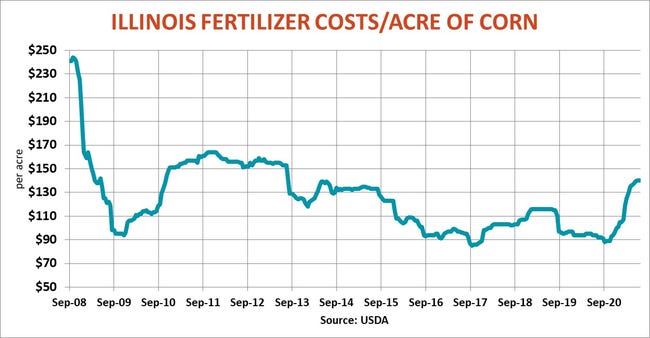

Fertilizer prices continue their march higher around the world. That’s bad news for U.S. farmers, for a couple of reasons.

The cost of N, P and K for an acre of corn is up $50 since Midwest growers purchased products last fall. And there’s no indication anything will get any cheaper this summer when suppliers post offer sheets for summer and fall deliveries.

The last time fertilizer costs rocketed higher on the wake of a bull market in grains was in 2011 and 2012. Back then ammonia and DAP at the Gulf didn’t peak until October/November of 2012, though urea eased by the end of that summer and potash fell back even sooner. On the retail side, however, ammonia in Illinois didn’t top out until April 2013, when it averaged $890, and overall fertilizer costs stayed elevated through planting. On the Southwest Plains, UAN didn’t peak until August 2013, ahead of seeding for the 2014 winter wheat crop.

And while 2022 may seem like a long way off, the rally by nutrients is already threatening to rerail corn profitability on next year’s crop. The increase in corn fertilizer costs amounts to 25 to 30 cents a bushel. Add in basis about the same and Monday’s December 2022 futures test of $4.70 veered dangerously near the red for some growers. November 2022 beans held $11.50 – by a tick – and are still in the black as markets try to encourage South American farmers to go pedal to the metal.

The damage last week? While there’s no word yet on July ammonia contract settlements, deals internationally last week topped $600 a ton including freight. For reference, June Gulf ammonia was at $485. Meanwhile, urea at the Gulf jumped $13 a ton to $444, a move of nearly $85 in less than two months. UAN followed suit, while DAP rose $17 to $617 and potash at the Gulf bounced $34 to $438.

Last week’s sharp downdraft in corn and soybeans caused deferred prices for phosphates and nitrogen to retreat, but the pullback was short-lived. Buyers from Argentina and Brazil continue to book cargoes as South America lays plans for an expected increase in seedings this fall, with those deals for urea the most expensive in the world.

Forward prices show only modest softening into the end of the year, with urea swaps into December only $25 cheaper than the nearby.

Inventories are tight due to supply chain woes caused by both man and nature. Shipping woes, plant shutdowns, politics and trade disputes added to the fertilizer market’s buoyancy.

Demand is also surging as economies recover from the pandemic and struggle to feed a hungry world. Farmers around the world are gearing up to expand crop production, a move that could put another nail in the coffin of the 2020-2021 bull market for grains.

Growers are forecast to add 23.5 million acres of coarse grains, soybeans and wheat around the world this marketing year, with more gains expected for 2022.

The Chinese government appears to be scrambling to stabilize commodity prices and increase domestic grain production, efforts that have prompted fears of a tax on fertilizer exports. Chinese companies have been told to increase stockpiles to make sure the country’s farmers have what they need, with domestic urea prices up 22% over the past two months. And China and India increased subsidies to farmers to make sure they can afford these higher prices. Both countries are big players in the fertilizer market.

China traditionally exports urea and phosphates while importing ammonia and potash. Data out over the weekend showed urea exports 30% higher through May than a year ago, while phosphate sales rose 46%. Chinese potash imports meanwhile are up 20% compared to 2020, with ammonia volume 18% higher.

Traders will be watching offers in India’s latest big urea tender due Thursday to see if Chinese firms participate. Compounding fallout from the sensitive political issue are backlogs at Chinese ports recovering from the pandemic, along with fresh COVID outbreaks affecting other Chinese and Indian ports. Global shipping is still trying to bounce back completely from the blockage of the Suez Canal in March. The result: the Baltic Dry Index, a barometer of shipping costs, hit its highest level in nearly 11 years last week, charges that should make imports into the U.S. even more expensive.

Indeed, a dart thrown at a world map is likely to hit a trouble spot for the nutrient industry. Egypt has imposed quotas on its producers to make sure farmers there have enough supply. Ammonia plant shutdowns in Saudia Arabia and Trinidad added to the tightness.

The Mosaic Company earlier this month announced the early closure of two potash mine shafts that could tighten supplies until another facility closed in January 2020 due to poor prices can be reopened. India is also expected to be in the market for K, while sanctions on Belarus over the forced landing of a plane from Greece to Lithuania and arrest of a dissident could affect that major exporter.

The phosphate market is still feeling the impact of U.S. tariffs on imports from Russia and Morocco, while dealing with higher nitrogen and sulfur prices as well.

While farmers watch their profit margins shrink, Wall Street is cheering the fertilizer rally. Share prices for Nutrien, CF Industries and The Mosaic Company hit multi-year highs over the past month.

About the Author(s)

You May Also Like