July 16, 2020

COVID-19 has impacted every link in the pork supply chain. Stay-at-home orders early in the pandemic triggered changes in pork flow. Restaurant and food service demand for pork plunged. Grocery store sales surged. In April and May, a second main shock crippled capacity to harvest hogs for pork.

Producers adjusted hog diets, upped stocking densities, sorted or topped off pens, and found additional facility space. Despite these short-term reactions to the unprecedented situation, some pig removals still occurred.

Disruptions and producers’ responses created potential for some odd-looking numbers and relationships in USDA’s June Hogs and Pigs Report. To help market participants understand which hogs USDA tallies and what the numbers represent, USDA provides definitions for items in the report, and some questions and answers pertaining to hogs and pigs estimates.

Euthanized unweaned pigs not included

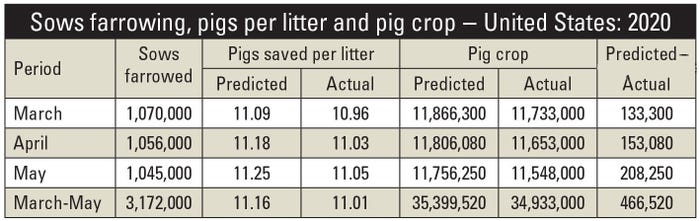

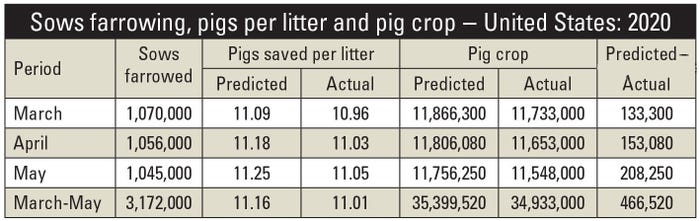

Unweaned pigs that die are not included in the pig crop. The pig crop is a function of sows farrowed and the number of pigs per litter. The denomination of pigs per litter is “pigs saved,” which for all intents and purposes are “pigs weaned.” The March-May average pigs saved per litter was 11.01, compared to 11.00 last year. While the litter rate was record high for the quarter, the 0.1% rise was well below what would have been predicted based on recent productivity.

Using data since 2014, a simple linear trend model predicted 11.16 pigs per litter. This would have been a 1.5% annual rise, which would have been modest compared to the 3.2% average annual rise of the previous four quarters.

Analysts can make inferences about pig removals based on the difference in predicted pigs saved per litter and the reported pigs saved per litter, assuming all else constant. For the March-May quarter, this equates to 0.15 pig. This may seem small, but when applied to 3.172 million sows, it equates to 466,520 pigs, or a 1.3% lower pig crop. This can be couched as additional prewean mortality. Monthly, the largest difference in predicted pigs saved per litter and the reported number was in May, which aligned with the apex in slaughter reduction and the resulting backlog that persists today.

Plunging pig prices and space constraints incentivized producers to keep only the most viable pigs in every litter, which likely contributed to the lower-than-expected pigs saved per litter and resultant lower pig crop. Also, USDA includes sows whose unweaned pigs are euthanized in sows farrowed but with zero pigs saved for that litter. Disease is typically the major driver in curbing litter rates. Nationally, 2020 has so far proven to be a milder year for incidences of porcine reproductive and respiratory syndrome and porcine epidemic diarrhea virus.

Euthanized weaned pigs not included

Pigs that are weaned and die are not included in the pig crop. The pig crop is defined as the number of pigs that were born alive during the reference period (monthly, quarterly or biannually) and are either still owned by the operation, or have been sold or slaughtered by the reference date (Dec. 1, March 1, June 1 or Sept. 1) of the publication. Pigs that die for any reason other than being slaughtered for human consumption are not included in the pig crop estimate.

The March-May pig crop, at 34.933 million head, was 479,000 head, or up 1.4% from 2019. This continues a trend of 24 consecutive year-over-year hikes in quarterly pig crop estimates. However, this is the third smallest rise of those 24 quarters.

These viable pigs are still subject to postweaning mortality. USDA treats pig death loss during the grow-finish process as the residual required to balance hog slaughter numbers and the reported pig crop six months or two quarters prior. This simple comparison between observed slaughter and the reported pig crop is only a rough estimate of actual pig death loss because the pig crop is used not only for slaughter but also for breeding. Also, adjustments are needed for herd expansion or liquidation in particular years, imports of feeder pigs and a couple of thousand exports of live hogs.

Regardless of these dynamics, USDA does not adjust pig crop figures to eliminate the imbalance, or residual, caused by death loss. In the latest report, USDA reviewed all inventory and pig crop estimates for June 2019 through March 2020 using the up-to-date pig crop, official slaughter, import and export data, and death loss data for 2019.

From the March to June report, USDA revised upward the estimate of the Dec. 1, 2019, all hogs and pigs inventory by 390,000 head, or 0.5%. The breeding herd was unchanged, while the market hog inventory, specifically the 50- to 119-pound category, captured all of the upward revision. Pigs of this weight would have reached market weight roughly mid-February through March. This paralleled the large year-over-year surge in slaughter during that period.

USDA revised up September-November 2019 sows farrowed by 18,000 litters (0.6%) and boosted the September-November pig crop by 198,000 pigs (0.5%), which aligned the pig crop with April-June 2020 slaughter. The pigs-saved-per-litter estimate remained the same. The mere fact that the pig crop was revised upward for a period corresponding to likely higher death loss resulting from reduced slaughter capacity affirms that pigs that are weaned and die are not included in the pig crop.

Euthanized swine estimated annually

USDA publishes death loss estimates in the Meat Animals Production, Disposition and Income Annual Summary. Death loss refers to pigs that die after weaning and cannot be counted in any inventory category. Analysts can use USDA data to calculate annual death loss percentage in several ways. One is simply dividing deaths by the total annual pig crop, which was just over 138 million pigs in 2019. By this measure, death loss was 8.7%. That is down from 9% in 2018, even with over 5.4 million more pigs.

The unusually wide range of pre-report estimates for the market hog inventories, especially the heaviest and lightest weight categories, indicates considerable disagreement among analysts as to the actual magnitude of death losses due to COVID-19 disruptions, including euthanized swine.

Analysts pegged the 180-pound-and-over category at between 102.2% and 126.8% of a year ago. This equates to a difference of 3.2 million head. A difference of 3.6 million pigs was suggested for the under 50-pound category. USDA's numbers were higher than the average of trade expectations for the lightest pigs and lower for the heaviest pigs.

We have no estimate on the number of weaned pigs removed prior to slaughter because that number is not required to be reported anywhere. If anything, that number is modest relative to earlier anticipations due to the tremendous efforts of producers and those throughout the supply chain. A long road remains though.

Producers making management adjustments to trim spring pig crop below expectations help limit on-farm backup and eventually ease slaughter capacity constraints. (Source: USDA NASS; Lee Schulz calculations; values may not add up due to rounding.)

The pipeline approach to pork production attempts to forecast hog slaughter at a specific future point based on observations at various points in the production cycle. Pigs enter the pipeline at weaning. The assumption is that what goes in the pipeline must eventually come out, barring “leakage” due to death loss, breeding herd additions and exports. If 2020 death loss is higher, impacts on the pipeline and slaughter could be higher than normal.

For more information on what USDA includes and excludes in hog numbers, read the USDA National Agricultural Statistic Service’s Q&A document.

Schulz is the ISU Extension livestock economist. Send email to [email protected].

Read more about:

Covid 19About the Author(s)

You May Also Like