September 6, 2016

While a complete cropping plan for 2017 doesn’t have to be decided right now, it does need to be lined out on acres being considered for wheat production.

Essentially the decision will have to be made this fall whether to plant wheat and probably double crop with soybeans or to plant a different crop in the spring of 2017. A lot of decisions to be made now even before we know how the 2016 crop year will came out. Discussions I have had with producers indicate that wheat acres planted this fall in Tennessee will be less than were planted a year ago. While overall wheat yields were good in 2016, concerns over lower prices have put a damper on wheat acres. Just the fact that cash wheat prices have dipped under $4 a bushel raised red flags that wheat prices for summer 2017 may be closer to $4 than $5 a bushel.

In Tennessee, the majority of wheat acres are double cropped with soybeans. We have been fortunate the last few years that our double-crop soybeans have had good yields and in some case as good as our full-season soybeans. However, there have been years where profits made in wheat were given back due to low-yielding double crop soybeans. How should producers plan for 2017 with these variables?

As in any plan, we begin with realistic yields and prices. For wheat as well as the comparison crops, I like to use the recent five-year average with some variance for high and low yields. Be realistic on prices, it is always helpful to use a lower and higher price scenario. For 2017, start to visit with suppliers on input prices. While many input prices for 2017 production won’t be set until next year, suppliers may be able to provide you some insight. We expect many input costs to come down or at least stay stable.

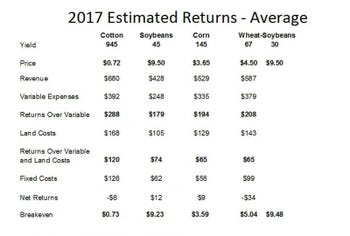

Should I plant wheat for 2017? Let’s look at returns on Tennessee state average yields and projected prices in Table 1.

Click to enlarge

Click to enlargeIn wheat production, it is always important to examine the returns based on how the land cost is calculated. Wheat almost always pencils out better on owned or cash-rented ground as compared to share-rent ground. The percent share rent and whether any expenses are deducted do make a difference.

For owned or cash-rent ground, I typically look at the returns over variable expenses. In Table 1, wheat/soybeans compare favorably to full season soybeans and corn when looking at returns over variable expenses. Cotton at a five-year Tennessee state average yield looks the best if a producer is set up to raise cotton. The cotton price does include rebates that are typically received from Tennessee gins.

If fixed cost (machinery depreciation, interest, and management cost) are brought into the equation then returns for full season soybeans and corn move above wheat/soybeans. Producers will have to examine their equipment situation with regard to fixed cost. On many farms, if additional equipment is not purchased for a particular crop there is not a real monetary expense but maybe rather a drop in value of the equipment as it goes over each acre.

When share rent is calculated as the land cost then wheat/soybeans fall in line with full season soybeans and corn and on the average have about the same returns thus more or less qualifying the statement that wheat looks better on owned or cash-rent ground compared to share rent. While not shown here, examining returns at 10 percent higher or lower revenue, which could be based on a combination of yields and prices, does not alter the returns in relation to each other.

In summary, wheat production (and again in Tennessee we are referring to the wheat/soybean system) can have a place in a producer’s cropping plan. Wheat prices are a concern, but generally speaking they have moved up or down in concert with corn and soybeans so their relative ranking with regard to prices should not change. The land structure where the wheat/soybean system is placed can have a bearing on the profitability.

Wheat looks best on owned or cash-rent ground. It can work on share-rent ground but it will need to be above-average production or a lower percentage share rent or one that shares in some of the expenses.

How well will wheat/soybean production fit in the overall cropping plan? Cotton producers many times find that there is a conflict of labor and machinery at wheat harvest and soybean planting. So that is also an issue that will have to be explored or carefully planned for.

Wheat and double crop soybeans can offer some diversification in the cropping plan that can assist in risk management. We never know from one year to the next what will be the best yielding crop or if one crop may offer a price advantage.

(Chuck Danehowers is a farm management specialist with the University of Tennessee Extension and can be reached at [email protected].)

You May Also Like