August 29, 2018

By Alejandro Plastina and Chad Hart

What can Iowa farmers expect from USDA farm programs in 2018 — specifically Agriculture Risk Coverage, Price Loss Coverage and the Trade Assistance Package of 2018?

The ARC and PLC programs were authorized by the 2014 Farm Bill. The Trade Assistance Package was recently unveiled by USDA in late August. It’s designed to aid farmers who are impacted by retaliatory tariffs in international trade, which resulted in decreased exports of U.S. farm products. Some farmers could see checks from the trade assistance program in their mailboxes as early as mid-September.

Farm program payments will not bring any relief to farmers in most Iowa counties with strained working capital in 2018. ARC-County payments on corn base acres will only be triggered in six counties in Iowa, and will average $26.13 per base acre. After 6.8% sequestration, the expected 2017-18 ARC-CO payments per base acre for these counties are $48.76 in Davis, $4.22 in Jefferson, $3.97 in Mahaska, $15.32 in Union, $50.62 in Van Buren and $33.90 in Wapello.

ARC-CO payments on soybean base acres will be triggered in five counties in Iowa and will average $19.71 per base acre. After sequestration, the 2017-18 payments per base acre are projected at $37.85 in Davis, $7.02 in Jefferson, $7.05 in Lucas, $39.58 in Van Buren and $7.03 in Wapello.

PLC payments per corn base acre will be triggered for the third consecutive year, ranging from $23.29 in Lucas County to $41.35 in Grundy County, averaging $34.65 for Iowa’s 99 counties. Since only about 1% of all Iowa base crop acres are enrolled in PLC, the impact of PLC payments on Iowa farms is limited. No PLC payments for soybean base acres will be given in 2018, as in all previous years during the 2014 Farm Bill.

Checks from USDA’s Farm Service Agency with ARC-CO and PLC payments are expected to start arriving in October.

In hindsight, ARC-CO was not the best choice for all farms with corn base acres:

• On corn base acres, 11 counties didn’t receive an ARC-CO payment since the program’s implementation (while PLC payments were triggered in all Iowa counties): Appanoose, Clarke, Decatur, Henry, Keokuk, Lucas, Monroe, Ringgold, Warren, Washington and Wayne.

• For 26 counties, the nominal value of all payments per base acre over the last four years under ARC-CO fell short of the corresponding value under the PLC program: Adair, Calhoun, Chickasaw, Dallas, Davis, Des Moines, Fremont, Guthrie, Hamilton, Iowa, Jasper, Jefferson, Lee, Louisa, Madison, Mahaska, Marion, Page, Polk, Pottawattamie, Poweshiek, Sac, Scott, Union, Van Buren and Wapello.

• For farms with soybean base acres, ARC-CO was often a better choice, given the null payments issued by the PLC program over the last four years. Eighty-seven counties received ARC-CO payments for soybean base acres at least once since 2015. But these 12 counties did not in any year: Adair, Appanoose, Calhoun, Carroll, Cerro Gordo, Guthrie, Henry, Madison, Mitchell, Monroe, Sac and Worth.

• Finally, three counties in south-central and southeast Iowa did not receive any ARC-CO or PLC payments over the past four years: Appanoose, Henry and Monroe.

For more information by county, see ARC/PLC Payments per Base Acre in Iowa, or download the ARC-PLC Projected Payments calculators.

Trade assistance package in 2018

On Aug. 27, USDA announced details for the short-term tariff relief package. The trio of programs making up the relief package is authorized to use up to $12 billion to reduce the impacts of trade disputes on U.S. agricultural producers. The three programs are the Market Facilitation Program, the Food Purchase and Distribution Program, and the Agricultural Trade Promotion Program.

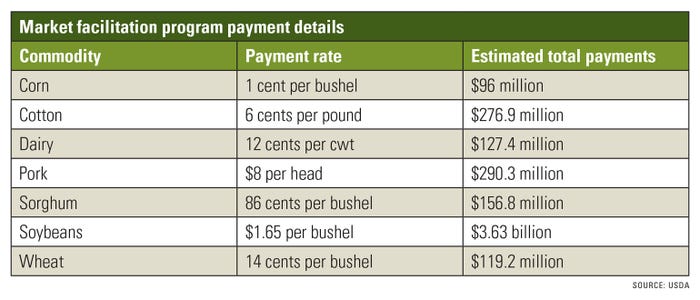

The Market Facilitation Program (MFP) will provide direct financial support to corn, cotton, dairy, hog, sorghum, soybean and wheat producers. The Food Purchase and Distribution Program will purchase commodities targeted in the trade disputes. The Agricultural Trade Promotion Program will provide additional resources to access and develop new international markets for U.S. products.

In the initial phase of this relief package, an estimated $6.31 billion of the $12 billion will be spent, with $4.69 billion for MFP, $1.41 billion for the Food Purchase and Distribution Program, and $200 million for the Agricultural Trade Promotion Program. The remaining funds could be used for a second round of support this winter, likely in December. Sign-up for the various programs will begin Sept. 4.

MFP crop payments

For MFP, crop payments will be based on current 2018 production, so farmers must apply after harvest. Hog payments will be based on the number of owned live hogs, as of Aug. 1. Dairy payments will be based on the historical production record for the Margin Protection Program for Dairy, established with the operation’s highest annual milk production during 2011-13. Dairy farms must have been operating on June 1 to receive a payment.

In all cases, applicants must have an ownership interest, be actively engaged in farming, have an average adjusted gross income of less than $900,000 for the 2014-16 tax years, and have complied with regulations on highly erodible land and wetland conservation.

Payment rates were determined by USDA, based on its estimates of trade disruptions for the individual commodities. For all commodities covered, the payments will be made on 50% of eligible production, with potential for another round of payments for the remaining 50% this coming winter. The table above shows the payment rates and estimated total payments by commodity this round.

Given USDA’s recent production estimates, Iowa producers stand to gain over $550 million from MFP, with the lion’s share going to pork and soybean producers. The MFP payments have a $125,000 cap per person or legal entity, but the cap works differently between crops and livestock. The cap for crops is a combined one, summing up producers’ MFP payments from all five of the crops. The cap for livestock products is separate from crops, so diversified producers with both crop and livestock production can receive more than $125,000 from the program.

A second MFP payment is not guaranteed this winter. If USDA determines that the trade disputes are still damaging U.S. commodity markets this winter, USDA will compute another MFP payment rate, based on the damage estimates at that time, and apply that payment rate to the remaining 50% of production not covered by the initial payments.

The Food Purchase and Distribution Program will purchase various products, from beef and pork to peanut butter and orange juice, that face trade disruptions. While USDA has outlined targeted values for individual commodities, the purchases will be adjusted to match estimates of economic damage from tariffs and will be spread out to match the purchases with needs in nutrition assistance programs.

Purchased commodities will be used in the school lunch program, along with other food assistance and child nutrition programs. Targeted purchases include $93 million of apples, $15 million of beef, $85 million of dairy products, $559 million of pork and $2.4 million of sweet corn.

Ag trade aid

The $200 million addition to the Agricultural Trade Promotion Program will be used for cost-share assistance on ag market development. Eligible U.S. organizations that create and promote ag trade relationships can tap into these funds for consumer advertising, demonstrations, exhibits, market research, public relations and outreach, and technical assistance. Applications for these funds will be open until Nov. 2 or until funding is exhausted.

For more details on these programs, see USDA’s Trade Retaliation Mitigation website at farmers.gov/manage/trm.

Plastina and Hart are Iowa State University economists.

Editor’s note: This article was updated Aug. 31, 2018.

You May Also Like