December 22, 2021

Rising land prices can derail succession plans. To the on-farm heir, start buying in sooner rather than waiting for both parents to die.

In recent columns, I’ve discussed how land values factor into farm succession. This month, I want to encourage both the younger and the senior generations to begin talking to each other about this issue.

Historic land value trends

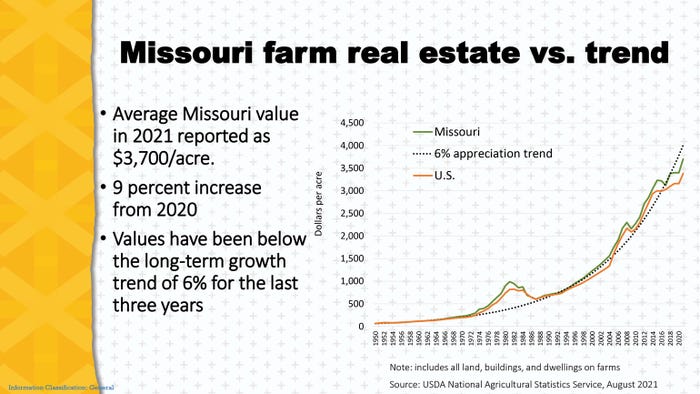

The USDA land price data reveals the long-term trend in land values. Beginning in 1950, the following graph depicts the average price for Missouri farmland per acre. From 1950 to the early 1970s, price increases were modest. However, prices rose very quickly in the 1970s, and in the 1980s, they fell just as dramatically.

In the graph below, the dotted line represents an annual increase of 6% from the initial 1950 value. Throughout most of my career, I’ve been able to say the average land price growth had never fallen below or broken through the 6% trend line. That did not mean land prices had never gone down — they most certainly did in the 1980s — but when land values stopped falling, they had not penetrated the long-term 6% annual increase trend line. Unfortunately, I can no longer make that statement.

According to USDA, Missouri farmland prices on average, which is a mix of cropland and pasture acres, rose by 9% in 2021. Prices averaged $3,700 per acre. However, from 2018 to 2020, land values were essentially flat — $3,380, $3,400, and $3,400 respectively. So, although prices rose by 9% in 2021, this year’s land value is still $308 per acre less than the 6% long-term trend line predicted.

The yellow line is the average all-U.S. farmland price. U.S. and Missouri land prices have had a similar pattern, though U.S. prices had already slightly broke through the trend line 20 years ago.

Implications for farm succession

To see how these trends affect farm succession, consider this example:

In 2010, one of my producers told me he had sold his farm for $1,650 per acre. When he bought the farm in 1965, he paid $100 per acre. He wanted to know how much his farm had appreciated each year on average.

A little math revealed a 6.425% annual appreciation. In 2010, $1,650 was a good price, but what would the farm be worth today, 11 years later, if he still owned it? If it had continued appreciating at 6.425%, it would be worth $3,273 per acre.

The producer may look at today’s land prices and kick himself for selling when he did, but the current prices may just be a continuation of the value he had been gaining all along.

This example highlights the effect of compounding — the same principle that leads to the advice that you should start saving for retirement when you are young. When you consider compounding, it’s the power of “time” that drives your assets’ value.

Make a plan for higher land prices

Admittedly, the 6% trend line has been broken through, so no one knows whether it is relevant for the future. However, actual prices paid at recent land auctions seem to be outrunning USDA’s numbers, indicating there’s a decent chance that prices could be back above trend soon.

Could land prices collapse? Absolutely! Anyone who lived through the 1980s can describe the nightmare they experienced. Anytime you start hearing an asset can’t fall, that’s when you should become extremely cautious. But what if land prices continue to rise? Would that affect your succession conversations?

Take the following common example:

Today, Mom and Dad’s farm is worth $3,000 per acre. Dad passes away, and a son or daughter takes over the farm. The successor makes financial invests in the farm as well as improvements.

Mom lives another 20 years, and upon her death, the successor gets the opportunity to buy out his or her brother and sister. Assuming a 6% annual appreciation, the new price tag for the farm is now $9,621 per acre. Ouch! If mom had only lived 10 years, the farm would still be worth $5,372 at her death.

In succession planning, your son or daughter should know he or she is building his or her future, not someone else’s. Often, when a son or daughter takes over the farm, he or she waits for the death of the final parent to purchase the farm. By waiting, the farm’s sales price may be two to three times more than it would have been had the successor bought the farm when the first parent passed away.

Be careful not to overextend yourself. Finding the cash flow to make this work is difficult, and no one knows what the future has in store for land prices. But if you think prices will continue to increase, the sooner you develop a succession plan, the better. Without a plan, the family farm could dissolve as the on-farm heir faces high prices that they may not be able to afford.

Tucker is a University of Missouri Extension ag business specialist and succession planner. He can be reached at [email protected] or 417-326-4916.

You May Also Like