Think DifferentOpen communications with your landlord to establish common goals and expectations.Share information to strengthen a landlord's understanding and appreciation for how farming practices benefit short-term and long-term returns.Create a synergistic relationship that recognizes market vagaries and shares risks and rewards.Consider new options, review alternatives and explore potential alternatives to traditional cash rent that better serve and strengthen an existing relationship.Follow the Golden Rule. Treat your landlord and his children as you would like to be treated when the day comes that you, too, are a non-operating landlord.

February 22, 2013

How secure is your relationship with all your landlords? At a time when aggressive operators are targeting long-term relationships, offering substantial bumps to rental agreements, what would your landlords accept? Do you know how to 'seal the deal' with every landlord?

"Arrangements with landlords are some of the most critical ones they have, perhaps more critical than the one with their lender," suggests Mike Boehlje, ag economist, Purdue University.

Your landlord relationships may become even more critical. While farmland ownership differs from state to state, a 2007 farmland ownership survey conducted by Iowa State University reflects a major transition in the rural economy. People over 65 currently own 55% of Iowa farmland, compared to only 29% in 1982. Landowners over 75 own more than half of that total.

Where and who this land goes to is likely to change rental relationships in a dramatic way. The 2007 survey disclosed that nearly two-thirds of land owned by those over age 75 would likely stay within the family, whether through sale, gift or inheritance. However, the land is likely to go to multiple owners. From 1982 to 2007, the amount of land owned by a single owner dropped from 41% to 29%. With more than half of Iowa farmland in transition in coming decades and most of it going to family members, the complexity of relationships between landlords and renters can only increase. Expanding operators will have to deal with not only multiple landlords, but also potentially, multiple owners of a given piece of ground.

Having 10 landlords or 100+ means potentially different types of relationships with each one, Boehlje notes. One landlord wants to be more informed about field and farm data, and the next may not care. Another may be invested in how the property appears, while the next is only interested in long-term productivity and building value. While some landlords are only interested in getting rent, these are possibly the least secure relationships of all as they have less reason to ignore an offer of higher rent from a competitive operator.

"Forward-thinking operators devote more time, energy and effort to understanding their landlords, what they want and how to deliver on those expectations," says Boehlje.

Even without change in ownership, a renter may do well to rethink his current relationship, suggests Randy Dickhut, vice president client relations, Farmers National Co., a leading farm management firm. He notes that escalating land values and rents are increasing landowner interest in the land.

"Non-operating landowners pay more attention to farm incomes and expenses and lease arrangements," says Dickhut.

ENTER FARM MANAGERS

For non-operating landlords, farm managers serve as a neutral conduit for information from a tenant. If managers are seeing this increasing interest from landlords, it is safe to assume it also is increasing among landlords with direct and often more complicated relations to renters. Dickhut counsels renters to communicate more openly.

"Renters need to be willing to update the landowner and farm manager with issues or progress and be willing to share data and information," says Dickhut.

Some land operators take that communication to new levels. While those working with professional farm managers and some landlords may be accustomed to sharing yield, soil and nutrient application data, profits have been private. That may be changing, according to Jason Henderson, vice president and Omaha branch executive, Federal Reserve Bank of Kansas City.

"Cash rent is still king, but I'm hearing about fixed cash rent with a possible bonus payment, depending on how good the year was," says Henderson. "Others are going in at the end of the season and making a voluntary bonus cash payment to be directed toward land improvement."

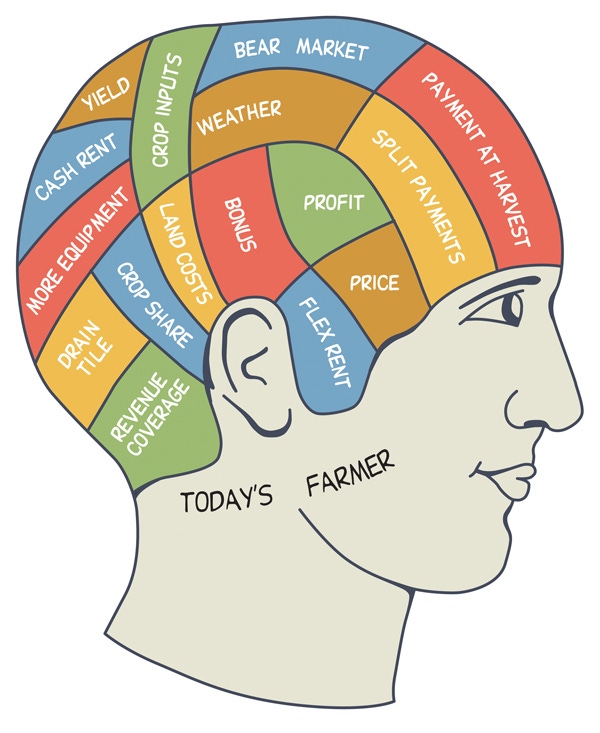

Henderson suggests the increased volatility of land and commodity markets are moving the industry toward more transparency as a way of strengthening relationships. Boehlje agrees, pointing to increased use of flexible cash rent based on yield and price as a tool for risk mitigation and management.

"Landlord and tenant have to be comfortable with data documentation and verification," he says. "Using the same information provided to crop insurance agents is one way to facilitate that transparency with a third party documenting numbers."

Greater transparency is important to landlord/tenant relationships, agrees Shonda Warner, president, Chess Ag Full Harvest Partners. Chess Ag manages several funds with over 35,000 acres in farmland investments across the U.S. with offices in Clarksdale, Miss. and Dakota Dunes, S.D. Warner grew up on a northeast Nebraska farm and has dealt with tenant relationships personally as well as professionally.

OWNERS ARE NOT EVIL

"We need to get past the traditional, often antagonistic, or even abusive relationship that can exist between landlords and tenants," says Warner. "To some farmers, outside investors are the evil corporate entity. Yet we all know renters who pay family members or old family friends 25% of the going rate. We need grown-up relationships where when you do great, we do great, and when you don't do as well, we don't do as well either. We want to attract excellent tenants and give incentives to grow. I don't think that is necessarily the historical relationship."

Chess Ag renters pay in bushels, not dollars, and make all management and input decisions within identified conservation and fertility maintenance goals. Warner sees the day where her firm could offer tenants 'buying power' opportunities. She recognizes that will require them to be confident Chess Ag is looking out for their interests as well as its own. That confidence may be coming as satisfied tenants grow by helping Chess Ag grow.

"We like to work with existing tenants as we acquire additional parcels in a given area," says Warner. "They know the local customs and culture. As they become more comfortable with us, they tell us about property that becomes available."

Colvin & Co., LLP, owns and manages about 4,000 acres in the upper Midwest through two investment funds and also helps independent investors evaluate, purchase and manage farmland. The management firm, with offices in Minneapolis, Minn. and New York City, is seeing an even closer relationship develop with some tenants.

"We've already done about 10 lease-backs, where farmers saw the opportunity to sell land to us and lease it back for a period of time," says the firm's founder and president Greyson Colvin. "They can put the money in a 1031 for new property or use it to buy more machinery and inputs, so they can lease more land. They see investors like us not as threats or competition, but as a source of capital."

Purdue’s Boehlje adds, "There are a lot of new and creative ideas being brought to the market by operators, as well as land management companies and landlords. Increasingly, arrangements become unique to different sets of circumstances. Progressive operators recognize they need to make sure relationships are less transactional and more synergistic, so landlords have less reason to switch and their land tenancy is more secure."

About the Author(s)

You May Also Like