August 26, 2021

Lack of rainfall is one of the primary risks for livestock producers dependent upon perennial grass forage production for grazing and haying throughout the year. Years such as 2021 remind us that weather events are out of our control.

Although it is impossible to control the probability and magnitude of precipitation, producers can manage the effect of poor precipitation if it materializes. There are several ways to do it. One way is to transfer some of this risk outside the operation through an insurance product called Pasture, Rangeland, Forage insurance.

USDA’s Risk Management Agency administers PRF insurance. It is available for purchase from crop insurance agents with coverage available on a calendar-year basis. The sign-up deadline for 2022 coverage is Nov. 15.

Lowdown on PRF

PRF insurance uses precipitation data from the National Oceanic and Atmospheric Administration Climate Prediction Center. It is a group insurance policy based on grids 0.25 degrees longitude by 0.25 degrees latitude, or about 16 miles by 12 miles in Nebraska.

The insurance provides producers with the opportunity to insure 70% to 90% of the Expected Grid Index Precipitation across a series of two-month intervals dispersed throughout the calendar year. Premium subsidies range from 51% to 59%, depending upon the coverage level selected.

County and perennial forage type, along with a producer-adjusted productivity factor, determine the dollar value of coverage attached to each acre. If precipitation falls below the insured coverage level, the producer receives an insurance indemnity payment for the productive value of the difference.

For example, suppose a producer insures a productive value of $24 per acre of grass at the 90% coverage level and places half of their coverage in May-June. If the May-June precipitation index turns out to be half of normal, then the producer could receive an indemnity payment equal to 40% of $12 per acre or $4.80 per acre insured.

This indemnity is meant to partially compensate the producer for the poor grass production that is likely to result from this weather situation.

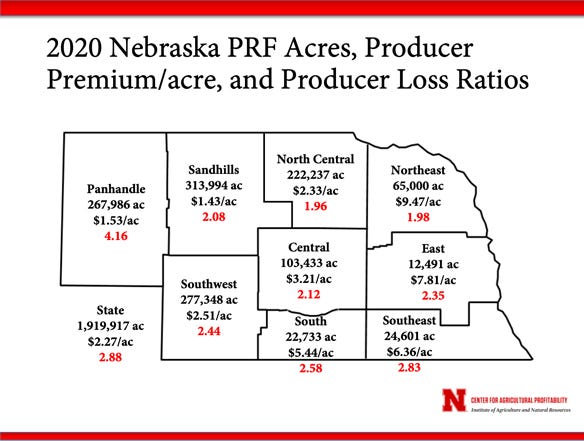

In 2020, Nebraska producers insured more than 1.9 million acres of perennial forage with PRF insurance (see map). Not surprisingly, most of these acres were in the western half of the state. Accounting for subsidies, the average producer premium paid was $2.27 per acre.

Panhandle and Sandhills producers paid lower premiums ($1.43 to $1.53 per acre) than producers did in the eastern third of the state ($6.36 to $9.47 per acre) because the insured value per acre was much lower in the Panhandle and the Sandhills ($20 to $22 per acre) than it was in eastern Nebraska ($88 to $113 per acre).

Producer loss ratio

We can calculate the producer loss ratio by dividing the total producer indemnities by the total producer premium costs. In 2020, the statewide average producer loss ratio for Nebraska was 2.88. The producer loss ratio was higher for the Panhandle than it was for other regions of the state.

Overall, the producer loss ratios across the state for 2020 represent a $2 to $4 average indemnity per dollar of premium invested. The year 2020 had some dry months in it, and that is how PRF insurance should work. However, the producer loss ratios for Nebraska in 2018 and 2019 were 0.44 and 0.60, respectively, indicating how results can vary year to year.

The 2021 crop year for PRF insurance is still in progress. Nebraskans insured a record 3.55 million acres with PRF insurance this year. The dry weather over the past several months is bound to make many people glad they decided to take out the insurance coverage this year.

However, PRF insurance represents a strategy for managing precipitation risk. Implementation of that strategy involves thoughtful consideration of the best package of coverage to put in place and the commitment to stick with it year after year.

Parsons is a Nebraska Extension agriculture economist.

You May Also Like