September 4, 2018

By James Mintert and Michael Langemeier

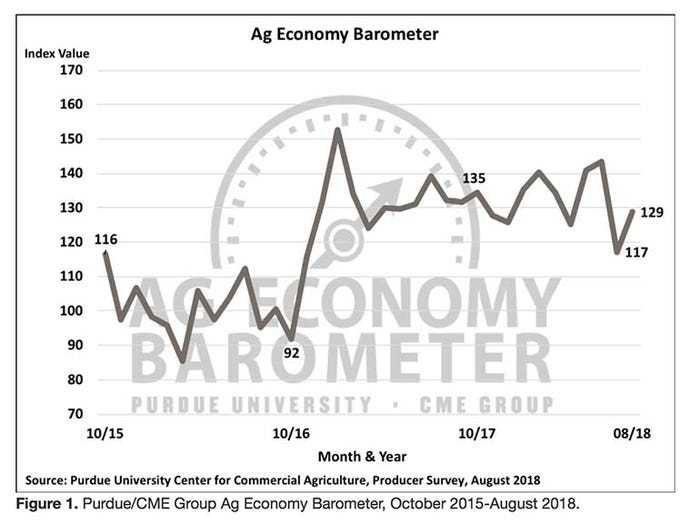

The Ag Economy Barometer rebounded 12 points in August to a reading of 129 after falling to 117 in July. Although the producer sentiment index increased in August, producer sentiment remains well below its late spring readings of 141 in May and 143 in June. The shift in producer sentiment occurred primarily because producer’s perception of current conditions improved as the Index of Current Conditions increased to a reading of 121 following a dip to 99 in July. The Index of Future Expectations also rose in August but the increase was modest, rising to 132 just 6 points above its July reading.

The shift in producer sentiment occurred against a backdrop of USDA announcing intentions to aid farmers impacted by importing countries imposition of tariffs on a multitude of U.S. ag products. Survey responses were gathered from agricultural producers in mid-August, after USDA outlined the assistance package in general terms, but prior to USDA’s Aug. 27 announcement providing details regarding how payments would be allocated among producers.

Less pessimistic

Producers were less pessimistic about the direction of the U.S. ag economy in the year ahead in August than they were in July. In August, 22% of respondents said they expected good times in agriculture in the year ahead, up modestly from 19% in July. The bigger change from July was among those expecting bad times in U.S. agriculture, which declined from 61% in July to 52% in August.

Producers shifting perspective on the U.S. ag economy was also evident in their response to a question about making large investments in their farming operation. In August, 26% of respondents said now is a good time to make large investments, up from 20% in July and unchanged from their response to this question back in June. Correspondingly, the percentage of producers that felt now is a bad time to make large investments fell by 8 points to 65% in August compared to 73% in July.

Farmland price outlook

After jumping 10 points in July, the percentage of producers expecting lower farmland values in the upcoming year improved slightly to 29% vs. 31% a month earlier. At the same time, the percentage of producers expecting higher farmland prices declined to 14% from 15%. Looking five years ahead, the percentage of producers expecting higher farmland prices declined from 47% in July to 42% in August. The percentage of respondents expecting lower prices also declined, falling 3 points to 14%.

Trade war less likely

U.S. ag producers are still concerned about a trade war, but they were somewhat less concerned in August than they were in July. In August, 51% of respondents thought a trade war was likely to reduce U.S. ag exports, down from 54% in July. And the percentage that thought a trade war was unlikely increased to 28% in August compared to 23% that felt that way in July.

The percentage of producers that feel trade conflicts will reduce their farm’s net income, 71%, was virtually unchanged in August from July. However, among those expecting an income loss the percentage income reduction they think likely shifted from July to August. In July, 35% of respondents expecting an income decline said they believed an income reduction of more than 20% was likely. In August, that percentage fell to 26% of respondents. Combining the percentage of respondents expecting

an income decline of up 10% and

those expecting a reduction of 10% to 20% indicates that, overall, producers’ concern about a trade conflict related income decline moderated from July to August.

In July, 65% of respondents that expect an income decline thought the income loss would range up to 20%. In August, 74% of those expecting an income decline put it in the range of 0% to 20%, indicating that producers previously expecting an income decline of more than 20% had scaled that back somewhat.

Pricing of 2018 soybean crop

Soybeans are the single commodity hit hardest by China’s imposition of import tariffs. Soybean producers were asked what percentage of their anticipated 2018 production they priced prior to June 1, 2018. June 1 was chosen because November soybean futures reached their spring peak in late May and then declined sharply during June as the trade conflict unfolded and as 2018 yield prospects improved.

Not all respondents that planted soybeans in 2018 were willing or able to estimate how much of their crop was priced prior to June 1 as 11% of respondents chose not to respond to the pricing question. However, among those that did respond, 25% of them said they priced more than 40% of their 2018 crop prior to June 1 and 27% said they priced 20% to less than 40% of their 2018 soybean crop. Nearly half (48%) of respondents said they priced less than 20% of their anticipated 2018 soybean production.

Perspective on relief package

Producers were asked “To what degree does President Trump’s $12 billion relief plan for U.S. farmers relieve your concerns about the impact of tariffs on your farm’s income?” Choices and answers:

Completely, 4%;

Somewhat, 43%;

Not at all, 47%;

Uncertain, 7%.

Source: Purdue CME Group

You May Also Like