November 10, 2017

Expect large volumes of corn and soybean bushels to be stored unpriced after this fall’s harvest. In addition, some farmers face cash flow constraints that will require decisions for many of these unpriced bushels. So does storing unpriced corn and soybeans beyond harvest really pay?

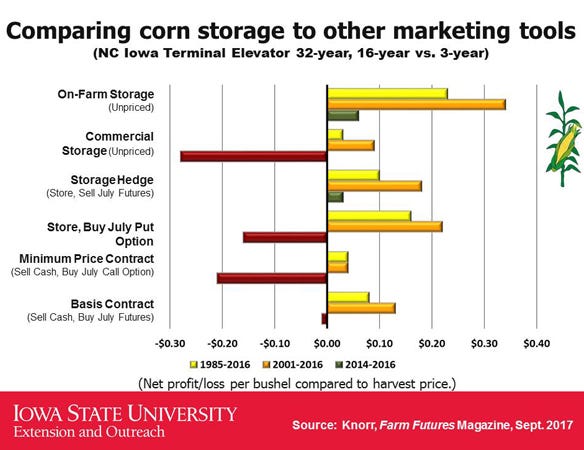

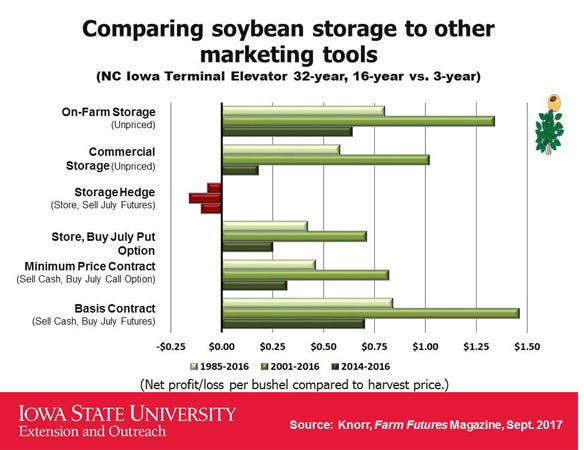

Data was collected annually over 32 years by Bryce Knorr, senior grain market analyst with Farm Futures magazine. The study compared storage strategies to four different crop marketing tools. These results are expressed as the net profit and loss per bushel for corn and soybeans as compared to the cash price at a north-central Iowa terminal elevator at harvest, usually in early October.

For consistency, the stored corn and soybeans were always marketed in mid- to late June, about the time July options near expiration. This is the same period of time when July futures prices usually rally due to the uncertainty of the growing crop. The four different crop marketing tools used for comparison consisted of:

• storage hedge

• store, buy a July put option

• minimum price contract

• basis contract

Bushels sold at harvest are replaced with either July at-the-money call options (a minimum price contract) or long July futures (a basis contract).

Results for corn

Knorr used a handling and storage costs of 1 to 2 cents per bushel per month for on-farm storage and 2.5 to 5 cents per bushel per month for commercial storage. Interest for stored grain was charged at the prevailing operating and CCC loan rates. Brokerage commissions are figured at $100 per contract, or 2 cents per bushel. Options premiums reflect the July put and call options using the at-the-money strike price at harvest.

The net returns are reflected as the net profit and loss per bushel for corn and soybeans, as compared to the cash price at harvest. These bar charts designate 3 different timeframes:

• 1985 to 2016 (32 years)

• 2001 to 2016 (16 years)

•� 2014 to 2016 (three years)

Returns are positive for corn stored on-farm and commercially, as well as the four marketing tools when comparing the 32-year and the 16-year periods. However, look closely at the darker bars that reflect the three-year period (2014-16). The only positive net return was for bushels stored on-farm (6 cents per bushel) and the storage hedge (3 cents per bushel).

Commercial storage lost 28 cents per bushel on average for this three-year period. The minimum price contract lost 21 cents per bushel; the store, buy July put option lost 16 cents per bushel, and the basis contract lost 1 cent per bushel.

Other than on-farm storage, only the storage hedge (store, sell July futures) had positive returns on average for all three periods of time, but only a modest return. A storage hedge involves capturing the carry in the corn market, which has remained large from 2014 to 2016 due to large U.S. production annually and ending stocks approaching 2.3 billion bushels for the 2017-18 marketing year.

Results for soybeans

For soybeans, using this same methodology, only the storage hedge (store, sell July futures) had negative returns for all three periods of time. Positive net returns for all other strategies and tools were largest during the 16-year period (2011-16). For the most recent three-year period (2014-16); on-farm storage provided a net return on average of 64 cents per bushel, while commercial storage was only 18 cents per bushel.

The other tools were all positive for this three-year period: basis contract (sell cash, buy July futures) netted 70 cents per bushel, minimum price contract (sell cash, buy July at-the-money call option) netted 32 cents per bushel and store, buy a July put option netted 25 cents bushel on average.

2017 crop marketing considerations

Futures carry is the difference between the nearby November soybean and December corn futures as compared to the deferred July contracts. This carry is relatively large for both corn and soybeans and a partial incentive to store beyond harvest, but preferably on-farm versus commercially.

Basis appreciation will be key to a profitable storage strategy. You can expect basis to remain abnormally wide during harvest for both corn and soybeans. While basis should narrow once harvest is complete, the cash flow needs for many farmers will eventually trigger cash sales.

Consider your own cost of grain ownership, including storage and interest charges. Many commercial elevators have slightly increased their storage charges as U.S. ending stocks increased. Interest charges for unpaid operating and term notes have also increased the past few years, which adds to storage costs.

With eight months or more of storage for the 2017 crops to play out, it’s unclear what marketing strategy and tool will work best. Tailoring your strategy to your local market requires study and perhaps some luck. Knorr concludes the results of the 32-year study by stating, “Flexibility is important, but deal with the market you have, not the one you want.”

For more information on marketing, visit the Iowa Commodity Challenge website. A new video titled “Comparing Grain Storage to other Crop Marketing Strategies and Tools” is scheduled to be posted beginning Nov. 10. It’s the 15th video on that site, joining a list of other video presentations and handouts explaining tips for successful marketing, market planning, use of crop contracts and other marketing tools, how to work with your grain merchandisers, and more.

Johnson is an Iowa State University Extension farm management specialist. Contact him at [email protected]. Source of the study cited in this article is Bryce Knorr, Farm Futures magazine, September 2017.

About the Author(s)

You May Also Like