February 13, 2019

Nebraska relies on property taxes as a source of public revenue to a greater extent than most states. In its 2019 State Business Tax Climate Index, the Tax Foundation ranked Nebraska's property tax as 40th, or 10th from the bottom (i.e., the 10th-highest property tax in the U.S.).

U.S. census data show that Nebraska ranks near the top (second out of 50) in terms of the proportion of public education costs borne by local taxes (i.e., property taxes) and in the bottom quarter (38th out of 50) regarding state aid to schools.

In Nebraska, ag land property taxes have risen to historic levels in recent years as state net farm income has declined, leading to an ag land property tax crunch for farm and ranch landowners. This tax crunch led to a proposed initiative petition for the November 2018 ballot that ― if adopted ― would have given farmers, ranchers and homeowners a refundable state income tax credit for about 30% of the property taxes they had paid. While this petition drive was discontinued in April 2018, the underlying issues giving rise to the petition drive remained in place.

In summer and fall 2018, I undertook a study of Nebraska's ag land property taxes as a percentage of state net farm income and how this compared with the same ratio for the U.S. as a whole.

To explore this, I obtained annual USDA Economic Research Service data for net farm income by state and for the U.S. as a whole, and annual ERS data for property taxes paid on agricultural land by state and for the U.S. as a whole. This allowed me to calculate the percentage of net farm income that went to pay ag land property taxes each year from 1950 to 2017 for Nebraska and for the U.S. as a whole.

By comparing those numbers, I determined that the percentage of net farm income that Nebraska farmers and ranchers paid for property taxes over this period was 146% of the comparable figures for U.S. farmers and ranchers, or 46% higher, confirming my original hypothesis.

For 2016 and 2017, ag land property taxes were 28% and 47%, respectively, of Nebraska farmers and ranchers' net farm income. Not only is Nebraska a relatively high property tax state in general, but agricultural producers carry a disproportionately high share of that property tax burden, compared with farmers and ranchers in other states.

The 146% figure is for the period from 1950-2017 or 67 years. I also have calculated how Nebraska ag property taxes as a percent of net farm income compared with the U.S. as a whole for more recent periods. The results show an increase in Nebraska property taxes paid as a percent of net farm income compared with the U.S. as a whole.

The 20-year average is 50% higher for Nebraska ag producers compared with their U.S. counterparts, the 10-year average is 47% higher, the five-year average is 64% higher, and the three-year average is 88% higher. The last two figures reflect declining Nebraska net farm income and fairly level ag property tax payments.

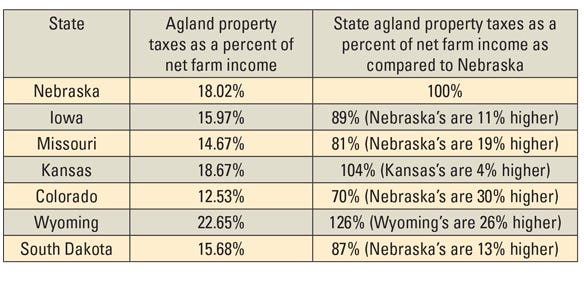

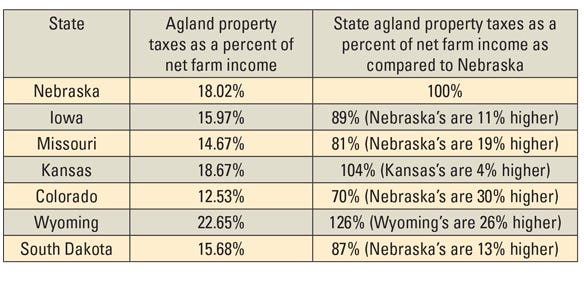

Agricultural property taxes paid as a share of net farm income for Nebraska and surrounding states, 1950-2017.

Nebraska agricultural interests expressed an interest in having this analysis extended to the states bordering Nebraska. Cicely Batie, a graduate student in the University of Nebraska-Lincoln Department of Agricultural Economics, performed the calculations for Colorado, Iowa, Kansas, Missouri, South Dakota and Wyoming.

Readers should note that Wyoming does not have a state income tax, and that Wyoming property taxes pay for some government programs that income taxes help pay for in Nebraska.

Nebraska's ag land property taxes as a share of state net farm income are 46% higher than for the U.S. as a whole. Nebraska relies on property taxes to fund K-12 education more heavily than any state except one. Nebraska farmers and ranchers carry a property tax load almost one and a half times as great as U.S. farmers and ranchers in general.

Aiken is a Nebraska Extension water and agricultural law specialist.

About the Author(s)

You May Also Like