August 7, 2018

By James Mintert & Michael Langemeier

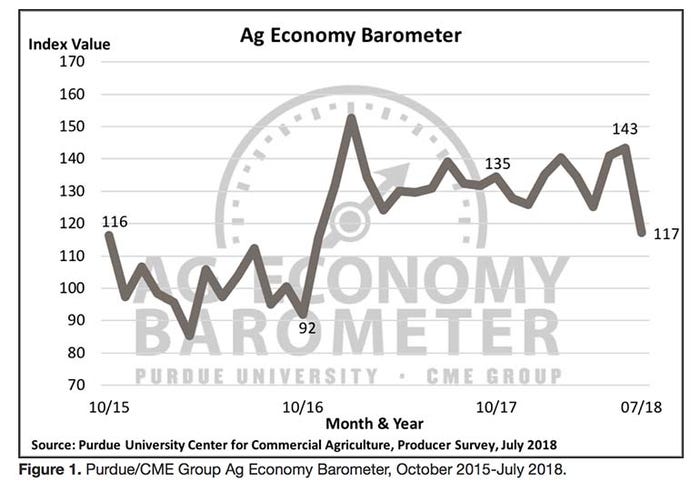

Ag producer sentiment fell sharply during July as the impact of commodity price declines and concerns about ag trade prospects weighed on producers’ perceptions of both current and future conditions in the agricultural economy. The Ag Economy Barometer declined 26 points to a reading of 117 in July, driven by sharp reductions in both the Index of Current Conditions, which fell from 138 to 99, and the Index of Future Expectations, which fell from 146 in June to 126 in July. This month’s decline, the largest one-month decline in the Ag Economy Barometer’s nearly three-year history, brings it back to the level observed immediately following the November 2016 election, although it still remains well above the low point of 92 reached in October 2016.

Negative short-term outlook

When asked whether they expect good or bad times financially in the U.S. agricultural economy in the upcoming 12 months, producers indicated they were decidedly more negative than they were just one month earlier. In July 61% of respondents said they expect bad times in the next year, up 15 points from June, while just 19% of respondents expect good times in the upcoming year, down from 26% a month earlier.

However, when asked whether they expect good or bad times financially in the U.S. agricultural economy in the next five years, producers’ outlook in July was virtually unchanged compared to June. In July 47% of respondents said they expect good times over the next 5 years compared to 45% in June, whereas 32% of producers said they expect bad times compared to 31% a month earlier.

Time to invest?

Each month, producers are asked whether now is a good or a bad time to make large farm investments. The percentage of producers indicating it’s a bad time for large farm investments jumped 13 points from June’s 60% to 73% in July, while the percentage of producers that felt it was a good time to make large investments fell to 20% from 26%. This was the most negative response to this question since March 2016.

Producers’ bearish perspective

On the July survey, producers were asked for their perspective on the likelihood that December 2018 corn futures prices would rise above $4.00 or dip below $3.25 per bushel between mid-July, when the survey was conducted, and fall 2018. A similar question was posed with respect to November soybean futures prices, asking about the likelihood of prices exceeding $9.50 or falling below $8.00 per bushel. At the time the survey was conducted, settlement prices for November soybean futures ranged from $8.45 to $8.64 per bushel and settlement prices for December corn futures ranged from $3.55 to $3.69 per bushel. Producers’ were decidedly negative about the future trading range for both soybean and corn futures. Less than 2 out of 10 producers expect to see corn futures trade above $4.00 per bushel or soybeans trade above $9.50 per bushel. In contrast, approximately 4 out of 10 producers in this month’s survey stated they think it’s likely corn futures will trade below $3.25 per bushel and soybeans will trade below $8.00 per bushel. For both corn and soybeans, prices at those levels would cover variable expenses on nearly all Corn Belt farms, but would fall short of covering fixed and overhead expenses, resulting in a significant cash flow squeeze for many farm operators.

Farmland values

Unsurprisingly, the negative outlook with respect to the agricultural economy and commodity prices spilled over into a more negative outlook for farmland values in the year ahead. On the July survey, 31% of producers said they expect to see lower farmland prices over the course of the next year. This compares to just 21% of producers expecting to see lower farmland values when the May survey was conducted and erases the improvement in farmland value expectations that was observed in surveys dating back to November of last year.

Trade war implications

Three times over the last 6 months we’ve asked producers if they think U.S. agriculture is at risk of a trade war that will result in a significant decrease in U.S. agricultural exports, most recently on the July 2018 survey. Not surprisingly, the percentage of producers that think a trade war is likely increased in July compared to both April and March 2018.

In July, 54% of producers said a trade war that reduces ag exports is likely compared to 47% and 46% in March and April, respectively. Similarly, the percentage of producers that thought a trade war was unlikely declined in July to 23% compared to 28% in March and 30% in April.

On the July survey, producers were also asked whether or not they expect trade conflicts to reduce their farm’s net income in 2018. Responses indicated that many farms are already feeling the impact of reduced ag exports as 70% of producers said they expect reduced net income as a result of trade conflicts.

In a follow-up question posed only to those expecting their income to decline, producers were asked by how much they expect their net income to decline.

Choices provided were

up to 10%,

between 10% and 20%, and

more than 20%.

Responses among these three choices were pretty evenly split with

29% choosing up to 10%,

36% choosing between 10% and 20% and

35% choosing more than 20%.

Combined, these results imply that more than 70% of respondents expect their net income to decline by 10% or more as a result of trade conflicts.

Source: Purdue/CME Group

You May Also Like