The ABC’s of government aid are adding up. And in many cases, those extra dollars are making farms profitable again.

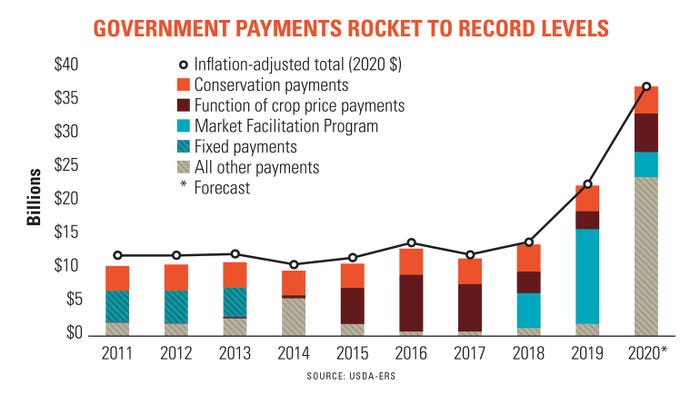

Thanks to CFAP (Coronavirus Food Assistance Program), MFP (Market Facilitation Program) and PPP (Paycheck Protection Program), as well as conventional risk management programs like ARC (Agriculture Risk Coverage) and PLC (Price Loss Coverage), U.S. tax dollars will make up nearly 40% of net farm income this year, the eighth highest since 1933.

These direct federal payments for 2020 are projected to come in at over $37 billion, according to USDA’s September forecast. And, you still have time to apply for “CFAP2” payments before the Dec. 11 deadline (click here).

“Overall in 2020, direct government payments are at their highest level ever even when adjusted for inflation,” says Economic Research Service economist Carrie Litkowski.

Farm profit jumps

U.S. farms are seeing increased profitability for 2019 and 2020, “and it’s all the result of government payments,” says Pauline Van Nurden, an assistant professor at University of Minnesota Extension.

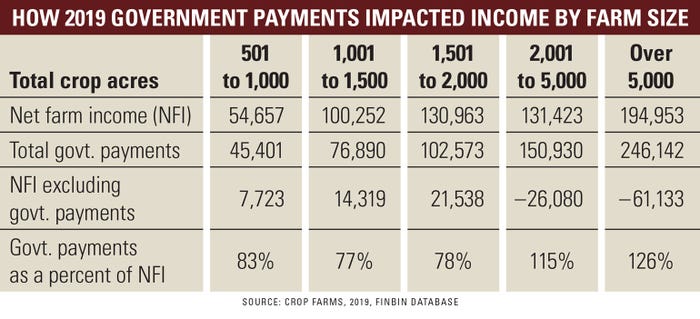

Based on 2019 data, several farms would have lost money without government assistance, according to FINBIN, a database of 3,500 U.S. farm operations tracked by the University of Minnesota’s Center for Farm Financial Management.

And despite payment limitations per farm, big farm operations also reaped big ad hoc government payments last year.

“We typically think the largest farms hit payment limits and receive government funding as a lower percent of income compared to small farms,” Van Nurden says. “Last year that was not the case. Larger farms are more profitable, but government payments were a large part of that profitability. Net farm income without government payments would have resulted in the largest farms losing money.”

126% NFI for large farms

According to the FINBIN database, farms over 5,000 acres received government payments that made up 126% of net farm income; in other words, they would have lost money without government funding. By comparison, small farms (500 to 1,000 acres) received government payments that made up 83% of NFI, and midsized farms (2,000 to 5,000 acres) saw government payments make up 115% of NFI.

According to the benchmark data, small and midsized farms would have still made money without government payments.

“For our largest producers, multi-entity, multi-person operations certainly have found ways around payment limits and take advantage of government programs,” Van Nurden says. “Overall, almost half of our producers would have had a loss or be at zero profitability without government payments.”

Digging deeper, the top 20% most profitable farms still had 36% of net farm income derived from government payments. From a commodity perspective, crop farms saw 95% of NFI coming from government payments, while only 35% of dairy profit came from government payments. Hog and beef farms had government payments make up 93% to 115% of NFI.

Business structure matters

Many family farms have discovered their business structure may be good for income tax purposes, but not for the Farm Service Agency, responsible for making most of these payments. Farms set up as general partnerships or in multiple limited liability companies reaped the bulk of CFAP payments this year.

“A general partnership allows you to get payments based on the number of partners,” says CPA Paul Neiffer with CliftonLarsonAllen. “If you had eight partners in a large farm family, they would have qualified for $2 million in payments, but if you’re structured as an LLC or corporation, you only qualified for $750,000 because of the overall three-payment limit.”

Many large operations could get around payment limits by setting up the farm under three or four LLCs, where each could get a payment.

“You have to understand the rules and plan accordingly,” Neiffer says.

The lesson learned from this recent round of government help? Find an adviser who understands how four business strategies work together: income taxes, FSA planning, liability protection and estate planning. “Those should all be tied together in your business structure,” Neiffer concludes.

About the Author(s)

You May Also Like