Think DifferentAdvice from a non-ag outsider with strong business credentials who regularly critiques his business plans has been critical to improving his farm management, says Jim Kline.Kline’s eyes were opened to the benefits of an outsider’s perspective when he served on the board of directors of a non-ag company with $30 million in annual sales. “I learned a lot from that,” he says. “I should have paid them for the experience.”When the company’s CEO retired, Kline asked if he would serve as a sounding board for his farm. “I think in agriculture, especially if you grew up in it, you have to think outside the box, especially financially,” he says. “My advisor asks tough questions. Doing something the same way you always have just isn’t good enough.”

November 4, 2013

Beginning in 2010, as good times for corn and soybean producers continued to boost farmland prices and rents to new highs, Jim Kline took a hard look at the go-go atmosphere and prepared for a downturn.

“I have tried to pride myself as I get older in not becoming overly conservative, but when you see land prices and rents go up as fast as they have the past few years, it tends to fall off relatively fast as well,” says Kline, who farms 8,000+ acres near Harford City, in east-central Indiana.

As he looked to the future, Kline, 56, turned to lessons learned from the 1980s farm crisis. He began paying down debt, trading machinery less often and slowing down his farm expansion. “Instead of buying land, bidding up rent and buying new machinery, we held back,” says Kline.

Today, Kline carries “little” land or machinery debt.

“My crystal ball was a bit fuzzy because I was early in backing off,” Kline admits. “But I farmed through the ‘80s. Within a couple of years, you can lose a quarter of your equity. We have been on a run like nothing I have seen since the ‘70s. I think we need to brace ourselves.”

Although Kline thinks tougher times are ahead, he claims no special insight on how the farm economy will play out in the coming years.

Like what you're reading? Subscribe to CSD Extra and get the latest news right to your inbox!

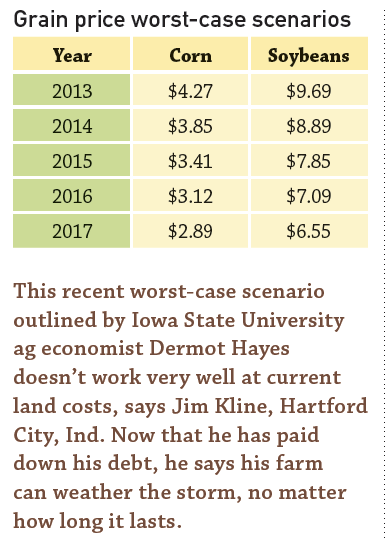

Some university ag economists see a bleak outlook. For example, a recent “worst-case” scenario outlined by Iowa State University Ag Economist Dermot Hayes shows corn prices as low as $4.27 in 2013, $3.85 in 2014, $3.41 in 2015, $3.12 in 2016 and $2.89 in 2017. Worst-case soybean prices were projected at $9.69, $8.89, $7.85 $7.09 and $6.55 for the same years.

“I think we could spend a lot of time where “4” is the first number for our corn pricing opportunities,” says Kline. “That doesn’t work very well at current land costs. Now that we have paid down our debt, we can weather the storm, no matter how long it lasts.”

Productivity investments

Over the past three years, Kline continued to invest in his farming operation even as he aggressively paid down debt. Instead of buying land, he focused on improving productivity of both owned and rented land, as well as improving relationships with landlords. That led to modest acreage increases, even though Kline wasn’t aggressively searching for more land.

“We have put in more drainage and removed fencerows and small woods if it was approved by NRCS,” says Kline.

He also made other core infrastructure improvements, including constructing a new 28,000 square-foot office, shop and machine storage complex, built with a goal of improving the farm’s overall efficiency.

His decision to construct the new office and machinery building was another reason to back off on machinery purchases, Kline adds. “In recent years, we haven’t traded as often as we typically have because we knew we were putting up the new building. We did that with cash, and not borrowed money. If we traded equipment every other year, we didn’t need a new shop.”

Preparing for growth

Part of Kline’s debt-reduction strategy has been to position his operation for continued growth if opportunities arise following a downturn. He recently expanded his 2014 rented acreage by a considerable amount, based in part on his solid financial position.

His long-term goal is to increase the size of his farming operation 50 to 100%.

“My Dad lived through the Great Depression,” says Kline. “He told me that people who had money coming out of the Depression really were able to capitalize on the situation. Cash was king. I want to be in a position to handle significant growth during a downturn.”

Kline hopes his outlook for a downturn is wrong. But if it isn’t, he says most farmers will be better able to handle tougher times than they were in the 1980s. “Agriculture in general is in a better position (financially) than we were in the ’70s and ’80s,” he says. “That doesn’t mean we won’t have a rough two, three or four years.”

About the Author(s)

You May Also Like