December 6, 2018

By James Mintert and Michael Langemeier

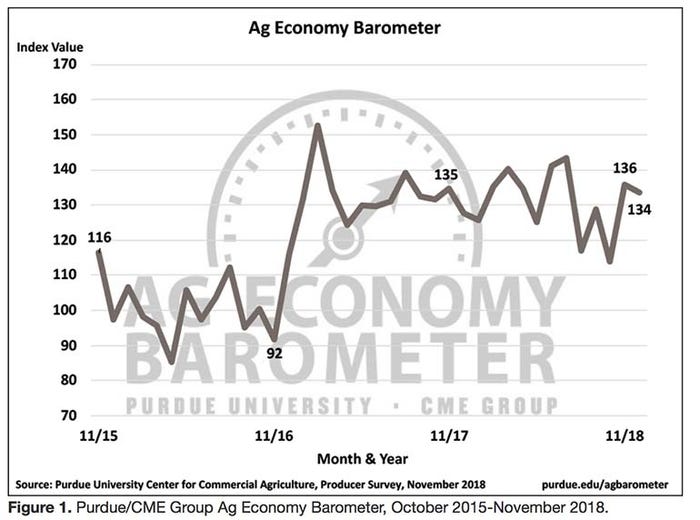

The Purdue University/CME Group Ag Economy Barometer declined to 134 in November, a drop from 136 in October.

The November reading leaves the barometer 6% below its most recent peak in June. Although November’s ag sentiment index was below the level attained last spring, it was still 6 points higher than a year earlier when the index of agricultural producer sentiment was 128.

The modest decline in this month’s barometer reading occurred because producers view of future conditions weakened slightly as the Index of Future Expectations was 143 compared to 146 in October. Even with this month’s modest decline, the Future Expectations Index remains well above its September reading and very near its spring peak, indicating producers still have a relatively optimistic view of the future. The Index of Current Conditions at 115 was unchanged compared to October. Unlike the Future Expectations Index, the November reading of the Current Conditions Index was still well below its late spring peak, when the index topped out at 138.

Make an investment?

One gauge of producers’ optimism is their willingness to make large investments in their farm operation. Each month we ask producers if now is a good time or bad time to make large investments in items such as buildings and machinery. Producers’ perspective on making large investments has ebbed and flowed this year. Producers were most favorably inclined towards making large investments early in the year when the Large Farm Investment Index peaked at a reading of 74. The index weakened in late winter and early spring before rebounding in late spring, just before trade disruptions hit the agricultural sector. By late summer the index was more than 30 points below its January peak, bottoming out at a reading of 42 in September. However, since September producers’ view regarding the advisability of making large investments has improved, rebounding to a reading of 52 in October and improving again to 56 in November.

Farmland values

Farmers became noticeably more pessimistic about farmland values this summer than they were last winter. For example, the percentage of farmers expecting lower farmland values 12 months ahead increased from just 16% in February to 32% in September. But on the October and November surveys, farmers’ pessimism about farmland values subsided with only 22% of respondents from the November survey expecting to see lower farmland values in the upcoming year.

Evidence of farmers more favorable attitude towards farmland values in November was even more pronounced when we asked farmers for their longer-run (5-year) perspective. The percentage of farmers expecting farmland values to move higher over the next five years plummeted from 46% in September to 21% in October. But in November, this percentage rebounded back to 50%, which is near the upper end of the range of responses we’ve received to this question since we first posed it in May 2017.

The shift in producers’ attitudes was largely the product of producers shifting from expecting higher farmland values to expecting values to remain the same (on the October survey) and then back to expecting higher farmland values from expecting values to remain the same (on the November survey). Additionally, in November the percentage of producers expecting lower farmland values in five years dropped to 9% compared to 23% in October, which was only the second time this percentage fell below 10% since we first posed this question.

Undercurrent of concern

Despite the improvement in long-term optimism regarding large investments in machinery, buildings, and farmland, there remains an undercurrent of concern about the farm economy among producers. The percentage of producers expecting profitability to improve has changed little in recent months, with only 13% of respondents in November indicating that they think farm profitability will improve in the next 12 months. Just 8% of respondents said they expect farmers equity position to improve in the upcoming year and 44% said they expect to see farmers’ equity position diminish.

Interest rates

Producers expect interest rates to rise next year and in the long-term. Looking ahead to next year, 85% of respondents expect to see higher rates than in 2018, while 14% expected to see lower rates. Over the longer term, 76% of respondents said they expect to see higher rates and just 4% expect to see lower rates. Looking ahead one year, only 1% of respondents said they expect rates to remain unchanged, but when asked to look ahead five-years, 20% of respondents said they expect no change in interest rates.

Trade optimism

Farmers are becoming more optimistic that current trade disputes will not hurt long-run growth prospects for U.S. ag exports. On six surveys, dating back to May 2017, producers were if they expect agricultural exports to increase, decrease or remain the same over the next five years. In April of this year, 46% of respondents said they expected ag exports to increase over the next five years. In July, this percentage rose to 49% and in August it rose again to 54%. On the November survey, 66% of respondents said they expect U.S. ag exports to increase over the next five years. At the same time, the percentage of producers that expect ag exports to decrease fell from 21% in July to 14% in August and to 10% in November.

Fewer soybean acres

For the second month in a row, soybean growers were asked about their 2019 planting intentions. In November, 30% of soybean growers said they planned to reduce their soybean acreage next spring, up from 19% that planned to reduce acreage when the same question was posed in October. Of the growers that plan to reduce their soybean acreage, 69% of growers on the November survey said they plan to reduce their 2019 acreage by more than 10% compared to 2018, up slightly compared to responses received in October. Twenty-six percent of growers plan to reduce their 2019 soybean acreage by 5% to 10% compared to 2018, virtually unchanged from responses received on the October survey.

Farm bill

The 2014 Farm Bill expired on Sept. 30, 2018, and new Farm Bill legislation was not a prominent point of discussion in most November 2018 Congressional races. Recently there’s been a push to encourage the lame duck Congress to pass new Farm Bill legislation before the end of the year. Seventy-five percent of respondents said they were either somewhat or very concerned about the lack of a new Farm Bill with 33% of respondents indicating they were very concerned. Just 24% of survey respondents said they were not at all concerned about the lack of new Farm Bill legislation.

Source: Purdue/CME Group

You May Also Like