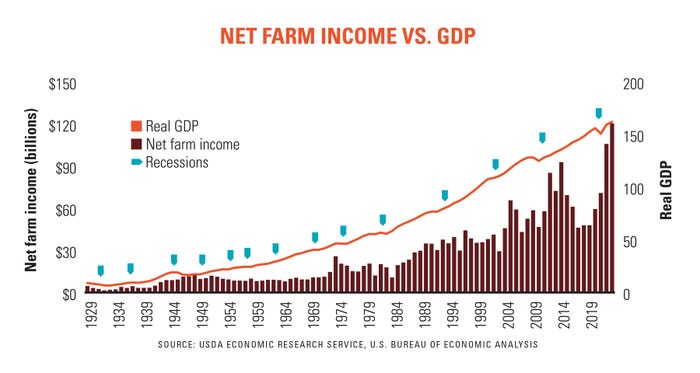

One of the stock slides from my presentations over the years when this question arose showed that net farm income declined during every recession except the one after World War II -- when rampant inflation elevated net farm income for a few years before the ag economy broke too, in 1949.

The pandemic also turned out to be an exception due to the massive amount of federal aid given to farmers beginning with the trade war compensation and extending into COVID relief. So, given what happened in the 1940s, the string of ‘up’ years in net farm income could also be threatened in 2023 or perhaps 2024.

Recession impacts on corn and soybean prices are more difficult to judge. The chart shows GDP as a placeholder for recessions. The old definition of recession used to be two consecutive quarters of negative real GDP growth. This has changed, and recessions are now dated by the National Bureau of Economic Research, which measures the business cycle when downturns began and ended. By their definition the pandemic recession lasted only two months.

Since the 1960 recession, corn futures ended the recessions higher six times and lower 3 times, and show a small negative correlation between price changes and the length of the recession; but neither of these is large enough to be statistically significant. Soybeans went up five times and down four, and show a somewhat stronger negative correlation between length of the recession and price changes, but again, not enough to be statistically significant.

Knorr writes from Chicago, Ill. Email him at [email protected].

Read more:

High stakes farming doesn’t have to be a gamble

How much, if any, should you forward contract before planting?

About the Author(s)

You May Also Like