What is a fair rental rate for pasture? “It sounds like a simple question, but it is not simple because there are so many different factors that go into what fair looks like to you,” Nebraska Extension beef systems educator Erin Laborie told a virtual audience attending the recent Love of the Land Conference, sponsored by Nebraska Women in Agriculture.

There are many considerations, discussion points and resources to help landowners and tenants come to an agreement.

Factors in play

“A lot comes down to landowner and livestock owner responsibilities,” Laborie said. “These include daily care, who is contacting the veterinarian if needed, expenses, the fencing situation, water and forage quality, and overall forage production.”

Is the tenant just paying a rental rate to use the land, or are other things included with the land? The land may have calving facilities or working facilities, maybe a house or other equipment included. If those things are included, that would raise the rental rate over what a tenant would pay if they were just renting the land.

Stocking rates and production are always topics of discussion for pasture rental rates. “Most lease agreements should lay out animal unit provisions, whether or not bulls are allowed to graze, the type of animals that will be grazing and the number of head,” Laborie said.

Fencing

“Typically, the landowner should have the fence in good condition,” Laborie said. “If there is fencing to be done, the costs of materials should be outlined.” Upkeep and maintenance of the fence is a point of discussion between tenant and landowner.

The type of grazing system also comes into play. “What kind of grazing system is being used? Is it rotational grazing or continuous grazing?” Laborie said. “How much forage should be left when the animals are rotated in a rotational system? Usually it is leave half, take half. What are the penalties if this agreement is not met?”

Fertilization of pasture is normally a responsibility of the tenant if the lease is on a per-acre basis. In the case of cow-calf pair leases, that cost could be split, she said. Noxious weed control also usually falls on the tenant. But eastern red cedar control is more of a landowner issue, Laborie added.

Other questions to consider in lease negotiations are what happens if there is a disaster, such as drought, fire or hail. “Who is responsible for deciding when the cattle should be removed or the stocking rate is reduced?” she said. “What is the prior notice for this? And who provides supplemental feed and water to the animals?”

Other questions to decide include hunting rights, which normally fall to the landowner. Grazing of crop residue on the property usually goes to the tenant, but is there a provision allowing the tenant to sublease the cornstalks or crop residue?

Figuring stocking rate

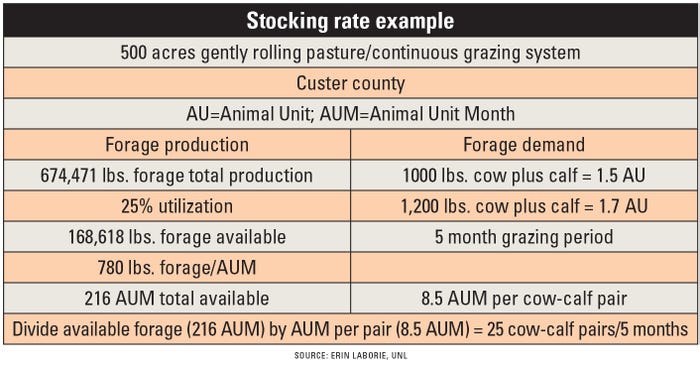

One animal unit is a 1,000-pound animal, so a 1,200-pound cow would equal 1.2 AU. An animal unit month (AUM) is the forage needed to carry one AU for one month, or about 780 pounds of air-dried forage.

Here is an example Laborie gave of balancing the stocking rate for a pasture with the forage production based on a scenario that includes 500 acres of gently rolling pasture in Custer County that a landowner wishes to rent for grazing cow-calf pairs:

Production

First, you can calculate the amount of forage that could be produced by the pasture by using the Web Soil Survey. According to the Web Soil Survey, this 500-acre pasture should produce 674,471 pounds per year of forage.

“Traditionally, we can only count on using 25% of total forage production,” Laborie said. “We want to leave about half out there for plant health, and we can account for another 25% being lost to trampling or to wildlife.”

Doing that calculation, 25% of 674,471 pounds per year of forage equals 168,618 pounds of forage available for grazing. Then take 168,618 pounds of forage available divided by 780 pounds of forage per AUM to convert to AUMs. That gives us 216 AUMs available for the year.

Demand

A 1,000-pound cow plus a calf until weaning equals 1.5 AU. Lactation creates higher demand for the cow, and as the calf matures and lactation slows, forage consumption increases by the calf. If the cow size is 1,200 pounds, this would equal 1.7 AU for the cow-calf pair. If the grazing period is five months, you would take 1.7 AU per pair multiplied by five months, which equals 8.5 AUMs per pair.

Available forage of 216 AUMs is divided by 8.5 AUMs per pair to get the stocking rate of 25 cow-calf pairs for the five months of grazing season in this example. This is figured for continuously grazing that pasture, so if the pasture is rotational grazed, it would give you a different situation, Laborie says.

Resources

Here are some resources for landowners and tenants:

Nebraska Farm Real Estate Report. Figuring out a fair pasture rental rate could start with studying the 2021 Nebraska Farm Real Estate Report, with a final report released last June, that lists land values and rental rates based on districts across the state. This report, which has been issued since 1978, offers important information for landowners and tenants.

“Within a given district, production expectations are relatively similar,” Laborie said. “But there is a lot of variability within the district as well, or even the county or even one of your pastures to the next.” The report offers maps that show rental rates on a per-acre or cow-calf-pair-per-month basis in each district with a percent change from the prior year.

Breaking it down even further, maps in the report will show high-grade, low-grade and average rental rates for each district. “The high-grade rates are where the landowner is contributing to the labor, maybe some facilities and equipment are provided, and the forage quality and production is higher,” Laborie said. “For the low-grade rates, the tenant is providing most or all of the labor, less infrastructure is provided, and the pasture conditions are not that good.” This same report also covers rental rates for 500- to 600-pound stockers.

USDA National Agricultural Statistics Service survey. This annual survey is released each year in August and covers a “per-acre” basis by county for nearly all counties in the state.

Ag Lease 101. This resource provides pasture rental publications and fillable pasture lease templates.

Grazing and hay records spreadsheet. This is an Excel-based spreadsheet that can help decide stocking rate. Enter basic haying and grazing records, and it can calculate AUMs, planned and available forage, stocking rates, grazing days, and other calculations. This link leads to a publication that explains the spreadsheet. There is also a video tutorial to help use the spreadsheet.

Learn more by contacting Laborie at [email protected].

About the Author(s)

You May Also Like