Big speculators and Wall Street investors went on a corn buying spree this fall, helping drive futures toward the top of their trading range over the past seven years. But the hopes of farmers holding 2020 crop inventory could depend on another class of traders who are much closer to home. The positions of commercial firms may offer clues to what happens to the cash market in the first half of 2021.

This category tracked by the Commodity Futures Trading Commission includes the large grain merchandisers and end users like ethanol plants that buy corn from farmers. And like farmers – and unlike commodity funds and investors – these businesses use the futures market to manage risk, not to speculate.

An ethanol plant that needs corn day in and day out to keep running can cover its feedstocks on paper by buying futures. Merchandisers like grain elevators don’t speculate on the corn they buy from farmers, instead hedging it by selling futures until they can make a sale to an end user.

Sales by commercials, or short positions, aren’t discussed much in coverage of CFTC Commitment of Traders reports put out most Fridays. But when speculators are buying, somebody’s got to be selling. This past fall that response came from commercial firms hedging what they bought from farmers to satisfy what looks like record corn demand.

According to the CFTC, commercial traders were short 6.24 billion bushels worth of corn futures, an all-time record, in mid-November ahead of the start to delivery on December contracts. They trimmed that position a little but were still short 5.71 billion bushels last week in the latest commitments report.

Do ‘strong hands’ help farmers?

At first blush such a large short position might seem good for farmers with corn in the bin. Grain held and hedged by commercials is said to be in “strong hands.” Merchandisers in part make their money on basis appreciation, and they can wait for demand to boost cash prices end users must pay.

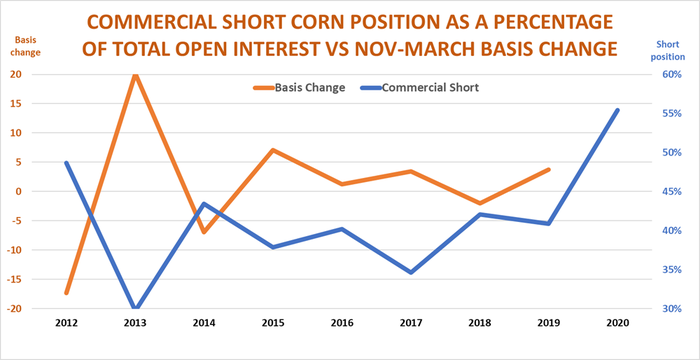

But history suggests those strong hands may not help farmers. There’s a significant negative correlation between the commercial shorts and basis gains into spring and summer. A negative correlation means two variables, in this case basis appreciation and the short position, move in oppositive directions. If that relationship holds for 2020 crop corn, the big commercial short suggests basis could weaken, not strengthen over the first half of 2021.

The average U.S. cash price for corn into December delivery was 15.5 cents under futures, more than 35% stronger than average. A year ago cash was 13 under due to the flood-shriveled 2019 crop, and basis faded into spring and summer.

Some years small crops lift fall basis. Other times the cause is robust demand, the factor that looks likely responsible this year.

Another dynamic may be in play too, though we won’t find out until Jan. 12. That’s when USDA releases its estimate of Dec. 1 corn inventories.

When farmers hold more corn on farm, Dec. 1 basis tends to be weaker as winter begins. Farmers aren’t selling because prices don’t meet their expectations or needs. That leaves more potential for cash to strengthen against futures. In these years, the farmers have the strong hands, at least for a time.

But when late fall basis is stronger, farmers hold less of the crop. Better cash prices give growers incentive to sell corn rather than store it. Basis appreciation into spring and summer in those years tends to be less. Commercials have bought what they need at weaker basis levels and hedged it, increasing their short position as a result.

Of course, demand for the 2020 corn crop could be even better than USDA forecasts, and the crop could be smaller, too, factors that could keep basis strengthening. Just make sure you can afford the risk if your marketing plan bets on that daily double.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like