May 3, 2019

Estimates of North Dakota’s state average pastureland values and cash rents set new highs in 2019, but they are up only slightly over the old mark set in 2016. When adjusted for inflation, most of the changes aren’t significant, says Bryon Parman, North Dakota State University Extension agricultural finance specialist.

He used data in the County Rents and Prices Annual Survey, funded by the North Dakota Department of Land Trusts, to develop the weighted regional averages.

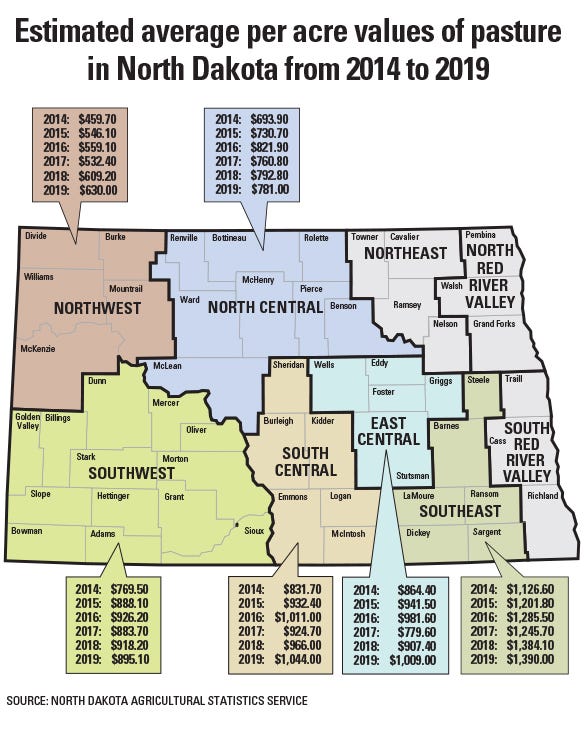

Compared to 2016, estimated pastureland values were up 2.3% from $891 per acre to $913 per acre in 2019, Parman reports.

This implies an appreciation rate of 0.6% per year, which is lower than the annual rate of inflation, nearly 2% during that same time frame, he says.

Rental rates

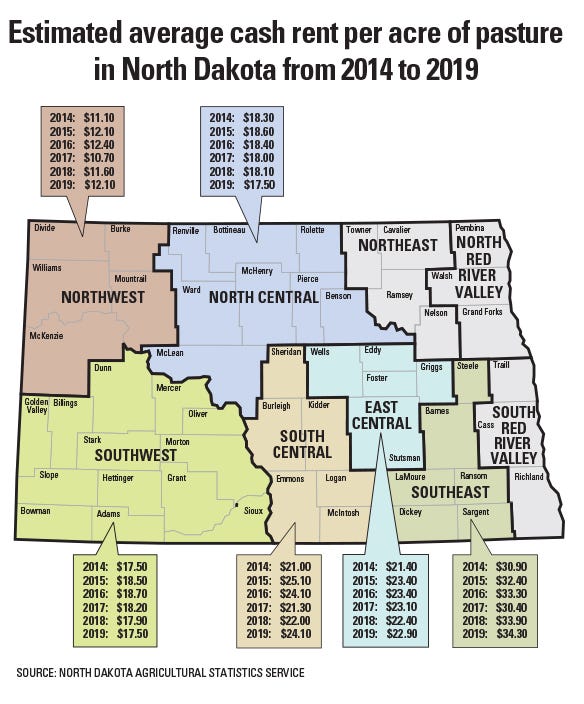

Statewide estimated cash rents for pastureland in North Dakota show a similar scenario. The average statewide cash rental rate is $18.30 per acre. The previous cash rent highs occurred in 2015 and 2016 at $18.20 per acre. Cash rents over the last four years have not grown significantly, leading to a declining inflation-adjusted rental rate, Parman says.

Since the previous highs seen in 2015 and 2016, nominal rental rates in the northwestern, east-central, southeastern and south-central regions dipped and then recovered most or all of their value in 2019. Rents in those regions were within 2% of the previous high set four years ago.

Meanwhile, the north-central and southwestern regions have failed so far in seeing their cash rental rates approach the highs experienced in 2015 and 2016, as they remain down 5% and 7%, respectively. Overall, when accounting for inflation, pastureland cash rents are down across all regions in North Dakota.

Sale values

“With respect to sales values, the northwestern region stands out with a total growth of 11% since 2016, with an implied appreciation rate of 3%, or 1% above inflation,” Parman says. “The southeastern region also has appreciated some since 2016, with an overall appreciation of 7.5%. However, the rate of gain in the southeast is 1.9%, just barely keeping up with inflation during that same period.

“The north-central region and the southwestern region both have failed thus far to achieve their previous highs noted in 2016, as they remain down 5% and 3%, respectively,” he says. “The south-central and east-central regions values are above their previous highs set in 2016, at 3% and 2.5% above 2016 values, respectively, again failing to keep up with the annual inflation rate.”

The southeastern has the highest pastureland rents and values in the state $34.30 and $1,390 per acre, respectively. The least costly remains the northwestern region with a cash rent of $12.10 per acre and a value of $630 per acre. This is also true when evaluated on a dollars-per-Animal-Unit-Month (AUM) basis, with the northwestern region rental rate being $17.60 per AUM while the southeastern is $48.30 per AUM.

“While pastureland often reacts sympathetically with what happens to cropland values and rents, consistency and overall decent margins for cattle producers have helped support pastureland values,” Parman says. “However, the rent-to-value ratio statewide of 2%, with an inflation rate of 2 percent and interest rates hovering around 5%, suggests there is plenty of room for pastureland to adjust downward at some point — or at least for rents to move up slowly while holding values constant such that the rate of return on ownership from a revenue-generating perspective improves.”

Of the nine identified regions across North Dakota, three are not included in the report because pasture rental and sales data is sparse in the northeastern, northern Red River Valley and southern Red River Valley regions.

Source: NDSU, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like