December 15, 2020

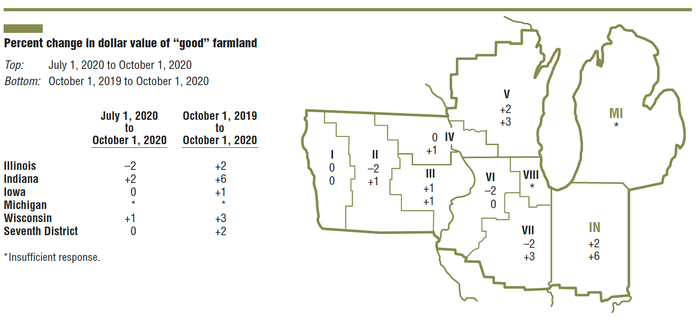

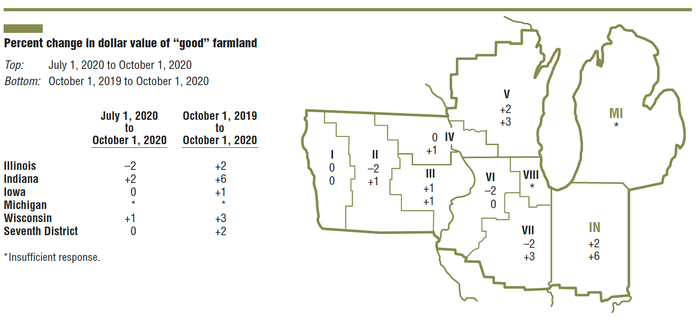

Farmland values were up 2% from a year earlier in the third quarter in the Seventh Federal Reserve District, according to the November 2020 AgLetter (available for download below). Lower interest rates, additional government payments and rising agricultural prices aided the price increase.

However, values for "good" agricultural land were the same in the third quarter of 2020 as in the second quarter, according to the 144 bankers who responded to the Oct. 1 survey. A majority of respondents, 82%, anticipated the district's farmland values would be stable in the fourth quarter of 2020.

The 2% increase in land value was a surprise as the district hadn't seen that large of an increase during the past six years. Indiana reported a 6% jump in farmland value and Wisconsin reported a 3% increase.

Crop conditions

Crop conditions

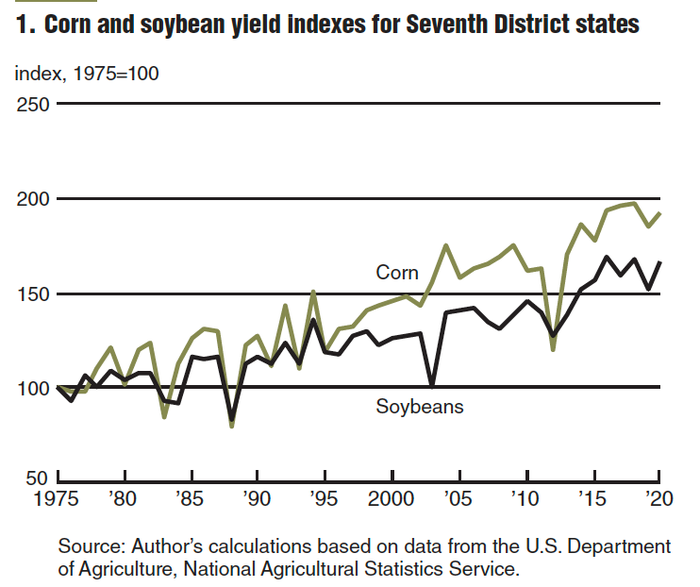

Corn and soybean yields in 2020 were quite close to their historical highs, with some states reaching records, according to USDA. USDA forecast corn harvest in the five states in the 7th District to increase by 9% from 2019, which would put it among the top five harvests on record. USDA forecast soybean production in the five states to rise by 16% from 2019, making it the fourth-largest harvest on record.

Commodity prices

The average price of corn in September 2020 was 9.3% higher than in August, but 10% lower than a year earlier, according to USDA. The average price of soybeans in September was 6.7% higher than in August and 11% higher than a year earlier.

Livestock prices were generally recovering from the impacts of the COVID-19 pandemic in the third quarter. September prices for hogs were up 5% from a year earlier, with cattle prices up 1% and egg prices up 22%. The average price for milk was up 1% in the third quarter from a year earlier.

By the end of October, more than $2.4 billion of Coronavirus Food Assistance Program spending, 24% of the $10.3 billion sent nationwide, had went to farm operations in the five states.

Credit conditions

Agricultural conditions in the 7th District were mixed in third quarter 2020. For the first time in seven years, there was weaker demand for non-real-estate farm loans compared with a year earlier in third quarter 2020. The availability of funds for lending by agricultural. Banks was sharply higher than a year earlier. For July through September, repayment rates on non-real-estate farm loans were a bit lower than a year earlier. In addition, renewals and extensions of non-real-estate agricultural loans was higher in third quarter 2020 than third quarter 2020. As of Oct. 1, 2020, the average interest rates on new operating loans, feeder cattle loans and farm real estate loans had fallen to their lowest levels on record: 4.65%, 4.79% and 4.24%, respectively.

Source: AgLetter, Agricultural Newsletter from the Federal Reserve Bank of Chicago, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like