Last Thursday’s Quarterly Grain Stocks report from USDA was no doubt an exciting market event, though corn and soybean prices did not escape the trading session unscathed. Indeed, sentiments from the report are continuing to resonate in markets and will likely continue to do so until at least next Tuesday’s October 2021 Crop Production and World Agricultural Supply and Demand Estimates reports.

The Sept. 1 data released last week provides the first full look at total 2020/21 corn and soybean consumption rates. The insights take a little more data analysis to find in the Quarterly Stocks report, so I’m devoting today’s column to a deep dive on corn and soybean stocks and usage analysis and the implications for farmers in the weeks to come.

Soybean supply surprise

USDA’s Quarterly Grain Stocks report surprised markets last week after finding 81 million more bushels of old crop (2020/21) soybean bushels. The finding bucked previous market forecasts, which were trading on the prospects of the second-tightest ending crop supply on record prior to the data release.

The 2020 soybean crop produced better yields than USDA had originally forecasted based on updated usage data analyzed by the agency’s National Agricultural Statistics Service in yesterday’s Quarterly Grain Stocks report.

Slower exporting and crush paces this past spring were re-factored into June 1 soybean stock estimates in today’s report. USDA added 2.5 million bushels of soybeans to June 1 stocks, pointing to lower usage rates amid high prices and seasonal shifts in Chinese export demand to cheaper Brazilian stocks.

The uptick in supply alleviates price pressure on the U.S. soy complex. USDA’s current stocks-to-use ratio for the 2020/21 marketing campaign stands at 3.9%, following only 2013 (2.6%) as the second tightest on record. The 81-million-bushel 2020 soybean production increase would grow the old crop STU to 5.7%, which is actually only the 11th tightest ending supply on record.

Based on the new supply revisions, it is likely that USDA’s World Agricultural Outlook Board will leave 2020/21 aggregate soybean usage rates unchanged in the upcoming October 2021 WASDE report.

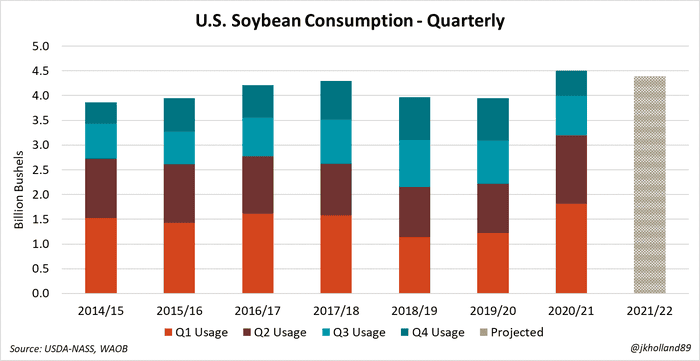

The soy consumption calculation

There’s little doubt the 2020/21 marketing year was an anomaly for soybean usage rates. First quarter consumption of 1.8 billion bushels accounted for 40% of total 2020/21 usage while second quarter consumption totaled 1.4 billion bushels, or 31% of annual consumption. Respectively, the prior six-year average for first and second quarter soybean consumption stands at 35% and 27%.

So it should come as little surprise that third (18%) and fourth (11%) quarter consumption rates were so low. Old crop prices peaked in July. With Chinese demand concentrated on South America, U.S. soy processers were unwilling to pay for the 1.56 billion bushels of soybeans left in the U.S. as of March 1, 2021, with many extending maintenance projects to safeguard against higher soy input prices.

The lower soybean consumption rate over the past six months grew 2020/21 supplies past what was previously believed to be historically tight measures. To be sure, soy stocks are likely to remain tight again this year, but not to the degree of 2020.

November 2021 soybean futures prices have dropped over $0.33/bushel since last Thursday. New crop November 2022 futures are down $0.09/bushel in the same time period. Prospects for both crops remain comfortably above breakeven levels for most growers across the Heartland.

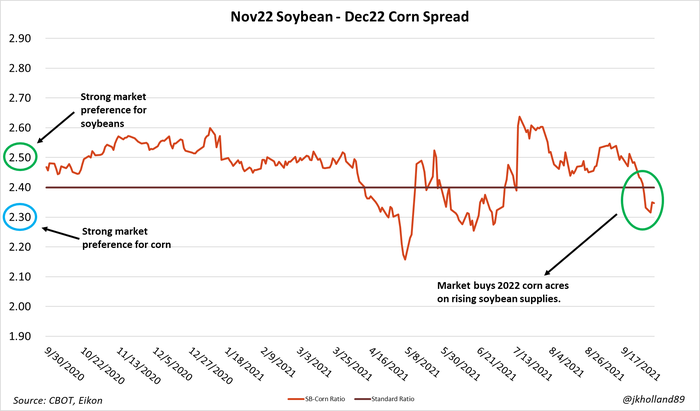

But the drop, paired with rising concern over China’s export demand prospects in the coming weeks, coaxed the market to buy 2022 corn acres for the first time since mid-July 2021.

2022 planting intentions shift

But farmers should not be too quick to adjust crop rotations just yet. The market does not voice a strong demand for corn until the new crop soybean-corn price ratio dips below 2.3. At market close last Thursday, that figure stood at 2.38 and is sitting at 2.35 today, hovering close to the 2.4 benchmark inflection point for corn versus bean acres.

That means that the market is not overly eager to buy either corn or soybeans, though a slight preference for corn has surfaced over the past week. To be sure, a lot of time remains until the 2022 crop will be planted, especially when 2021 crops are still awaiting harvest.

Soaring input costs will play a significant factor in next year’s acreage allocations, especially as cries for product availability for next spring’s fertilizers and pesticides are already being loudly voiced amid ongoing logistic disruptions in the supply chain.

Corn supply pressures ease

USDA made a score of corn balance sheet revisions last Thursday that necessitated make changes all the way back to fall 2020 production estimates.

Revised stocks data led USDA to cut 71 million bushels of corn from 2020 production values. 2020/21 ending supplies came in on the high end of trade expectations at 1.236 million bushels, but it was not high enough to trigger a selloff, thanks in large part to smaller beginning 2020 stocks.

But December 2021 corn futures prices have still depreciated $0.06/bushel over the past week, especially as 2021 yield reports continue to point to larger 2021 supplies. Factoring in the smaller 2020 crop and lower usage rates, the October WASDE report will likely show 121 million fewer bushels of corn usage in the 2020/21 marketing year.

It remains a toss-up over where USDA’s World Agricultural Outlook Board will add in those bushels in its October 2021 World Agricultural Supply and Demand Estimates (WASDE) report later this month.

However, the higher soybean stocks added optimism to 2022 corn acreage expectations, sending deferred contract prices higher. Keeping 2021/22 usage rates constant at 14.80 billion bushels and new crop production at 15.00 billion bushels, new crop ending stocks could rise an additional 50 million bushels.

That would increase the stocks-to-use ratio up to 9.9% from the current level of 9.5%. Even with the extra boost from old crop supplies, stocks will remain at the ninth tightest on record. Growers can breathe easy that profitable prices are not likely to disappear soon.

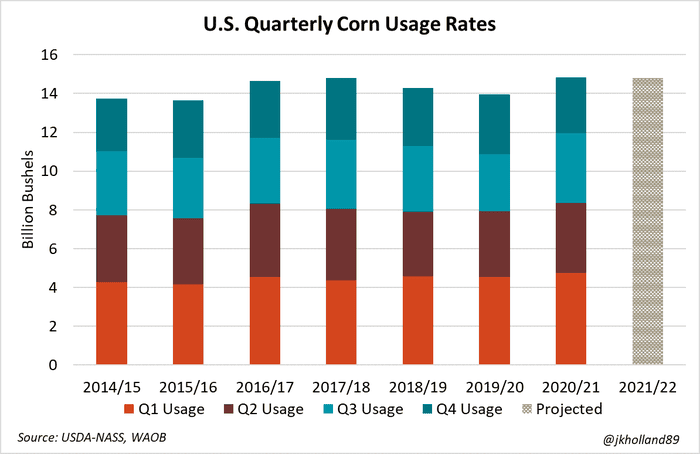

Who didn’t use 2020/21 corn?

Spring 2021 corn consumption rates were higher than USDA indicated in its June 30 quarterly stocks update. The Sept. 30 report saw USDA slash 2.7 million bushels of off-farm stocks, suggesting that rapid export paces last spring were likely more brisk than markets had originally factored.

The data backs this up. Third quarter corn usage has averaged 23% of total marketing year consumption rates over the past decade. But an uptick in export demand from China brought that total to 24% this spring. And it didn’t take long for fourth quarter usage to suffer in the wake of a strong third quarter consumption.

Fourth quarter corn usage data typically is among the smallest of the marketing year. But the Sept. 30 stocks report saw only 19% of 2020/21 corn demand used up in the fourth quarter – the lowest quarterly usage rate since 2012/13 (18%).

Monthly corn usage rates for ethanol production released by USDA last Friday saw 417 million bushels of corn consumed for ethanol in August 2021 – the fifth lowest monthly volume for corn consumption for ethanol. In USDA’s September 2021 WASDE report, WAOB forecasted 2020/21 corn usage for ethanol at 5.035 billion bushels.

Friday’s data release suggests that only 5.032 billion bushels of corn were used to make ethanol over the past marketing year. If WAOB decides to change 2020/21 corn consumption rates for ethanol next week, it likely will not be a significant shift.

But the U.S. cattle herd is just fractionally lower (1%) than the same volumes a year ago. And U.S. corn exports to China tapered off in July and August as it harvested a larger corn and wheat crop. It seems likely USDA will deduct those extra 2020 corn bushels from a combination of exports and feed and residual allocations in next week’s WASDE.

Trade released from USDA and the U.S. Census Bureau yesterday pointed to record-setting U.S. corn and soybean exports during the 2020/21 marketing campaign. High prices will make 2021/22 a strong competitor with last year’s export volumes. But easing demand from China could hinder another year of record-breaking usage. Demand certainly is not going anywhere but expect volatility to remain ever-present in the months to come.

About the Author(s)

You May Also Like