July 28, 2017

Rising imports of frozen beef have triggered an automatic increase to Japan's tariff rate under the WTO on imports of frozen beef from the United States.

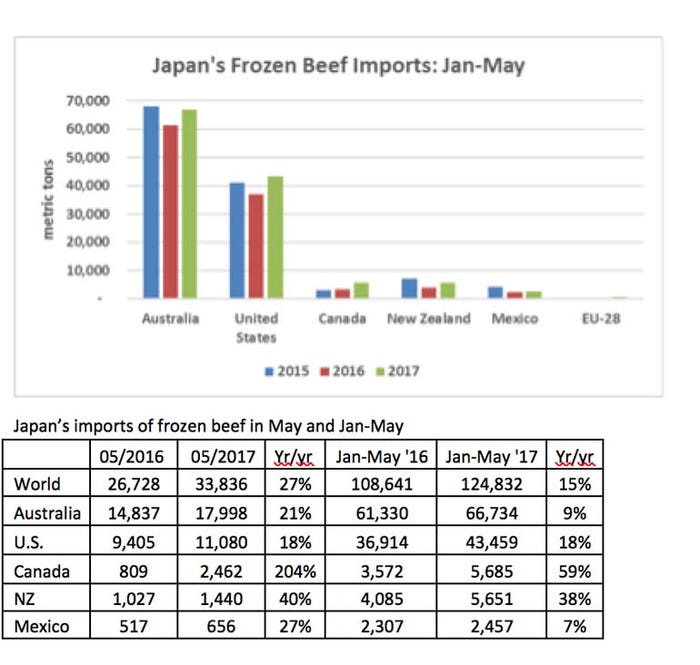

As agreed to in 1994 in the WTO Uruguay Round, Japan maintains separate quarterly import safeguards on chilled and frozen beef, allowing imports to increase by 17% compared to the corresponding quarter of the previous year from countries covered under Japan's "safeguard" mechanism. Imports exceeded this by a margin of just 113 metric tons, according to the U.S. Meat Export Federation.

Exceeding the import criteria triggers an increase in tariffs from 38.5% to 50%. The new rate will begin Aug. 1, 2017 and last through March 31, 2018. The tariff will affect only exporters from countries, including the United States, Canada and New Zealand, which do not have free trade agreements with Japan currently in force.

"Japan is the top export market for U.S. beef in both volume and value and anything that restricts our sales to Japan will have a negative impact on America’s ranching families and our Japanese consumers," said National Cattlemen's Beef Association president Craig Uden.

U.S. exports to Japan were valued at $1.5 billion 2016, according to data compiled by the U.S. Meat Export Federation.

“I am concerned that an increase in Japan's tariff on frozen beef imports will impede U.S. beef sales and is likely to increase the United States’ overall trade deficit with Japan," said Agriculture Secretary Sonny Perdue. "I have asked representatives of the Japanese government directly and clearly to make every effort to address these strong concerns, and the harm that could result to both American producers and Japanese consumers.”

Perdue said the increased tariff will harm the U.S. trade relationship with Japan, which has shown signs of strain as President Trump has talked about restricting steel imports. The chairman of the Japan's Iron and Steel Federation hinted that retaliation could occur in other areas, such as farm products.

The NCBA's leader says nobody wins in this situation.

"NCBA opposes artificial barriers like these because they unfairly distort the market and punish both producers and consumers," Uden said. "Our producers lose access, and beef becomes a lot more expensive for Japanese consumers. We hope the Trump Administration and Congress realize that this unfortunate development underscores the urgent need for a bilateral trade agreement with Japan absent the Trans-Pacific Partnership."

The implications of this rise in tariffs is significant for U.S. beef exports because U.S. frozen beef now faces an even wider tariff disadvantage compared to Australian beef. The duty for U.S. beef will be 50% compared to 27.2% for Australian beef.

The U.S. Meat Export Federation says this will have a negative impact on Japan's foodservice industry.

"USMEF will work with its partners in Japan to mitigate the impact of the safeguard as much as possible," said Philip Seng, USMEF president and CEO. "We will also continue to pursue all opportunities to address the safeguard situation by encouraging the U.S. and Japanese governments to reach a mutually beneficial resolution to this issue.”

Source: USDA, NCBA, U.S. Meat Export Federation

You May Also Like