July 23, 2020

Many tenant operators will likely struggle coming up with a positive cash flow for cash-rented land in 2021. The impact of the coronavirus leaves demand uncertain, as reflected in lower crop futures prices being offered. You can expect U.S. ending stocks for both corn and soybeans to remain adequate and the global economy to slowly recover from the pandemic. Regardless, most all of Iowa’s 23.4 million tillable acres will be planted to corn and soybeans next year. Crop input costs aren’t expected to decrease significantly from those experienced in 2020.

Thus, a great deal of focus will be placed on reducing 2021 cash rental rates. Farmland rent tends to be the largest fixed cost per acre associated with row crops. Tenant operators, encouraged by their ag lenders, will want to discuss with their cash rent landlords in August the possibility of adjusting cash rental rates lower.

Role of flexible cash farm lease

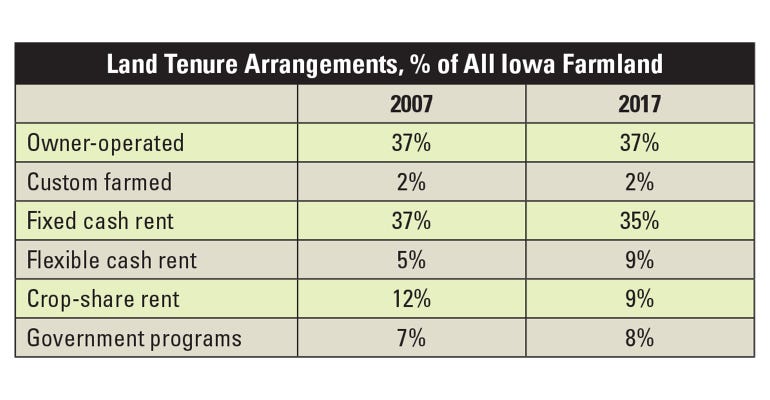

The proportion of Iowa farmland operated by the landowner has stabilized at about 37% over the past decade. That’s according to the most recent farmland ownership and tenure survey conducted every five years by Iowa State University.

What has changed is the popularity of different types of farm leases. From 2007 to 2017, traditional crop-share leases decreased from 12% of total farmland acres to only 9%, while flexible cash rent leases increased from 5% to 9%. The acres rented under a fixed cash rent lease fell by 2%.

Flexible cash rent leases typically establish a minimum base rent and allow the tenant to share a potential flex payment with the landlord when the tenant has higher crop revenue on the rented farm. This “flex payment” usually reflects the farm’s yields, harvest cash prices or the average cash prices for harvest-delivered bushels, and then subtracts non-land crop input costs.

Rent values by lease type

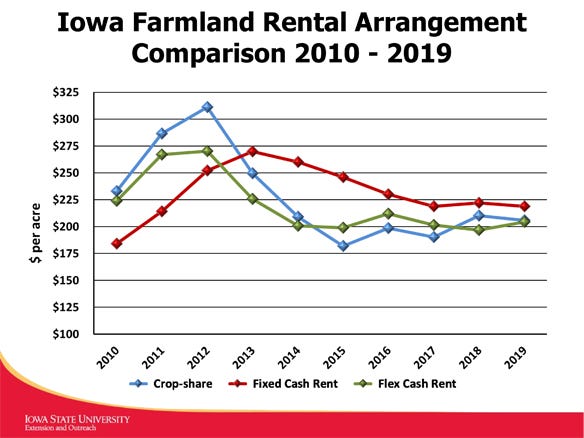

How have returns to fixed cash, flexible and crop share leases compared in recent years? The chart accompanying this article shows estimated rents per acre realized by the landowner for the past 10 years for a 50-50 corn-soybean rotation.

Of course, actual rents will differ for each farm. The fixed cash rent values are the statewide average cash rents paid in Iowa each year, based on ISU Extension’s annual survey. The flexible cash rent values are estimated at 30% of the gross revenue per acre from corn and 40% of the gross revenue per acre from soybeans (Ag Decision Maker File C2-21).

From 2010 to 2012, crop prices were rising. Crop share and flexible rents rose immediately because they were directly tied to current prices. Fixed cash rents lagged for about two years and then caught up. In 2013, the crop share and flexible cash rents started to nose-dive in response to the lower corn and soybean prices, while fixed cash rents were slow to decline.

Most years, these fixed cash rents were negotiated before the price decline was known. More recently, all three rents have been close, as prices and yields have both stabilized. Now with the uncertainty caused by the pandemic, many tenant operators will turn their focus on reducing these fixed cash rents for 2021.

Implementing flexible cash lease

Gross crop revenue was calculated by multiplying the state average corn and soybean yields for each year by the state average cash prices in October, November and December of the same year. USDA commodity payments and multiple peril crop insurance payments received each year are also included.

The value of the crop-share rent is estimated as one-half of the gross revenue for each crop minus one-half of the costs typically shared by the landowner (seed, fertilizer, pesticides, drying, hauling and storage), based on ISU Extension typical cost-of-production budgets ( Ag Decision Maker File A1-20).

Tenant operators with encouragement from their ag lenders will explore ways to reduce crop production costs for 2021. This might include moving from a fixed cash rent to a flexible cash rent lease. The base rent would be lower than the existing fixed cash rental rate.

The landlord benefits from a potential “flex” payment in addition to the minimum base rent. Should the gross crop revenue exceed the costs of production, an extra payment by, say, mid-December could be made. In addition, the landlord could receive annually a record of planted acreage, actual yields, average cash price bids for harvest delivery, and perhaps a summary of crop production and stewardship practices.

Johnson is an Iowa State University Extension farm management specialist. He can be reached at [email protected].

Read more about:

Land LeasesAbout the Author(s)

You May Also Like