May 8, 2019

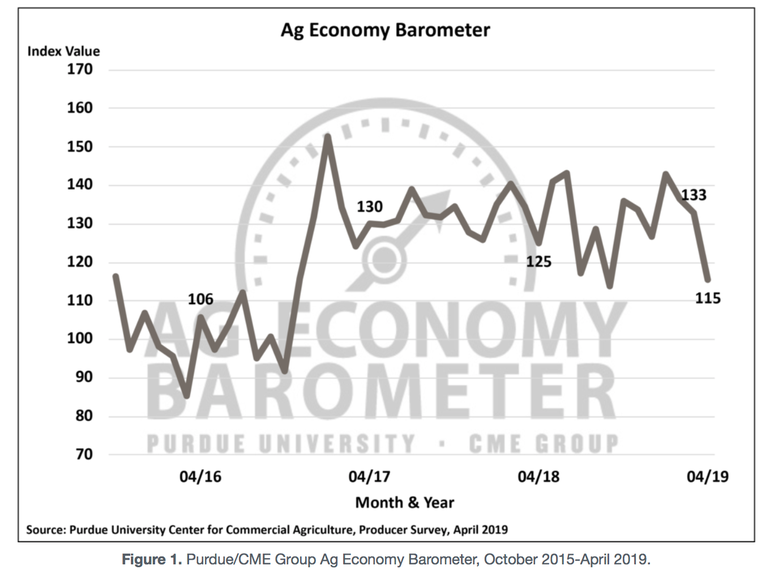

The Ag Economy Barometer declined 18 points in April to a reading of 115. The decline in the index was the fourth largest one-month fall in the barometer since data collection began in October 2015.

The barometer’s decline was driven by worsening perceptions of both current economic conditions and weaker expectations for the future as the Index of Current Conditions fell 21 points to a reading of 99 while the Index of Future Expectations declined 16 points to a reading of 123.

Do farmers see this as a good time to make large investments?

The percentage of producers that viewed now as a bad time to make large investments increased to 74% from 69% in March and the number that viewed now as a good time to make large investments declined to 22% from 26% a month earlier. When combined, these responses pushed the Large Farm Investment Index to a reading of 48 in April, 9 points lower than in March and the fourth weakest reading of the investment index since fall 2015.

Where do farmers see farmland prices going?

Farmers’ expectations for farmland prices in the upcoming 12-months also weakened in April as the percentage expecting higher values fell to 13% from 14% while the percentage expecting lower values increased to 28% from 25%.

The largest response category, those expecting farmland values to remain about the same, fell to 59% from 61%.

Although the one-month change in farmers’ perspective on farmland values was more modest than the decline in the investment index, it still stands in sharp contrast to the perception producers had of farmland values a year earlier. In April 2018, 18% of producers expected higher farmland values, while 64% expected values to remain about the same, and 18% expected values to decline, a notably more optimistic outlook than recorded in April 2019.

What do farmers expect financially?

Over half (56%) of farmers in the April survey said they expect their farms’ financial performance to be about the same as last year. However, 27% of farmers said they expect this year’s financial performance to be worse than last year. In comparison, when the same question was included in the April 2018 survey, just 19% of respondents expected worse financial performance for their farm than in the prior year.

Do respondents think the trade war will be resolved by July 1?

In the April survey, 28% of respondents said they expect to see the trade dispute with China settled by July 1. In March, 45% of respondents said they thought it likely that the trade dispute with China will be settled by July 1.

Will the trade dispute be resolved in a way that benefits agriculture?

In April, 71% of respondents said they expect a favorable resolution to the trade dispute with China versus 77% on the March survey.

Should the U.S. try to rejoin the Trans-Pacific Partnership?

Less than half (47%) of respondents favored rejoining TPP, while 29% said they were not in favor of rejoining the trade agreement. One-fourth of respondents said they were uncertain whether or not the U.S. should rejoin TPP.

Source: Purdue University, CME Group, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like