April 29, 2016

Considerable debate surrounds the U.S. crop insurance program, including its cost, role in farm conservation and impact on farm management and farmland values. Experts at the University of Illinois examined the broader considerations that underpin these specific debates. Unless these broader considerations are addressed, crop insurance will likely remain a topic of debate well beyond the next farm bill.

Crop insurance has emerged as a continuing policy issue on the American Agenda.

Crop insurance continues to successfully ward off attempts to cut spending, but each confrontation spends political capital and likely increases the ranks of critics. Discussions will continue until the reasons underlying the discussions are addressed.

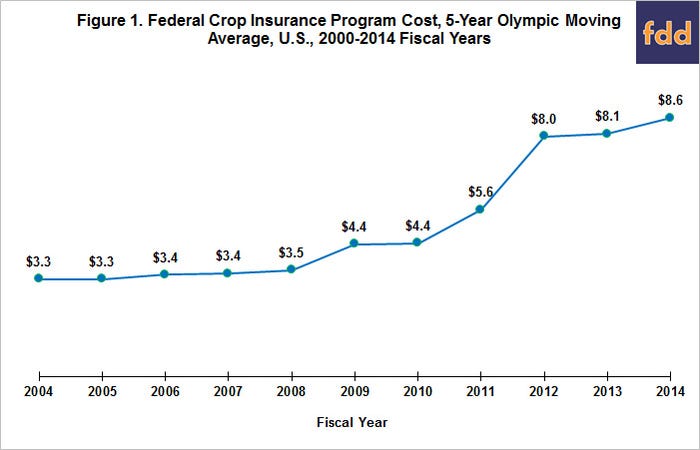

Crop insurance's emergence as a policy issue reflects in part a large expenditure program whose spending has grown fast even during a time of crop farm prosperity.

Premium subsidies account, by far, for the largest share of spending on crop insurance. Moreover, premium subsidy per dollar of insured liability has also increased. If society wants to reduce spending on crop insurance, it will eventually have to address premium subsidies.

Federal spending on insurance premiums have evolved from a small to large expenditure item. Large expenditure items face different questions than small expenditure items. Simply put, for large expenditure items, benefit-cost assessment centers on society at large as much as program beneficiaries. "Whether money is better spent on another program society desires?" becomes a central question for no other reason than a large sum of money is involved. The implication is that supporters need to justify the program, not in terms of what it can do for program beneficiaries, but what the program can do for society.

Prior to the late 1990s, crop insurance could succinctly be described as a government policy to assist farmers in times of stress resulting from yield shortfalls, usually from weather over which the farmer had little control. The non-agriculture public could easily understand and clearly relate to this story. However, yield insurance has morphed into revenue insurance which may now be morphing into margin insurance on the difference between gross revenue and some measure of cost. County insurance has morphed into shallow loss insurance (SCO) with cotton now having its own shallow loss program (STAX). Yield (AHP) exclusion and Harvest Price Option (HPO) are non-trivial add-ons. These changes have value to farmers and insurance companies and agents, but the story about what risk is being covered and how much farmers may or may not have control over these risks has become muddied and complex at best. Crop insurance supporters continue to create new products and add-ons rather than speak to the relevancy issues being raised by critics. From the political process perspective, the importance to a program of having a simple story to which the general public can related cannot be emphasized enough.

The simple measure presented in Figure 5 calls into question whether crop insurance is cheaper than ad hoc crop disaster assistance.

Crop insurance has another fundamental dilemma: there is no objective rationale for the current matrix of premium subsidy rates, either in total or by product and coverage level. The matrix of subsidy rates is a political equilibrium based on what society will pay. Lack of an objective basis for the rate of a subsidy is not an issue until a program becomes an issue. Failure to satisfactorily address the objective measurement question will ultimately lead to cuts and potential elimination of a program. The direct payment program confronted the same problem in terms of an objective basis for its payment rate per acre for a given crop. The failure of its supporters to address this question ultimately contributed to direct payments being eliminated in the 2014 farm bill. This issue of an objective based measure for the premium subsidy rate will be explored further in the next article in this series on why crop insurance has become an issue.

Originally posted by University of Illinois.

Data Notes

1. A 5-year Olympic average is used throughout this paper to eliminate low and high value years that may skew the data.

2. Fiscal year for the U.S. government starts October 1 and ends September 30. It is denoted by the year in which it ends. Thus, for Figure 5, fiscal year expenditure is matched with crop receipts for the calendar year that overlaps the most number of months. For example, U.S. fiscal year 2014 expenditures are matched with crop receipts for the 2014 calendar year.

3 Ad hoc crop disaster assistance does not include marketing loss assistance and oilseed payments made during fiscal years 1999-2001. Congress authorized these payments in response to low prices, not low yield; with a contributing factor being the elimination of target price programs by the 1996 farm bill. The two programs subsequently became the basis for reinstituting a target price program, specifically the countercyclical price program in the 2002 farm bill. In summary, these two programs are more similar to commodity program payments.

4. Insured liability is adjusted to account for the increasing share of crop insurance contracts that contain the harvest price option (HPO). To account for the HPO feature, the liability for contracts that had HPO was increased by 7.3%. This factor was the average increase from the initial insurance price to the harvest insurance price of corn, sorghum, soybeans, upland cotton and wheat when their price increased over the 1973-2015 crop years. Contracts that had the HPO feature were Crop Revenue Coverage (CRC), Revenue Assurance (RA), Group Risk Income Protection - Harvest Revenue Option (GRIPH), Revenue Protection (RP), and Area Revenue Protection (ARP). All RA contracts are assumed to have the HPO option even though it was an option. Data on RA does not contain a breakout by HPO option. Anecdotal evidence suggests that the HPO option was commonly chosen.

You May Also Like