February 5, 2013

Curiosity paid off for Sam Keyser in 2012 when he collected 100% of the value of a weather insurance policy that he tried for the first time. "I was curious about the insurance. I know how easy it is to miss pollination or have to replant in a cold, wet spring. That may not impact my Federal Crop Insurance (FCIC) yield, but it affects my overall yield."

In 2012, the Geff, Ill., grower insured part of his corn crop, trying Total Weather Insurance (TWI) coverage on 300 of his poorest acres and 300 of his best acres as a test. "I just insured corn; we have more trouble with major yield differences in corn than soybeans," he says.

Keyser says the policy "maxed out for heat stress, daytime and nighttime, and pollination during one of the hottest, driest years on record. The corn was off to a beautiful start; we had a 180-200-bu. yield potential. It was wet in the beginning, and then it quit raining."

FCIC coverage for his 6-bu. yield was based on a 135-bu. actual production history (APH). The TWI coverage was based on the level and type of weather risk he chose to insure for the relative maturity of his hybrids.

In Spalding, Neb., Joe Diessner insured all of his corn and soybeans for the 2012 season. "I saw articles about the insurance and it looked interesting. We're always hot and dry. I figured we'd get paid if it was hot and dry and we wouldn't if the weather was good and we got a crop. With irrigation, we might not have a FCIC loss, but we could still be down on yield. So I took all of the coverage."

For corn, TWI covers specific weather perils such as early drought, drought, daytime heat stress, nighttime heat stress, excess moisture and low heat units/freeze during the growing season, he explains.

"It really kicked in this year (2012)," Diessner notes. “On the pivots, we ran two to three years’ worth of irrigation. The weather insurance helped pay for that. It works well together with FCIC. TWI insures the top end that FCIC doesn't.”

He received checks covering losses on his corn and soybeans. To collect, "there are no adjusters, no guess work, no human error or emotion. After the coverage ended, the check came within two weeks."

During the extreme weather of 2012, 80% of all policies written to cover corn paid out, according to Jeff Hamlin, director of agronomic research for California-based Climate Corporation. For soybeans, he says the number was 79%. Like the weather, payouts varied by state. In Illinois, 98% of the corn policies and 91% of the soybean policies paid out. It was 100% of corn policies in Nebraska and 42% in Minnesota.

"These weather insurance policies are parametric," Hamlin explains. "The policy specifies that if a specific weather event happens, the grower is going to automatically get paid a predefined amount based on the expected loss of yield associated with that weather event. It is a complement to FCIC, allowing growers to lock in profits above and beyond where FCIC can protect them.

"For example, if you’re a 1,000-acre farmer, with a 150-bu. APH, at the 80% FCIC level, you are guaranteed 120 bu. But you may spend and fertilize for 180 bu. because you know that is what your land can achieve if the weather cooperates. The revenue potential of this grower at $6 corn, if he made the 180 bu., would be $1.08 million gross revenue. If instead he went below 120 bu. and he received a FCIC claim, his gross revenues would be $720,000. So his unprotected revenue risk was 60 bu. times $6 corn, or $360,000. Many growers across parts of the Corn Belt missed out on this potential revenue last year because they had poor yields driven by bad weather."

Hamlin continues, "The cost of TWI in Iowa or Illinois during 2012 for many growers was between $30 and $40/acre. We had growers get paid up to $350 or $400/acre."

Weather history and forecasts, agronomy, historic yield and data loss are the basis for the insurance rates. "The price changes daily, based on forecasts. It has to be quoted on the day the grower signs up," he notes. "Also, the grower can change the rate paid by adjusting the temperature for coverage of heat loss, or the number of days for heat loss coverage and pick target yields based on the hybrids he intends to plant."

Growers must enroll by March 15, the same as FCIC.

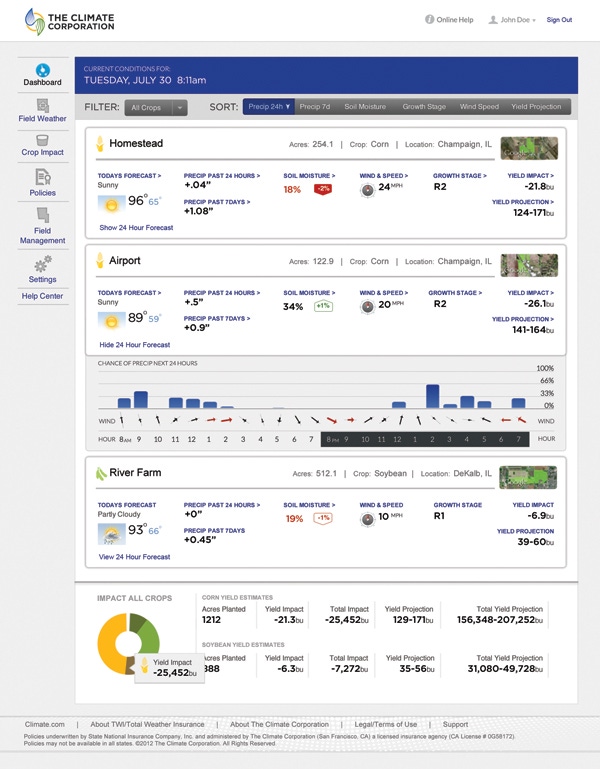

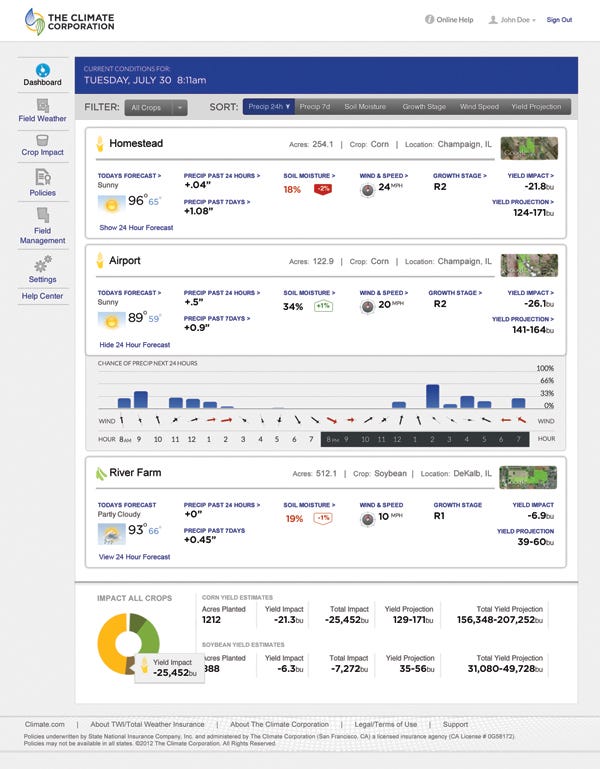

Climate.com planning tool

"We listened to growers’ questions and built an online service that can give them more information about what’s going on in their fields and provide them with data that they can use to improve their planning and decision-making," Hamlin says.

New for 2013, http://climate.com provides yield forecasts, weather forecasts, historical weather data back to 1980, and more for each of the fields they farm, he says. "During the growing season they’ll be able to see the current status of what is happening in each of their fields, updated daily. Each field will show a yield projection updated daily based on the most recent weather in the field along with crop and soil type. And growers will be able to get an up-to-date weather data including yesterday’s rainfall total, hourly forecasts for the next 24 hours for spraying or a seven-day forecast for the field," Hamlin says.

Since the 2012 test paid off, Keyser has signed up to insure corn for 2013.

Diessner plans to insure his corn and soybeans. "I was really impressed. If it would have rained, there would have been no insurance payment and we would have had a better crop. But we had 100-degree weather for 10 days or longer with no rain. So we got paid."

About the Author(s)

You May Also Like