I spent much of my summer reading headlines. “Drought in the Northern Plains.” “Dry Spots Develop in Iowa and Illinois”. “Crop Conditions Far Short of Year Ago.” The steady drumbeat of bullish news was dense enough that I had prepared a dramatic announcement for release in my September column; “The bear has left the room.”

Not so fast.

Despite the headlines, it appears we may be lurching towards our third largest corn crop - and largest soybean crop - ever produced. Regardless of how we feel about these facts, harvest is here and we need to address a few important questions.

Is this the time to get bullish?

With demand running solid, the shock needed to put a bull in the market must come from the supply side of the equation. Dryness in the Northern Plains and a strong spike in the spring wheat market served to remind us of how quickly a market can turn. But the spring wheat market is not large enough to change a bearish tone.

The headlines had me leaning bullish in mid-July but the August report threw cold water in my face. Call me neutral but hopeful that the spark will strike soon.

Should I be pricing the 2018 or 2019 crop?

In July, there were a few weeks when some experts were looking ahead to next year, and the following year. Hindsight will tell us if it was a good idea. For myself, however, Dec’18 corn and Nov’18 soybeans at $4.20 and $10.20, respectively, did not cry out for early action (the numbers for 2019 were no better). I might pay attention with December corn above $4.50 and November soybeans closer to $11.00.

The key phrase here is “pay attention,” something I was not doing when Sep’18 spring wheat futures traded above $6.75/bu. That would have been a great place to start (sigh).

When will basis start to improve? Cash prices are composed of two pieces; the futures price and basis. We focus on futures because it is the larger part of the cash price. Basis, however, has been the most persistently bearish piece.

From a western Corn Belt perspective, it has been over two years since we have seen anything resembling a strong basis. Exports are strong. Domestic demand is strong. A few crop scares gave us a stronger board. Basis remains weak. The weak basis simply reflects ample supplies in the country and the ease of buying corn and soybeans. Basis will remain weak until we find a way to reduce stocks with even better demand or a real crop problem. Is this frustrating? Yes. But prepare for more of the same through much of the 2017/18 crop year.

What does this mean concerning the most popular marketing strategy after harvest?

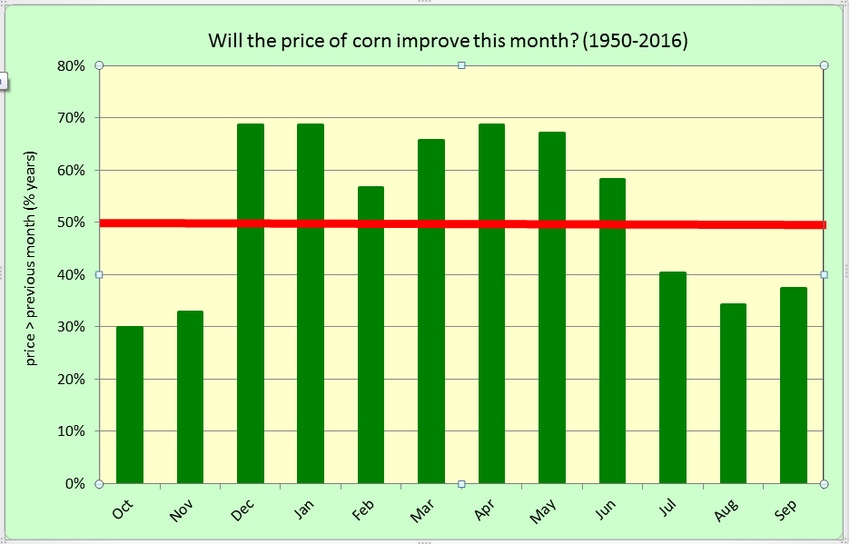

You know the strategy – put it in storage and wait for a better price. Despite bears stalking the grounds, this has worked for corn in each of the last three years, and two of three years for soybeans. I suspect it will work again this year. The odds are in your favor (see accompanying chart).

About the Author(s)

You May Also Like