Think DifferentRun the numbers on every farm, including yield history, projected input costs and crop prices for three to five years.Review options like conservation programs and conservation compliance requirements.Prepare a flexible rent program that fits each farm and its fields, provides a reasonable return for operator and landlord and shares future profits.

October 9, 2015

Like any high-stakes card game, knowing when to hold or fold is vital to your farm business. That is especially true today for land leases – with input costs holding, crop prices folding and operators dangling from record high rents. Something has to give, and land leases are it. In late summer 2014, Ryan Drollette, Iowa Extension farm management specialist, was getting calls from operators concerned about rates. This year the tables turned.

"I've heard more from landlords who report that operators are terminating leases with no attempt to negotiate," says Drollette. "The landlords are caught off guard and are wondering what to do."

"We fielded around 100 calls prior to September 1 when tenancy terminations were due in Iowa," reports Jason Smith, DreamDirt Farm and Ranch Real Estate, Mondamin, Iowa. "Usually, calls are from landlords who want to know how much more they can ask. This year, 80 percent of the calls were from operators cancelling leases."

Jim Farrell, president of Farmers National Company, Omaha, Neb., has plenty of experience with what to do. As farm manager for 4,900 farms across 24 states, Farmers has prepared landowner clients and been proactive with operators, he reports.

"We saw some difficulty in the spring of 2014, and we're more geared up to work with operators in 2015," he says. "We made sure they had financing. We had some let leases go, but not a high percent of farms on cash rent."

Farrell expects that to change this fall and winter as operators secure financing.

Treat a money-losing lease like a futures option

"We've had a variety of bankers indicate concern with capital burn," Farrell says. "Not a lot of operators built up cash reserves, choosing to avoid taxes with equipment upgrades and land purchases. Much of what was there will be eaten up this year."

Operators in that position need to run the numbers, advises Mike Boehlje, professor, Agricultural Economics, Purdue University. He and his fellow Purdue economists have put together an advisory on that topic. In a zero or negative net margin world, he suggests treating a money-losing lease like a futures option: Figure out what you have to gain, what you have to lose, what you can afford to lose and do it now.

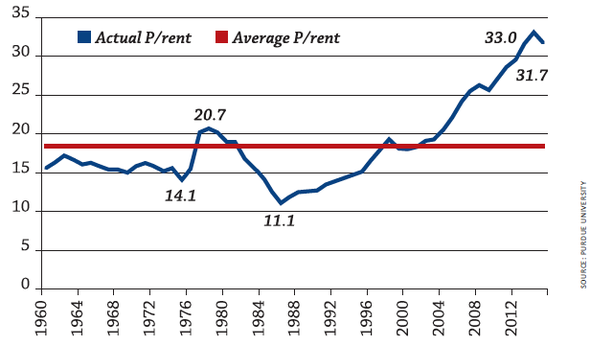

Land values and cash rent could have a dramatic fall ahead of them if the price (P) to cash rent (rent) ratio is to return to its historical average of 18.4%. This chart from Purdue agricultural economists shows trends over the past half-century including the rapid rise in the previous high in the late 1970s and corresponding collapse in the 1980s. Cash rents would have to remain high and interest rates stay low or move lower to maintain a high P/rent ratio, with neither expected in coming years. Chart: Purdue University

"Operators and landlords alike know the conversation is not going to be pleasant so they put it off," says Boehlje. "It's important to start thinking about it now, rather than at the last minute."

If a premium must be paid to "hold'em", how much working capitol will it take? "If an operator pays a premium of $75 per acre for two years and then has to give it up in year three, does he really want to do that?" asks Boehlje. "Our sense is that bankers are very concerned about the burn rate of capital this next year and will be asking tougher questions at loan review," he adds.

Renegotiation

Renegotiate rates and terms

A better strategy than justifying capital burn is to renegotiate lease rates and terms. "Everyone's goals are different, but a common goal is to make things work," says Brian Thompson, president, Soy Capital Ag Services, Bloomington, Ill. "Communication is critical in setting rents. Remember, we are currently only one world event – such as drought, excess moisture or early frost – away from changing price projections."

Thompson points out that a number of lease options exist that share the risk and reward of yields and pricing. Smith suggests the time has never been better, given the disparity he sees between landowners who understand rates have to drop and where operators want them to drop.

Base rate plus reward

"The majority of our landlords are sitting back to see where things go," he says. "More are looking at a base number per acre and then some sort of reward for the landlord when profits are there."

A new variable to include is the 2014 farm program. Smith points to conservation compliance costs that need to be considered, while Thompson points out that the farm program's safety net needs to be considered, especially in the case of flexible or profit sharing leases. "Government payments for the 2016 crop year won't be determined until October 2017," he says. "That needs to be in the discussion.

"Flexibility requires transparency, a willingness to show and share numbers," argues Bohlje. "Success as a bidding or negotiation strategy will depend on presentation of the data and the risk appetite of landlords. Some may be receptive, others not, but it provides concrete evidence the operator is not simply trying to make more money."

About the Author(s)

You May Also Like