November 8, 2018

By James Mintert and Michael Langemeier

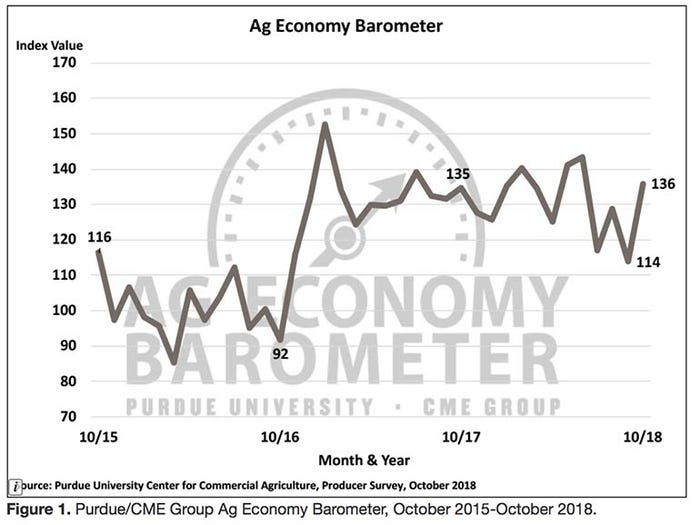

The Purdue University/CME Group Ag Economy Barometer increased 22 points from September to October, continuing its trend of large month-to-month shifts as producers continue to be buffeted by shifts in major commodity prices and news about trade negotiations with key ag trade partners. The October barometer reading was 136, the same as October 2017.

This month’s recovery in the barometer was underpinned by improved perceptions of both current conditions and future expectations as the Index of Current Conditions rose 19 points to a reading of 115 and the Index of Future Expectations rose 24 points to a reading of 146.

Although both current sentiment and future expectations rose in October, it is a relatively positive view of the future that is really underpinning the Ag Economy Barometer. This month’s Index of Future Expectations reading of 146 pushed the index back to the peak attained this past spring before the ag trade conflict with China erupted. In contrast the Index of Current Conditions, even with this month’s rebound, remains well below the levels recorded in winter and spring 2018.

Some of the optimism about the future was probably attributable to producers’ relatively optimistic perspectives regarding the future direction of crop prices. In October we asked producers about their expectations for corn, soybean, wheat, and cotton prices, looking ahead 12 months. In each case, more producers said they expect to see higher prices than lower prices and for corn, soybeans, and wheat, the ratio of producers expecting higher prices to those expecting lower prices was just over 3 to 1.

What they said:

34% of producers said they expect to see higher corn prices,

11% of producers said they expect lower corn prices,

39% expect higher soybean prices,

34% expect higher wheat prices,

12% expect lower soybean prices,

10% expect lower wheat prices

23% expect higher cotton prices

10% expect lower cotton prices.

Reaction to USMCA

In early October, the Trump Administration announced that a new trade agreement, referred to as the U.S.-Mexico-Canada Agreement, had been reached. The trade agreement will not go into effect until the U.S. Congress and legislatures in both Mexico and Canada approve it.

Producers were asked to what extent the agreement relieved their concerns about farm income in the upcoming year. Results were mixed. More than 60% of producers said the agreement at least somewhat relieved their farm income concerns, whereas 25% of producers said it did not relieve any of their concerns.

Large investments

Ag producers’ views with respect to making farm investments improved in October, but producers remain cautious about making large investments in their farming operations. The percentage of producers indicating now is a bad time to make large investments declined modestly to 72 in October, down from 78 a month earlier, while the percentage that said now is a good time to make large investments rose to 24 from 20 in September. Combining these two responses into a diffusion index that characterizes farmers’ perspectives on making investments in farm machinery and buildings yielded a reading of 52 in October, up 10 points compared to September, but still well below readings from last winter and spring, which were in the 60s and low 70s.

Farmland value

The percentage of respondents expecting lower farmland values in the year ahead declined to 17% in October, 15 points lower than a month earlier. There were also fewer respondents expecting higher farmland prices in the next 12 months as that percentage fell to 12% in October from 16% in September.

The reduction in the percentage of farmers expecting higher farmland values was even more noticeable when the same question was posed over a 5-year, instead of 12-month, time frame. Looking ahead 5 years, just 21% of respondents said they expected farmland values to rise. This was a 25-point drop compared to a month earlier and was the lowest percentage of respondents expecting farmland values to rise five years out since the question was first asked in May 2017.

Less soy?

Producers were asked about their initial 2019 soybean planting intentions. Among growers that planted soybeans in 2018, nearly one out of five (19%) said they expect to reduce their soybean acreage in 2019, while the majority (77%) of farmers said they would hold their acreage constant. Those who indicated plans to reduce their soybean acreage were asked how large of a decrease they are planning for 2019. Two-thirds of the respondents said they planned to reduce their 2019 soybean acreage by more than 10% and 27% said they plan to reduce their soybean acreage by 5% to 10%, both compared to their 2018 acreage.

Source: Purdue/CME Group

You May Also Like