February 10, 2021

Most farmers have a meeting with their accountant, banker and attorney where issues regarding taxes are typically raised. This area is extremely complex and someone who tells you that they know everything about taxes probably knows very little. Even Albert Einstein once said, “The hardest thing to understand is the income tax.”

As such, the purpose of this article is not to teach everything there is to know about taxes — rather to explain some core concepts to make taxes a bit more understandable.

Estate and gift taxes

The federal estate tax applies to transfers of property upon death. The federal gift tax applies to transfers of property during life. The tax rate on these asset transfers either upon death (estate tax) or during life (gift tax) is 40% of the net fair market value of the assets transferred.

However, the good news is that that the government applies a combined exemption to the gift and estate tax. The combined exemption means that whatever amount you use for gifting will reduce the amount you can use for the estate tax. For 2021, the exemption amount is $11,700,000. Under current law, that amount is indexed for inflation. In addition, each year, a person may gift $15,000 of assets to someone without filing a gift tax return with the IRS and without using any of his/her $11,700,000 gift/estate tax exclusion. For example, a farmer may gift his three children each $15,000 and not file a gift tax return and not use any of his/her exclusion amount.

Income taxes

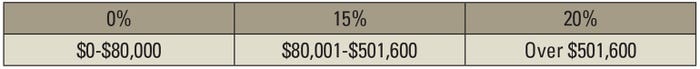

The federal income tax is a tax the government applies to a person’s income. Income from earnings, interest, dividends and royalties is taxed at ordinary income tax rates. Income from the sale of certain assets, such as stock or capital gains assets, is taxed at capital gains rates.

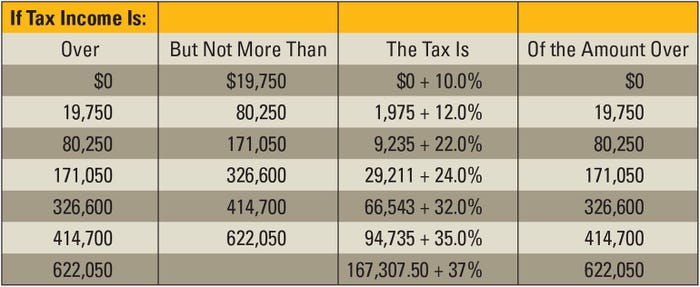

Federal income taxes are progressive. In other words, as taxable income increases, it is taxed at higher rates. Different tax rates are applied on income in different rates (or brackets) depending on the taxpayer’s filing status (married, single, etc.). The rates apply to taxable income, which is adjusted gross income minus either the standard deduction or allowed itemized deductions. Income up to the standard deduction (or itemized deductions) is generally taxed at zero.

A taxpayer’s capital gain is determined in reference to the cost basis of the asset sold. For example, if you purchase a property for $20,000, make $1,000 of improvements, your basis is $21,000. If you then sold the property for $25,000, your gain is $4,000 ($25,000 minus $21,000). Cost basis is also reduced by deductions for cost recovery (i.e., depreciation).

As a farmer, it is important for you to have at least a basic understanding of the federal tax system. For example, can a tractor purchase be justified when depreciation is considered? How much tax will be paid if the woodland parcel is sold?

Good tax planning involves preserving the benefits associated with tax deferrals, deductions and exemptions. Also, minimizing taxes over time and not just in the current year is important. It is extremely critical to a have an experienced and qualified (not the cheapest!) farm tax accountant on your team of advisers.

Schneider is a partner in the agricultural law firm of Twohig, Rietbrock, Schneider and Halbach. Call Schneider at 920-849-4999.

About the Author(s)

You May Also Like