Many call us crazy, but our kids are on the family farm bank account. It is a move that could turn them into financial wizards or swindlers. Only time will tell.

Actually, our daughters have been on the farm account since they were 12. It was around that time they started understanding 4-H livestock projects cost real, hard-earned money. And they needed to know just how much.

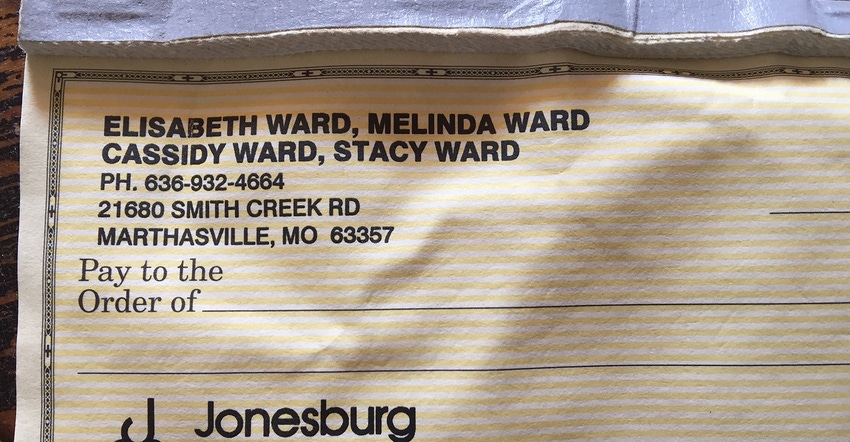

Their names are listed right there with ours on the account. They can write and deposit checks, monitor account information online and budget for farm purchases. Over the 11 years, they have made some wise choices and others that, well, served as a hard lesson. Through it all, as parents, we saw the benefits and drawbacks to a family farm account.

Rewards of a family farm account

Here are the positives:

• Taking ownership. When their names first appeared on the check, they were excited. They had ownership in the decisions for the farming operation. Buying and selling of breeding stock and market lambs took on a new meaning, because they were gaining or losing money into an account with their name. They began to look at an animal and wonder if it was worth the money, could they get a return on the investment.

• Teaches financial responsibility. Learning how to write a check, deposit a check and balance an account took practice. Understanding budgeting for a year was important because income did not come in every month. They were not always perfect, so don't expect them to be.

• Limits farm supply runs. As young drivers, they could make trips to the feed store and neighbors for hay. Selfish, I know. But delegating these tasks allows them to realize they could load 50-pound bags of feed and stack hay bales without Mom and Dad.

• Offers sense of freedom. At livestock shows, with one kid at the sheep trimming stand, Mom at the camper and Dad at work, someone has to get lunch. Having the ability for any member of the family to use the farm account solves that problem. It also gave the girls freedom to purchase equipment needed if we were not around.

Risks of a farm account

While we found great benefits to a family farm account, there were a few concerns:

• Overdraft fees. With four people on an account, everyone must pay attention. What they found out was there were fees for taking money that wasn't there. They realized paying the bank your hard-earned money because you don't pay attention is not fun. Yes, they learned on the farm dime — but at least they learned the remedy. Today, they set their personal debit cards to decline a purchase if there are not enough funds.

• Drain you dry. You must trust your children. At any given moment, our children can take every last dime in the account. If you do not have faith in your kids to keep the farm afloat, a family account is not for you.

Farm account future

Our daughters are grown — one married, another graduating college. Still, the family farm account remains. It progressed so that each daughter has a debit card. It has one last-name change and will likely have another. Some question why continue.

I could say for sentimental reasons, which is partially true. Really, it boils down to two things:

• Security as we age. If something would go wrong — injury or illness — our daughters could keep our farm functioning. We don't want to be a financial burden to our daughters' young families. Access to money during these times is helpful.

• Safety as they mature. Our daughters learned to manage a family account and their own checking and savings accounts. However, life comes at you hard, sometimes taking you off guard. Our farm account serves as their safety net. All of us hope they never need to use it.

The family farm account is a great experience. Talking about money, investing in the future and securing the farm create a deeper family bond.

Ultimately, I hope it laid a foundation for our daughters to become the financial wizards for the next generation.

About the Author(s)

You May Also Like