March 1, 2012

Remember the anxiety you felt prior to that last major USDA report? That feeling of not knowing what to expect at the opening bell can cause some heartache, but there are some simple steps you can take to prepare for these reports.

There is no time like the present to brush up on those strategies, because one of the year’s most unpredictable market reactions is coming up March 30.

By the nature of your business, most of your risk in an upcoming USDA report results from a potential price drop. Develop a risk-management strategy to protect your income from a major market downturn. If prices go higher after the report, so much the better because you will benefit from the remaining unsold grain.

There are two factors you should consider when deciding how to price-protect grain. First: does the current price achieve the profit goals you established? Second: What is your market opinion: bullish, bearish or neutral?

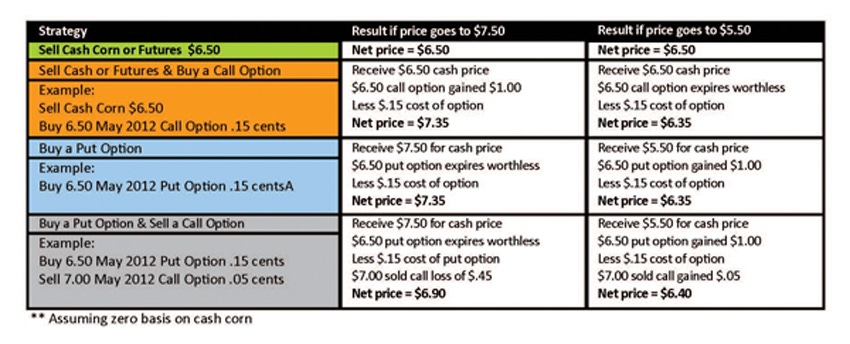

Check out these four strategies in the chart that can be used to implement a solid risk-management plan. If prices meet or exceed your goals, consider scaling in a cash sale or sold futures contract – the first scenario on the chart. That will lock in a profit above your goal whether you’re bearish, bullish or neutral; never a bad decision when you’re selling for a profit.

However, if current prices do not meet your goals, consider implementing an options strategy or a hybrid cash-grain contract that uses one of the options strategies.

Note that all three option strategies presented are designed to have comparable up-front premium costs. They differ in when and where the income will be received (Up front from the elevator? Or deferred from your brokerage account?), as well as a varied range in potential upside and downside opportunity. All three option strategies are appropriate regardless of whether you’re bearish, bullish or neutral about the market’s prospects after the report. If you’re bearish, they protect your downside risk. If you’re bullish, they will leave your upside opportunities open. And finally if you’re neutral, each strategy allows you opportunity in either direction. The key behind each strategy is to give you a sense of comfort and allow you to sleep at night.

There seems to be an endless sea of reports during the year, all with potential to move the markets. Once we make it past the plantings survey, you should continue to use this risk-management approach ahead of the June 29Planted Acreage report and the January Annual Crop Production Summary & Winter Wheat Seeding. Those two reports are sure to make the sparks fly, alongside the entire parade of monthly and weekly projections.

Through it all, keep focused on what your profit goals are and execute accordingly. If you let your emotions define success, odds are you will be disappointed. Visit with your local grain buyer, marketing advisor or broker to learn more about implementing a successful marketing strategy.

About the Author(s)

You May Also Like