Although many headlines focus on a declining farm income in 2021, the net farm income outlook is still well-above average and offers a positive story for 2021, says Carrie Litkowski, economist at USDA’s Economic Research Service of the USDA.

USDA currently expects net cash income to finish 2020 at $136.2 billion, but to fall to $128.3 billion in 2021. USDA expects net farm income, which includes the value of inventory changes, to decrease $9.8 billion (8.%1) to $111.4 billion in 2021. Despite this decline, 2021 net farm income would still be 21% above its 2000-19 average of $92.1 billion.

While speaking at the USDA Agricultural Outlook Forum on Feb. 19, Litkowski outlines that government payments are forecast to have more than doubled in 2020, to a record level of $46 billion. This increase was due in large part to supplemental and ad hoc disaster assistance payments to farmers for COVID-19 relief. In 2021 government payments are forecast to decline 45% in nominal dollars.

“I think the farm income story is still a positive story for 2021,” says Litkowski.

“Farmers need to do what they've always done, which is maximize their output and reduce their costs, to try to get through the year,” suggests Litkowski. “And if they're struggling, look for the aid that might be available to them that could maybe help their bottom line.”

Regional differences

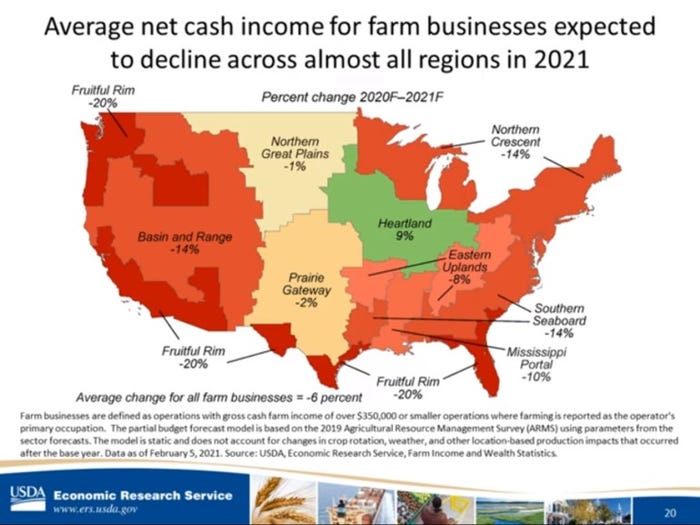

All farm businesses are expected to see on average lower government payments, and higher expenses in 2021, she notes. However, some regions fare better than others with eight of the nine regions showing declines but at varying levels.

In looking at the fruitful rim, which includes California, it could see the largest decrease in average net cash farm income at 20%. “This is due to forecasts for lower receipts for fruits, nuts, and vegetables as well as lower government payments and higher expenses,” she says.

“On the flipside, the heartland is the only region where average net cash farm income is projected to increase in 2021,” Litkowski adds. “Farm businesses in this region are expected to benefit from higher receipts from corn, soybeans and hogs, which are grown a lot in that region.”

The Prairie Gateway region could see just a 2% decline in average net cash income. Litkowski notes that even though it is a decrease, it is not as dramatic as seen in other regions. “Even though we’re forecasting a decline at 2%, that’s a relatively rosy picture maybe compared to other regions,” she says. Similar to other regions, it is expected to see lower government payments on average paired with higher production expenses, but what is helping to keep the average income from going too much lower is the higher receipts for cattle, corn and soybeans.

Further reducing farm income, sector production expenses (including expenses associated with operator dwellings) are forecast to increase $8.6 billion (2.5%) in nominal terms to $353.7 billion in 2021, led by higher spending on feed, fertilizer and labor. However, these production expenses would remain 18.9% below the record high of $436.1 billion in 2014 when adjusted for inflation, explains USDA Chief Economist Seth Meyer.

Litkowski adds USDA is forecasting that total cash receipts, animal product and crops are going to increase about $20 billion in 2021. And then we are also forecasting the government payments will fall $21 billion resulting in a net loss of $1 billion.

In 2020, government payments were a significant portion of farm income. When asked if assuming payments are lower in 2021 will better markets for commodities make up the income difference, or will higher expenses diminish potential gains in income, Nate Kauffman, vice president and Omaha branch executive with the Federal Reserve Bank of Kansas City, says all eyes will be on China.

Kauffman says the trade disruptions of the last two years and the resulting Market Facilitation Program payments made up a significant portion of the recent government support

“I think key as we look at 2021 is going to be the persistent strength of China that was a major driver in commodity prices the last half of 2020,” Kauffman says. “So, we will want to watch closely what those orders look like going into China and obviously that's going to be tied again back to some of the broader concerns around the pandemic."

About the Author(s)

You May Also Like