USDA’s Economic Research Service released its 2021 Farm Sector Income Forecast this morning, offering its third projection of 2021 financial indicators for the U.S. farm economy. The 2021 forecast offers more profit potential than in 2020, with several underlying trends worth noting.

Cash receipts pave way for income gains

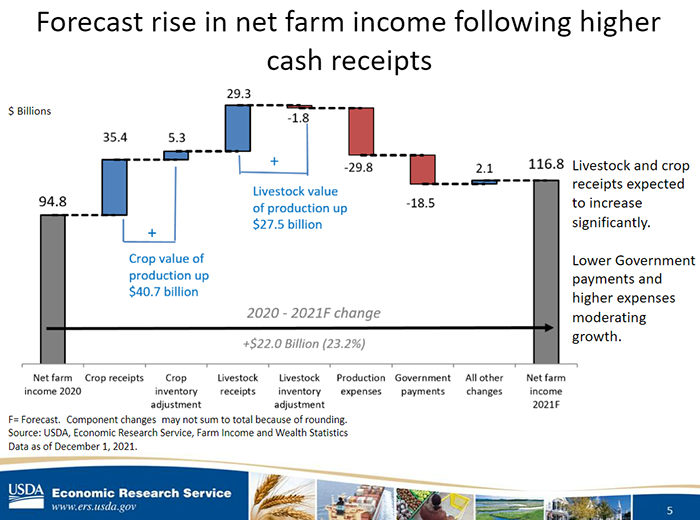

ERS forecasts calendar year 2021 net farm income at $116.8 billion, a 23% increase from 2020 profits and the highest inflation-adjusted profit level farmers have earned since 2013. Net farm income forecasts increased nearly $4 billion from earlier 2021 forecasts issued by ERS in September 2021 due largely to corn markets.

USDA-ERS senior economist and Farm Income Team program leader Carrie Litkowski cited updated 2021/22 corn production and price estimates as well as modified corn usage data from the National Agricultural Statistics Service’s Quarterly Grain Stocks report as compounding reasons for the upward revisions in a webinar reviewing the tri-annual financial estimates.

The chief driver of the uptick in farm incomes relative to 2020 levels is due in large part to higher commodity prices in 2021. Rising crop prices added nearly $41 billion to 2021 profits while another $28 billion was added to the value of livestock receipts.

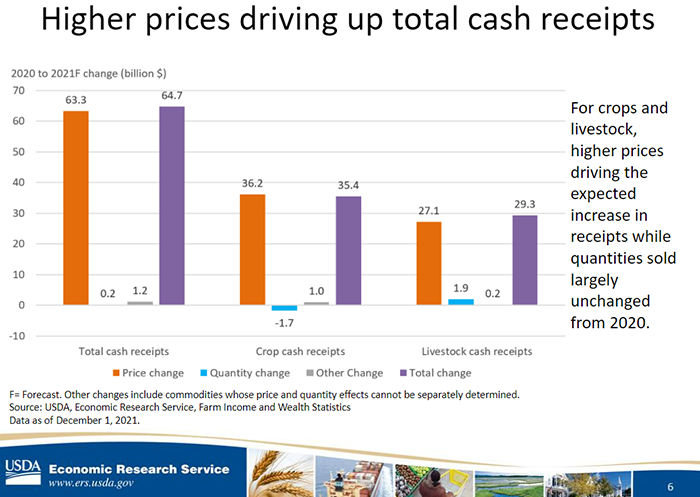

Litkowski dug further into cash receipts for the 2021 calendar year, observing that quantities of crops and livestock sold in 2021 closely matched 2020 volumes. Thus, price has been the primary driver of higher net farm incomes across the Heartland.

“Essentially all of the higher receipts are derived from higher prices,” Litkowski stated.

Indeed – corn prices in 2021/22 will be the highest since 2012/13 and soybean prices are slated to notch the second-highest price on record for this year. High broiler and hog prices were the top contributors to the first annual increase in total animal product receipts since 2017, though dairy cash receipts are expected to decline after inflation adjustments.

Corn (+47%), wheat (+21%), and soybean (+16%) receipts account for the biggest share of increasing crop cash receipts in 2021 relative to a year prior. While higher commodity prices drove soybean and wheat gains, higher volumes sold in addition to high prices powered corn receipts to a staggering $71 billion in 2021, up from just under $50 million in 2020.

Wheat has a chance to notch higher price and quantity gains for 2022 receipts, however. The ERS dataset only gathers data through September 2021, so current high wheat prices – and potentially higher acreage for next year – are not likely to be reflected in net farm income estimates until 2022 projections are issued in February 2022.

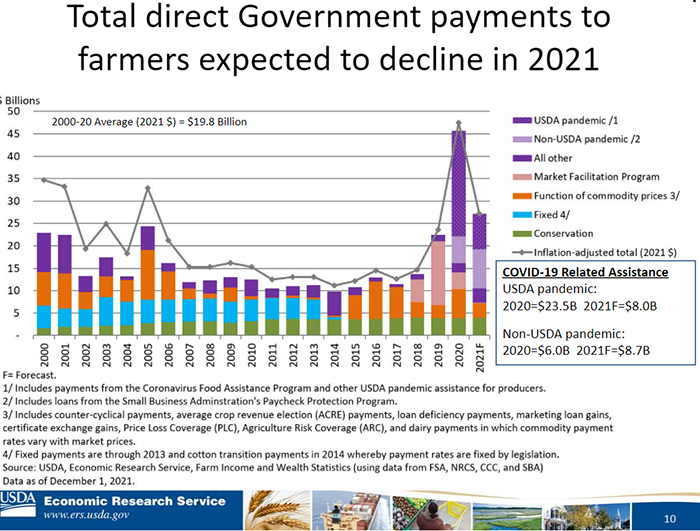

Easing government payments to farmers in 2021

Those gains came without the aid of government payments, which are expected to fall a staggering 40% from 2020 levels to $27 billion. Last year, Market Facilitation Program, Paycheck Protection Program and COVID-19 pandemic relief payments accounted for 48% ($46 billion) of U.S. net farm income.

As the pandemic wound down this year and with the end of MFP payments, only $27 billion in Federal direct farm program payments were issued with the lion’s share distributed through COVID-19 relief programs. That figure comprises 23% of U.S. net farm income in 2021.

Government payments to farmers have been closely watched in recent years and with good reason. Prior to 2018, government payments only contributed an average of 18% to U.S. farm net incomes. Litkowski cautioned that further revisions are possible to 2021 government payments to farmers as loan forgiveness requirements are finalized at the year’s end.

Litkowski also noted that ARC/PLC payments to farmers are likely to be nominal this year due to profitable commodity prices and does not expect further MFP payments in the future. An increase in Dairy Margin Coverage payments in 2021 was largely offset by small total ARC/PLC losses.

Additional profit pain points

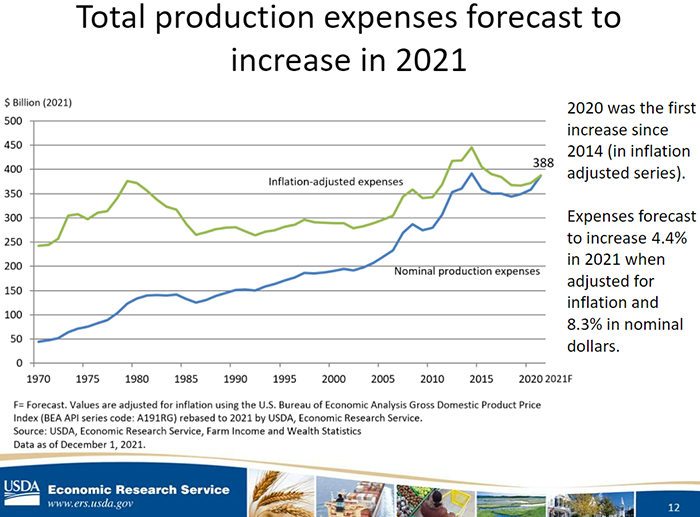

Rising production costs also ate away at farm profit margins across the U.S. this year. The latest ERS estimates peg rising fuel, raw materials, production and logistics costs as the primary drivers behind the nearly $30 million increase in production expenses between 2020 and 2021.

Bear in mind, ERS calculations also factor in 2022 prepaid input purchases booked in 2021. And today’s data was compiled from data collected in September 2021. So while these figures are represented in this current data set, ongoing supply chain issues and rising fuel costs this fall could further tighten 2021 profit margins and increase farm production costs in 2022.

Even with the shrunken government checks and rising costs, farmers still saw net cash farm incomes rise 11% from 2020 while net farm incomes rose 19% over the same period. The differences between the two measures are largely due to timing and accounting differences.

All told, the farm financial outlook is largely positive for the U.S. farm economy. Despite volatile markets and turbulent economic conditions, farmers are poised to end 2021 on a high note due in large part to strong commodity prices. Enjoy the margins now, because 2022 is likely to bring higher expenses and more potential for lower commodity prices based on current futures price spreads.

For the latest data released by USDA-ERS on Farm Sector Income and Finances, click here.

About the Author(s)

You May Also Like