followed by crop price (37%). Combined, these two account for 80% of the factors for setting a flex lease. Crop price remains a major concern between landlords and tenants. Crop yield and other factors accounted for the remaining 20% for basing a flex lease off across the state in 2022. These factors may vary depending on the regional concerns surrounding the lease. For example, dryland operators may be more concerned with crop yield, whereas irrigation producers might focus more on price fluctuations.

The price factor for flexing a cropland lease may be based on a local cash, regional, futures or an established guarantee determined by another entity. Panel members indicated that the local cash (spot) price (48%) was the most common price factor for flex leases. Crop insurance price guarantees (24%) were reported as the second-most commonly used value. This form of price guarantee is based on the value of the 30-day futures price average during planting and harvesting. Futures and terminal or regional, along with other prices, accounted for 17%, 6% and 5% of the values for basing a flex lease off when using the price factor.

The majority of cropland rental arrangements in Nebraska did not change to another lease type to account for higher input expense in 2022. Cash leases remain the dominant rental type, as respondents indicated 51% of leases in Nebraska were this type, followed by 37% being crop share. Flex leases account for approximately 12% of the remaining cropland leases across the state. Crop revenue and price serve as the most popular factors for basing flex leases off when mitigating risk between landlords and tenants. Operators using price-flexing cash rents most commonly use local cash (spot) prices.

Jansen is a Nebraska Extension agricultural economist.

You May Also Like