Author’s note: These USDA reports typically contain a lot of numbers and charts. As an analyst, I positively adore these, but I understand from an audience perspective it is not always efficient to read. So I have bolded the key points from the latest update for an easier read. Enjoy!

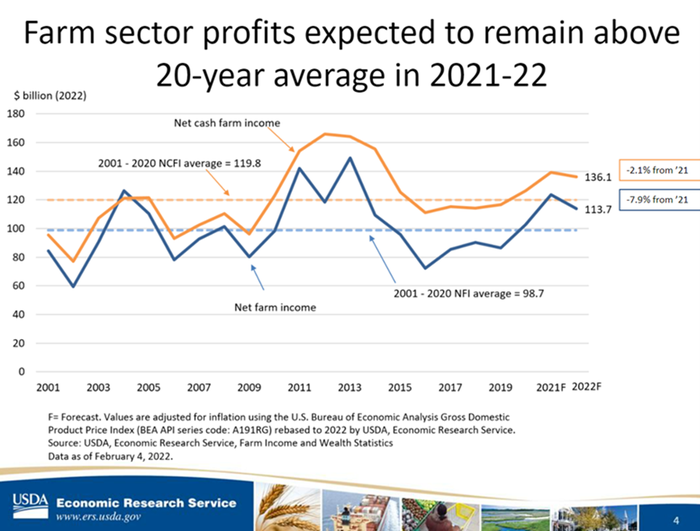

USDA’s Economic Research Service released its first look at 2022 Farm Financial Indicators today and the results were somewhat mixed for Farm Country.

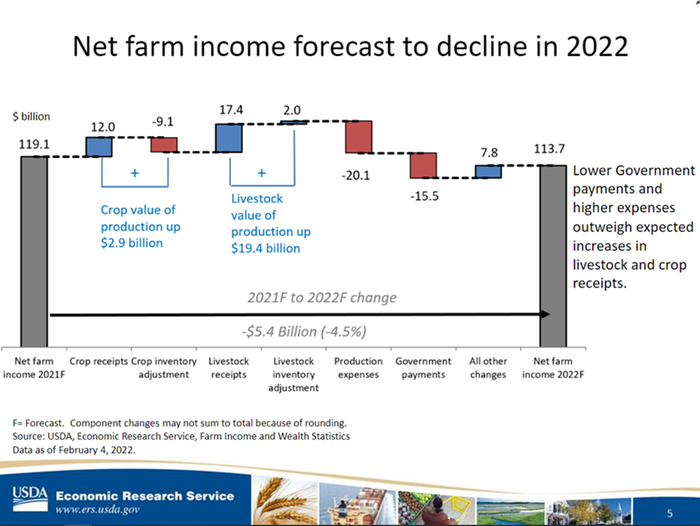

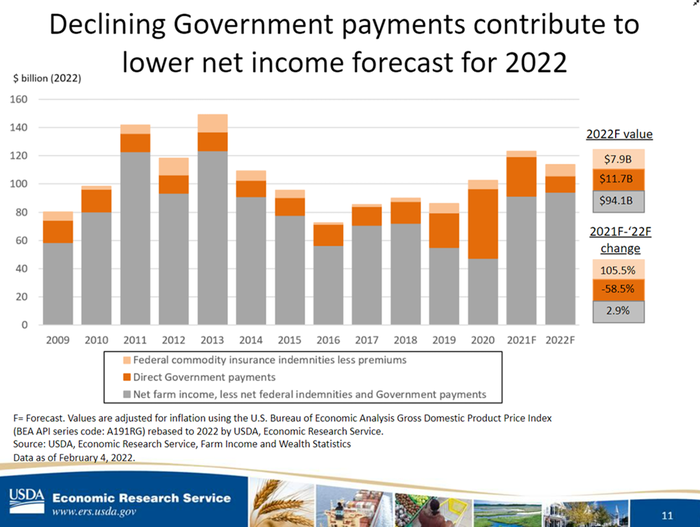

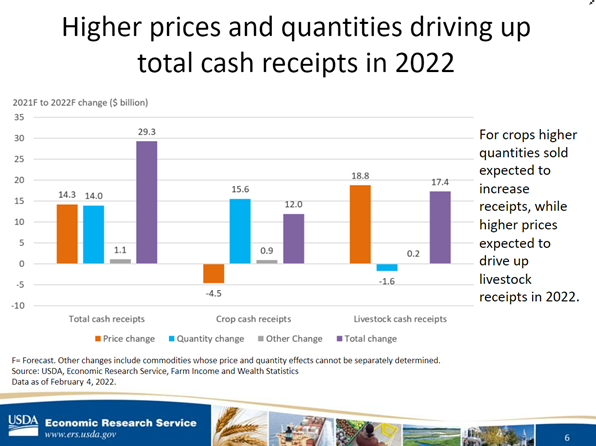

While 2022 cash receipts for crop and livestock sales are expected to rise 5.1% and 8.9% respectively on soaring commodity prices and inflationary pressures, the same phenomena will also limit the profit outlook. ERS forecasts an $18.1 billion (5.1%) annual increase in production costs. Cost increases and lower government assistance to farmers will be the contributing factors to the $5.4 billion annual loss in on-farm profits this year, leaving net farm income at $113.7 billion in 2022.

“All crop farms will see production costs rise and lower government payments in 2022,” Carrie Litkowski, senior economist and program leader in the Farm Economy Branch within ERS’ Resource and Rural Economics Division, said in a webcast on Friday afternoon.

The ERS revised previous forecasts for Calendar Year 2021 on-farm income $2.3 billion higher to a record-setting $119.1 billion on rising commodity prices late in the 2021 calendar year, which boosted cash receipts for crop (+$5.3B) and livestock (+$3.6B) sales.

To be sure, USDA’s 2022 farm income forecast of $113.7 billion is nothing to shrug at thanks to the high revenue potential of soaring commodity prices. It is the third largest annual net farm income in nominal terms in the history of the U.S. farm economy, trailing only 2013’s $123.7 billion and last year’s $119.1 billion net farm income hauls.

But for farmers struggling to navigate a high-cost environment and persistent supply chain issues, that fact likely offers little comfort, especially as many operators begin to develop longer-term forecasts.

High production costs & inflationary pressures

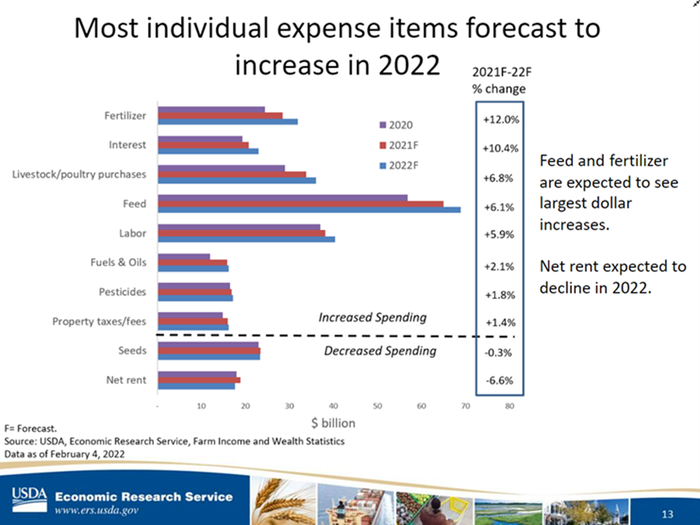

“Nearly all categories of expenses are forecast to be higher in 2022, with feed and fertilizer-lime-soil conditioner purchases expected to see the largest dollar increases,” the ERS Farm Income team stated on its website.

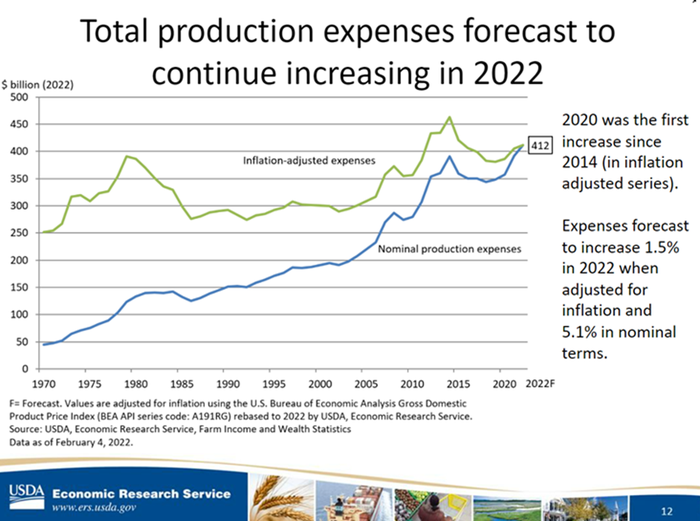

Litkowski observed that when adjusted for inflation, 2022 farm input costs will be the highest since 2015. “We’re expecting production expenses to increase in both 2021 and 2022 in the inflation-adjusted series,” Litkowski noted.

Total production expenses in 2022 will rise to the highest level since 2015, after being adjusted for inflation. Much of that increase is tied back to higher feed prices, which are derived from high grain prices currently trading in the market. Feed is also the largest expense in the farm sector, magnifying the ag industry’s pain.

“We’re forecasting higher prices to continue trending into 2022,” Litkowski warned. Fertilizer costs in 2022 are slated to rise 12% - the largest annual increase from 2021 of all the aggregate input costs. High NPK prices are the chief driver behind the surge, but Litkowski also hinted that USDA is forecasting higher acreage in 2022 that will require additional fertilizer spending.

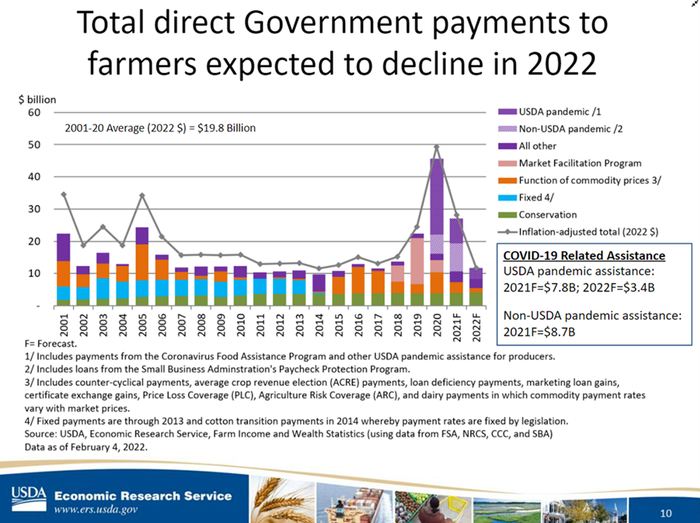

Waning government support

Government payments to farmers in 2022 will drop 57% from last year to a mere $11.7 million – the smallest subsidy volume directly paid to farmers since 2017. Government payments in the four previous years totaled an astounding $108.9 billion due to ad hoc programs, such as Market Facilitation Program and COVID-19 relief payments.

Payments trended lower following 2020 and have fallen $34 billion in the two years following the pandemic’s onset and disastrous trade relations with China. “Government payments are another source of income for farmers and have been rather volatile in the last several years,” Litkowski surmised.

Thankfully, strong cash receipts will play a major role in offsetting much of the pain associated with less government support, especially as smaller sums are paid out from crop revenue insurance programs such as the Agriculture Risk Coverage and Price Loss Coverage programs in the era of high commodity prices.

“In 2022, net farm income, less net federal indemnities and government payments, will rise 2.9%,” Litkowski shared, offering little hope for further government assistance in 2022.

Implications for row crop producers

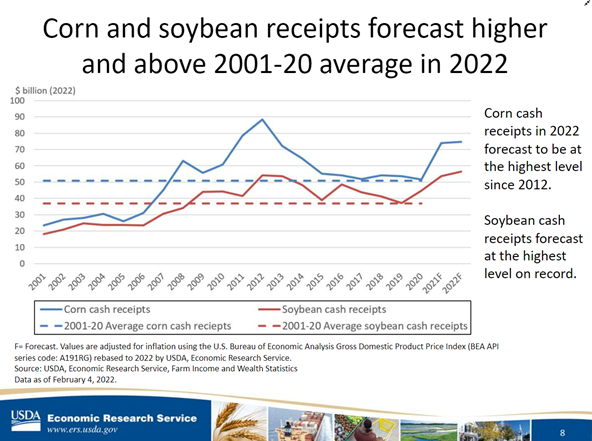

While cash receipts are on the rise, the timing of farmer sales will factor heavily into 2022 profit outlooks. “Crop receipts are forecast to increase $12 billion in 2022,” said Litkowski. “But about $9 billion in crop sales in 2022 are expected to be from 2021 inventories.”

The ERS increased 2021 cash receipts for crops and livestock by $5.3 billion from earlier December 2021 forecasts to reflect sales of 2021 crops in the 2022 calendar year at current high forecasted prices. Crop sales accounted for more than two-thirds of the revised uptick.

And it’s a trend that will likely stick through the 2022 calendar year. Litkowski’s team found that higher quantities of soybean, corn and wheat sales in 2022 are likely to be the driving force behind the record cash receipts. Corn and soybean cash receipts will top out at the “highest level since their peak in 2012,” Litkoski noted.

“We can do a simulation to find if the change is coming from higher prices or higher quantities sold,” Litkowski explained, citing National Agricultural Statistics Service data as the primary source of farmer selling patterns in the marketplace.

Unfortunately, price could be a limiting factor for cash sales. USDA expects more acres to go into crop production in 2022, which could limit upward price potential for row crop farmers.

Dynamics in the livestock market are likely to be opposite. “I think it’s very interesting that crops and livestock tell such a different story when you look at it from this perspective,” Litkowski mused after explaining that higher livestock cash receipts in 2022 are likely to be earned on higher prices and fewer quantities sold this year.

Awaiting the rest of 2022

“Historically, the [farm] balance sheet is strong,” Litkowski assured audience members. “Debt [in 2022] is forecast to fall slightly in inflation adjusted dollars – about 1%.”

Litkowski observed that while farm-level debt loads remain relatively low and are likely to be stable in 2022, the value of farm assets is likely to decline at a faster rate than growing debt levels.

But even with the higher farm leverage, the ag balance sheet and income statement largely reconcile a healthy farm economy. In 2020, Chapter 4 bankruptcies fell 4% from the previous year. “In 2021, we expect bankruptcies to fall further,” Litkowski forecasted, noting that only bankruptcy data through September 2021 is currently available.

The dairy industry is slated to see the most significant net cash farm income growth in 2022, which is a welcome reprieve after multiple years of depressed prices. “Milk receipts will increase 18%, which should be enough to offset higher costs and lower government payments,” Litkowski predicts.

Crop farms are projected to remain profitable, but the tightening profit margins in 2022 are an unwelcome caveat to optimism throughout the Heartland. Time will be the ultimate decider of profit margins in 2022, but even with higher production costs and lower government payments farmers still have plenty of chances to capture profits in 2022.

Find more information about the 2022 Farm Sector Income Forecast here.

About the Author(s)

You May Also Like