November 28, 2012

Generally, farms with more of their acres cash rented at higher cash rent levels will face more downside income risk compared to farms with fewer acres cash rented at lower cash rent levels. As a result, farms with high cash rent levels could face large losses in some future year. This is illustrated by projecting 2013 incomes for farms with different rental situations.

Farm Situation

The following farm situation was used in a previous post to project 2013 incomes. The situation is designed to be representative of commercial grain farms in Illinois:

The farm has 1,200 acres.

Expected yields are 187 bu./acre for corn and 54 bu./acre for soybeans, with two-thirds of acres in corn and one-third in soybeans.

Farm costs are specified at levels contained in 2013 crop budgets.

The farm has $480,000 of debt.

Revenue Protection (RP) at the 80% coverage level is purchased for both corn and soybeans. Trend Adjusted Actual Production History (TA-APH) yields are 180 bu. for corn and 50 bu. for soybeans.

Projected prices used to set crop insurance guarantee are set at $6.10 for corn and $12.70 for soybeans. These projected prices will be determined at the end of February and have a critical importance in limiting downside revenue. Lower projected prices will lower worst-case net farm incomes.

Income Scenarios

Incomes are projected under three scenarios:

Expected 2013 incomes are generated with cash prices of $5.80/bu. for corn and $12.40/bu. for soybeans. Prices at these levels currently can be obtained for 2013 fall delivery.

Worst-case incomes are generated by lowering corn and soybean prices to the point where crop insurance payments occur. A number of price-yield combinations will result in the worst-case incomes. A similar procedure lowering yields will result in the same worst-case incomes. Worst-case incomes will be lower with lower coverage levels on RP crop insurance policies.

Long-run incomes are projected at cash prices of $4.50/bu. for corn and $10.50/bu. for soybeans. These prices represent estimates of average, or long-run, prices over the next five to 10 years.

Rental Scenarios

Incomes are generated under four different cash rental situations:

Base case – $300/acre cash rent.The base case has 10% of its acres owned (120 acres), 60% cash rented (720 acres) and 30% share rented (360 acres). Cash rent is set at $300/acre. These rental percentages and cash rent level are close to averages for commercial farms in northern and central Illinois.

All cash rent – $300/acre cash rent. Under this scenario, all rented land is cash rented, meaning that 90% of all farmland is cash rented. Cash rent is set at $300/acre.

All cash rent – $350/acre cash rent. Cash rent is increased to $350/acre, with 90% of farmland cash rented.

All cash rent – $400/acre cash rent. Cash rent is increased to $400/acre, with 90% of farmland cash rented.

Projected Incomes

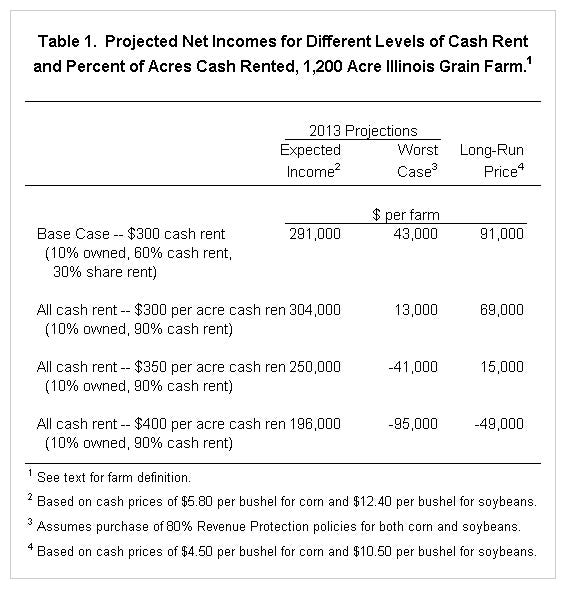

The base case with 30% of its acres share rented has projected net farm income of $291,000 (see Table 1). The $291,000 income would be above the average for the years from 2007 through 2011. The worst-case income is $43,000 and the income at long-run prices of $4.50 corn and $10.50 soybeans is $91,000.

Shifting all share rent acres to cash rent acres while maintaining a $300/acre cash rent results in $304,000 net income, slightly above the $291,000 income for the base case (see Table 1). Higher income occurs because share rent landlords receive more than $300/acre at a $5.80 corn price and $10.40 soybean price. The worst-case income declines from $43,000 under the base case to $13,000 under the all cash rent scenario, illustrating that share rent arrangements reduce downside risk to farms.

Increasing cash rents reduces incomes. When all rented farmland is cash rented, projected incomes is $304,000 for a $300/acre cash rent, $250,000 for a $350/acre cash rent and $196,000 for a $400/acre cash rent (see Table 1). Worst-case incomes are $13,000 for a $300/acre cash rent, -$41,000 for a $350/acre cash rent and -95,000 for a $400/acre cash rent. Note that it is not possible to guarantee a positive net income with high cash rents and RP insurance at an 80% coverage level. Projected long-run incomes are $69,000 for a $300/acre cash rent, $15,000 for a $350/acre cash rent and -$49,000 for a $400/acre cash rent.

Summary and Observations

Given current estimates of 2013 cash prices, projected incomes for all rental scenarios will be relatively high, suggesting that 2013 could be a good income year. Worst-case incomes are considerably lower than projected incomes. Note that farms with high percentage of acres cash rented at high cash rent levels cannot assure themselves of positive incomes using 80% RP crop insurance. In some year in the future, these results suggest that farms with high amounts of cash rent may face large losses.

Under long-run prices, projected incomes are low or negative given high cash rent levels and a high percentage of farmland cash rented. If prices return to the lower, long-run levels, there will likely be downward pressure place on cash rents so as to avoid negative farm incomes.

You May Also Like