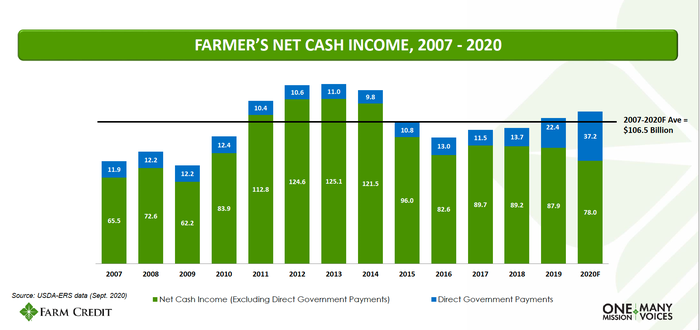

COVID-19 has impacted agriculture in myriad ways from farm-to-fork, but the financial impact has been muted by an infusion of federal dollars, Farm Credit leaders said during an Oct. 21 webinar exploring the pandemic's impact on agriculture.

Farm Credit has more than half a million customers nationwide and has served the agricultural market for more than 100 years. It provides loans in the areas of farm real estate, farm production, farm cooperatives and agribusiness, rural infrastructure, rural home lending and exports. The majority of its loans, 87%, are $499,000 or less, said Todd Van Hoose, president and CEO, Farm Credit Council.

Nationally, over the past few years, there's been a steady uptick in the number of non-performing loans, he said.

"It's not dramatic, but it's a gradual deterioration of financial status among farmers," Van Hoose said. He emphasized that the numbers are a birds-eye view and individual situations are unique.

Looking back to the 1980s, he said non-performing loans topped 20%. Now, the number is less than 5%.

"We are in a much different environment," he said. "Even with real problems in commodity prices, international trade markets, terrible weather, pandemic disruption, all of these things happening, agriculture still, by and large, getting by, although I'll show you a little bit of deterioration in financial performance."

The farm sector debt-to-asset ratio is rising, meaning farmers are more leveraged. At the same time, the working capital ratio is falling, so farmers have less margin for error in their business management and their ability to withstand disruptions has declined.

Stable, but uncertain

In the northeastern U.S., Farm Credit East serves a diverse group of producers, with dairy producers making up 24% of their portfolio, said Mike Reynolds, CEO, Farm Credit East. Farm services comprise 13%, cash field crops comprise 11% and greenhouse, nursery and sod producers comprise 10%. Livestock producers comprise 9% of their portfolio and fruit producers comprise 8%. Their balance of wholesale and retail operations is likely different than the rest of the nation, Reynolds said, because of their population density.

While the overall credit quality of their portfolio has remained stable at more than 92%, credit quality can be a lagging indicator, Reynolds said.

When COVID-19 was first experienced in the northeast, Farm Credit calculated that in the absence of government assistance, the number of loans experiencing trouble would have doubled to 16% to 18%, putting those producers in difficult situations.

Digging into the portfolio, the dairy industry bears special mention. The stability of their dairy portfolio has been declining since 2016, with an uptick projected for 2020. The percent of producers with fully acceptable credit is 81%, while those who bear watching is 10%. That segment of the industry has little room for additional adversity, Reynolds said.

"Certainly as we went into 2020 we were coming off what we thought would be a good price year for milk," he said. Producers were getting $18 to $19 per hundredweight, but as COVID-19 impacted supply chains, prices tanked by about one-third, down to $12 and some processors put supply controls in place. The outlook for 2021 is the same as 2020 or slightly lower.

Looking ahead to 2021, the government assistance programs were helpful and will make a difference.

"There still remains a lot of uncertainty about the impacts of COVID-19, cases here in the northeast, unfortunately are on the rise again. We will monitor that closely and make adjustments as necessary," Reynolds said.

COVID fatigue is real, he said, and they will continue to keep an eye on both customers and employees. While market disruptions have stabilized, there is still uncertainty.

Pandemic and derecho

In the nation's heartland, where Mark Jensen is CEO of Farm Credit Services of America and Frontier Farm Credit, the pandemic and the derecho have stressed balance sheets. Nearly 40% of customers in this region are grain producers, 15% are involved in beef production and 7% in swine.

In early 2020, grain producers had spent six years reconciling the realty of lower commodity prices and increased trade and weather volatility. After 2014, several producers adjusted their operations to include off-farm income or another enterprise. In early 2020, about 7% of their portfolio was highly stressed and experiencing some challenges.

Then came the pandemic. Ethanol industry production dropped essentially overnight. One out of every three bushels of U.S. corn is run through ethanol plants and that demand source dropped to about half, Jensen said.

There were also immediate shifts in food consumption and COVID outbreaks at meat processing plants that halted or slowed processing. Customers were calling who had thousands of animals ready for slaughter with no place to take them. They didn't see widespread euthanasia, but the whole system backed up.

"Frankly, if I were to just sum it up, what we were seeing during that period as we were talking with customers and all kinds of contacts within the industry is . . . I believe we were weeks if not a month or two away from a disaster, frankly," Jensen said. "I think it was an economic disaster brewing in terms of these producers not having anywhere to go with these products and the price situation they were experiencing huge losses very quickly so if that continued it would have put people out of business quickly. We had an environmental disaster brewing if those packing plants hadn't been able to get back into production when they did. . . . That all leads up to a potential food security issue."

Then, the derecho came roaring across the region, with the most significant impact in Iowa where 13 million acres of farmland were impacted with crop loss valued at $3 billion. About 8,000 homes were damaged or destroyed in the 20 impacted counties.

Crop insurance will provide much-needed assistance to many of those impacted by the storm, Jensen said.

For now, things have stabilized. Direct payments have bridged the gap and exports and prices are stabilizing. Going forward, trade access, crop insurance, ethanol, labor availability, broadband and rural infrastructure will be key issues.

Read more about:

Covid 19About the Author(s)

You May Also Like