Trade disputes and international disruptions affecting agriculture are nothing new for farmers. The latest headlines causing heartburn involve fertilizer, just as farmers gear up for 2021 crop purchasing decisions. While these developments might not affect some fall applications, the seasonal window for locking in the best deals may be closing, if it’s not already locked shut.

So far, some nitrogen and phosphate products are most affected by two events in recent weeks.

First, the U.S. launched an investigation of phosphate imports from Russia and Morocco, after The Mosaic Company alleged those countries unfairly subsidize their producers. If the U.S. International Trade Commission agrees, duties could be slapped on these shipments. And while a preliminary ruling isn’t expected until early August, the penalties would be retroactive to imports after June 26, when Mosaic filed its petition.

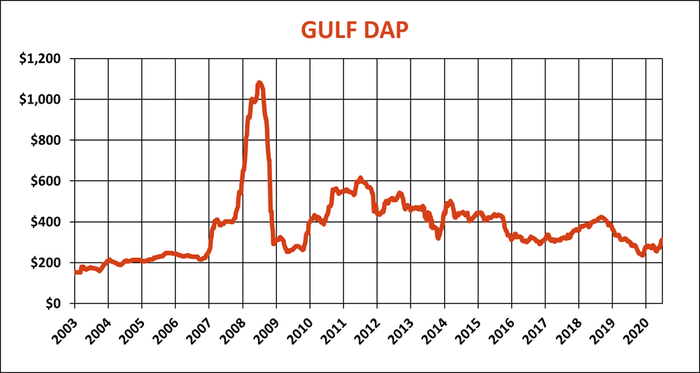

Prices for DAP last month were already rising off their lowest level in a decade. Since then the Gulf DAP benchmark shot up another $40 a ton to close at $314 last week. Retailers tearing up offer sheets matched that hike, taking their prices above $435.

Morocco and Russia dominate phosphate imports into the U.S., accounting for around 85% of the DAP and MAP brought into the country last year. The U.S. is the still the world’s third largest producer of phosphate rock, but output here is falling. Mines in central Florida, once billed as the “phosphate capital of the world,” have closed due to environmental concerns.

China is by far the world’s biggest phosphate producer, but exports to the U.S. plunged in the wake of the 2018-2019 trade war. Sales to other customers around the world fell off earlier this year as the country shuttered during the coronavirus pandemic, but picked up again in June.

China is also a player in the other fertilizer market story this summer. Chinese urea exports more than doubled in May and June year-on-year. But exporters there balked at selling on the cheap in India’s latest tender earlier this month, which failed to secured more than a couple cargoes. That sent India’s buying agency scrambling to arrange another tender due to close this week, with sellers licking their chops over prospects for higher prices. It’s also unknown whether China will be permitted to export urea into India anyway as trade relations soured after border clashes in June.

Gulf urea costs are up $25 a ton off three-year lows hit in June, closing last week at $207. Some retail prices are resetting higher as a result, though dealers who didn’t adjust lower this summer may not post increases.

Still uncertain is whether the turmoil in urea and phosphates will be enough to lift other fertilizer markets out of the doldrums. Some dealers cut ammonia offers last week, reflecting part of the $40 drop in Gulf costs since spring planting, with average retail prices now down around $430. Big regional differences remain, with a $100 spread from the cheap Southwest to the more expensive Midwest.

UAN swaps at the Gulf continue to leak lower with the spring/summer application season over. July swaps for 32% at the Gulf closed Friday at $118, but deferred contracts for the rest of the year traded at a $6 to $11 premium, suggesting a seasonal bottom.

Potash prices continue to see slow but steady downward pressure, as big importer China is out of the market and low crop revenues don’t encourage much buying. The Gulf price dropped to $191 last week, the lowest in more than three years. Corn Belt offers edged a little higher, however, to $230 at terminals, suggesting a little fall buying interest, with recent retail offer sheets running from $320 to $350.

Energy input prices, meanwhile, have stabilized after the coronavirus crash in crude oil. U.S. crude futures started the week around $41 a barrel, close to my current $40.65 projection based on fundamentals of supply and demand.

Usage is slowly returning, offset by the decision earlier this month by OPEC and its allies to begin reducing the cuts to production made after prices plummeted. U.S production is off summer lows, but remains 2 million barrels a day below the record set this winter. Another drilling rig was put back into service last week after that metric fell to its lowest level since 2009.

With economic recovery moving in fits and starts around the world, sharply higher energy prices don’t look likely unless a hurricane disrupts production in the Gulf or closes refineries. Midwest diesel production is edging higher but still remains 14% below year-ago levels as refineries extend seasonal downtime. Inventories in the region dropped a little from the record established the previous week, as seasonal demand from agriculture wanes.

Midwest cash benchmarks continue to trade below ULSD futures settled in New York Harbor, but that basis should narrow a bit in August as ag buying returns ahead of harvest. Wholesale prices ended last week 5 to 8 cents below the futures print of $1.25, with fall cash swaps settling $1.25 to $1.26. That suggests the market doesn’t anticipate a whole lot of upside risk, though supply chain disruptions can cause local markets to sky rocket at just the wrong time for growers. Look for fall farmgate offers to run around $1.75 or so.

Propane is also well off its COVID lows with wholesale benchmarks closing last week just below 50 cents a gallon. Costs typically rise into the end of summer ahead of the winter heating season, though swaps suggest only a few cents upside currently, which could take average farmgate prices to around $1.10 to $1.15.

Energy prices in general benefit from a weaker dollar, and the greenback is down more than 6% from the top of its recent range. Gold hit an all-time high Monday, benefiting from worries the massive monetary and fiscal stimulus from central banks and governments, led by the U.S., will ultimately trigger inflation. In normal times these fears might spill over into a more widespread rush into commodities, including fertilizer and farm products. So far, however, that hasn’t happened, though the Federal Reserve this week should keep its monetary spigots flowing freely.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like