September 9, 2017

By Chris Hurt

The pork market had a great performance in 2017, and prospects for 2018 look positive, as well. What do I mean by a “great performance”? For 2017, pork production will increase about 3.5%, and prices are likely to be sharply higher — by about 12%. More production and higher prices seems to defy economic logic. But what is evident is that pork demand is really strong this year.

Strong demand means consumers are still buying more pork even with higher hog prices. So what’s going on? There seems to be at least three components.

First, the U.S. economy is doing well. More people have jobs, wages are increasing, and household wealth is rising partially due to high stock market prices. Second, consumers love the taste of bacon, and it’s finding its way into an increasing number of sandwiches and other food products. Finally, our foreign customers like U.S. pork. They’re being stimulated to buy more from us due to improving world incomes and the falling value of the U.S. dollar.

Since the start of the year, the dollar index has fallen nearly 9%. A cheaper dollar means foreign currencies are stronger, and those currencies buy more in the U.S.

Price comparisons

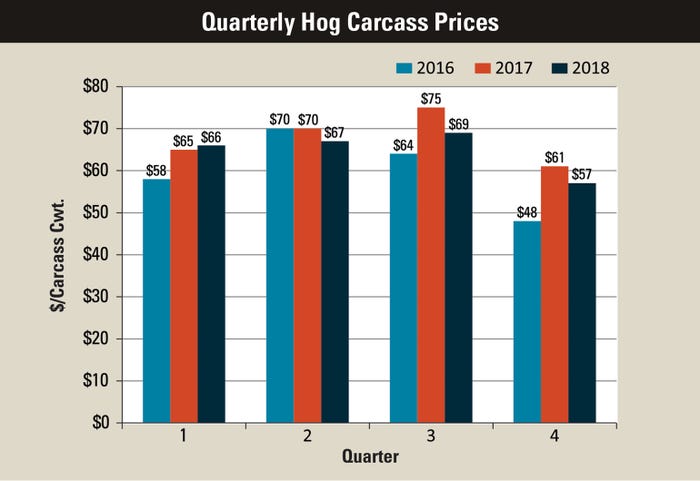

In 2016, lean hog prices averaged about $60 per hundred pounds. In 2017, that average is expected to be around $67. Big quarterly jumps occurred in the third quarter of 2017, and are expected in the fourth quarter, as well.

In the third quarter of 2017, prices were about $11 higher than the same quarter a year earlier. A bigger increase is expected in the final quarter of 2017, up $13 from the year before.

Favorable crop yields are sending signals of abundant feed supplies and a continuation of moderate feed prices into 2018. That will help keep expansion going, with pork production growing by around 3% again in 2018. But next year we can’t count on further growth in demand. You can expect prices to drop $2 to $3 from 2017 levels.

Bottom line figures

Total costs of production are expected to be in the mid-$60s for the rest of 2017 and into 2018. At this point, 2018 looks like a year when farrow-to-finish producers who have average costs can cover all of their production costs, including family labor and full depreciation on buildings and equipment.

Once feed prices finally dropped starting with the 2014 crops, the pork industry has experienced a dynamic period of growth. By the end of 2018, the industry will have expanded production by 17% from 2014 levels.

That growth is about 4% per year, on average, over the four years. While that isn’t computer industry growth rates, it’s impressive for agriculture, which tends to grow at 1% to 2% per year. As I said, the pork market has had a “great performance.”

Hurt is a Purdue University Extension ag economist. He writes from West Lafayette, Ind.

You May Also Like