January 6, 2021

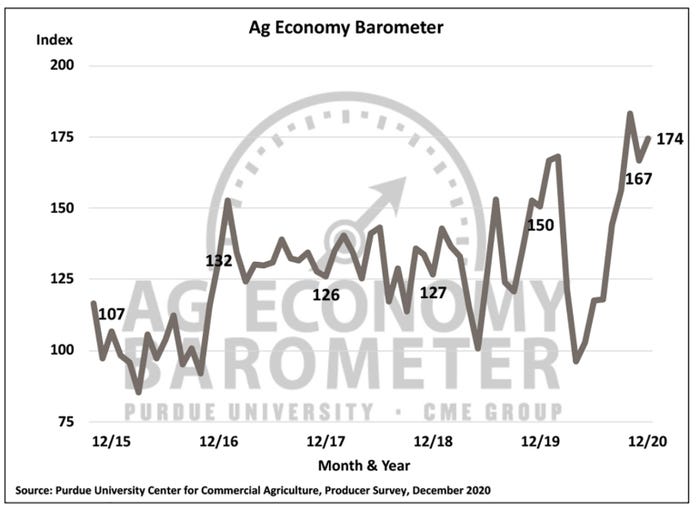

The Ag Economy Barometer rose to a reading of 174 in December, up 7 points from November. December’s sentiment improvement still left the barometer 9 points lower than in October. Both of the barometer’s sub-indices, the Index of Current Conditions and the Index of Future Expectations, were higher in December than in November although the current conditions improvement was three-times the size of the future expectations increase. The Index of Current Conditions climbed 15 points to 202 whereas the Index of Future Expectations increased by just 5 points to a reading of 161. The farm income boost provided by the ongoing rally in crop prices appears to be the driving force behind the improvement in the Current Conditions Index and the overall improvement in farmer sentiment. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from Dec. 7-11, 2020.

Capital investment

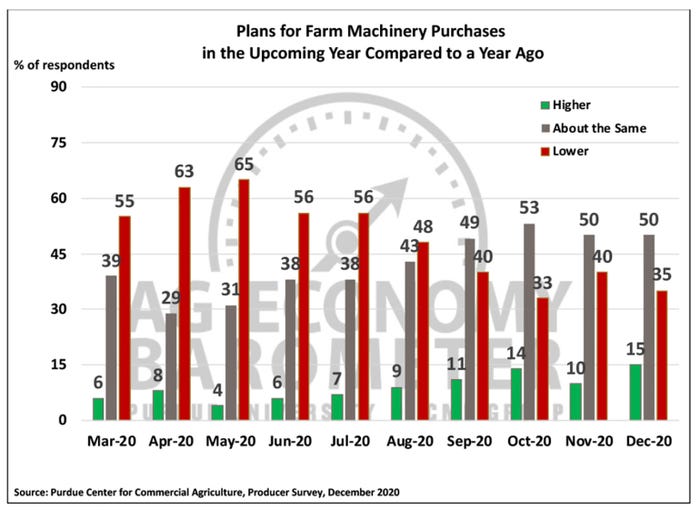

Producers were noticeably more inclined to think now is a good time to make large investments in their farming operations than in November. The Farm Capital Investment Index increased 13 points in December to a record high 93. The comparison is even more dramatic when December’s reading is compared to earlier in the year. December’s investment index reading was 28 points higher than back in August, when the crop price rally was just getting underway in earnest, and it is more than double the April reading of 38. The percentage of farmers expecting to increase their machinery purchases in the upcoming year rose 5 points to 15% in December, while the percentage expecting to reduce their purchases declined by the same amount.

Producers were noticeably more inclined to think now is a good time to make large investments in their farming operations than in November. The Farm Capital Investment Index increased 13 points in December to a record high 93. The comparison is even more dramatic when December’s reading is compared to earlier in the year. December’s investment index reading was 28 points higher than back in August, when the crop price rally was just getting underway in earnest, and it is more than double the April reading of 38. When asked more specifically about their plans for farm machinery purchases, the percentage of farmers expecting to increase their machinery purchases in the upcoming year rose 5 points to 15% in December, while the percentage expecting to reduce their purchases declined by the same amount.

Trade

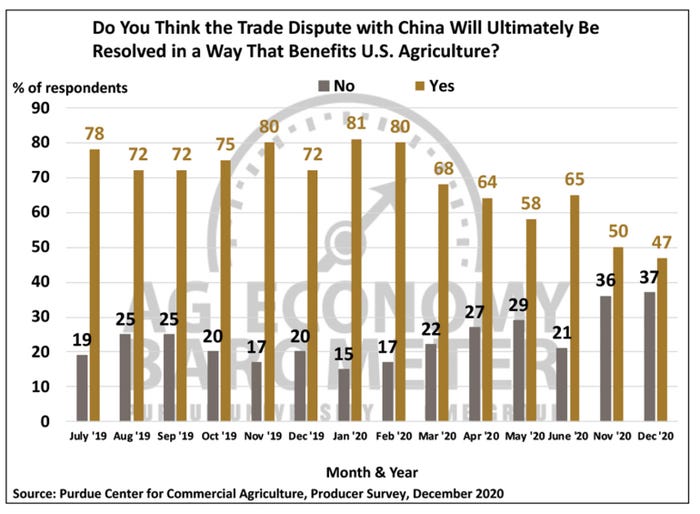

U.S. exports to China have increased substantially in recent months, especially for corn and soybeans. In turn, the rise in exports has been key to the improvement in crop prices. Despite that, producers have become less optimistic that the trade dispute with China will be resolved in a way that’s beneficial to U.S. agriculture. For example, in the first quarter of 2020 an average of 76% of respondents thought the trade dispute’s ultimate resolution would favor U.S. agriculture. In the spring quarter, that average declined to 62% and in December it fell further, to just 47%.

Producers also became somewhat less optimistic about U.S. agriculture’s trade prospects as year-end approached. In the three-month period from August through October, an average of 63% of farmers in our survey said they expected U.S. ag exports to increase over the next five years. However, ag trade expectations were less optimistic in November and December with an average of just 52% of respondents expecting to see growth in U.S. ag exports over the upcoming five years.

Policy change

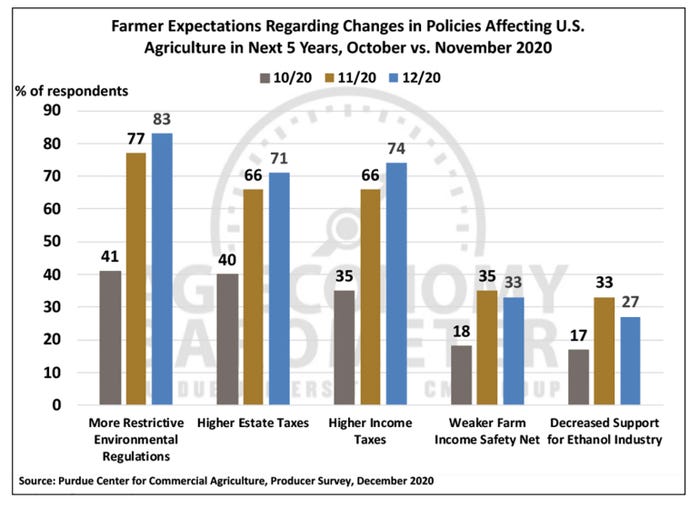

On the December survey, farmers continued to express concerns following the November election about several key policy issues affecting agriculture. More than 80% of farmers in the December survey said they expect environmental regulations to become more restrictive, compared to 41% who felt that way in October. Over 70% of producers expect to see higher income and estate taxes compared to 35% and 40%, respectively, who felt that way in October. One-third of farmers said they expect the farm income safety net to weaken compared to 18% percent who felt that way in October and just over one-fourth of producers said they expect government support for the ethanol industry to weaken compared to 17% who felt that way in October.

James Mintert and Michael Langemeier are with Purdue Center for Commercial Agriculture.

You May Also Like