Farmers aren’t the only ones hoping for another round of Coronavirus Food Assistance Program (CFAP) direct payments. Bankers stand to be the largest beneficiary of a second helping of CFAP relief, according to our most recent Farm Futures survey.

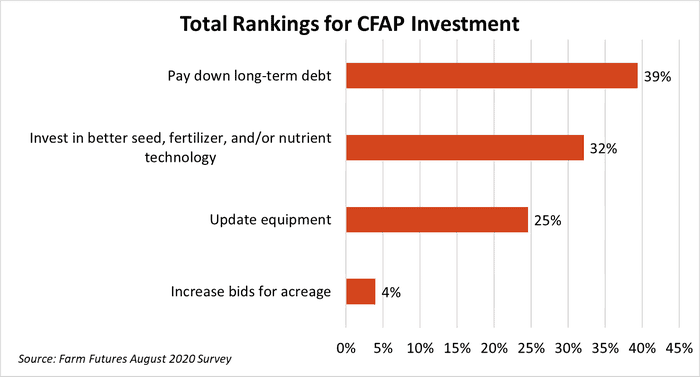

In a mid-July 2020 poll of 1,044 respondents, farmers say they will likely use CFAP payments to pay down long-term debt as opposed to spending the aid on operational investments like more expensive inputs, updating equipment, or increasing cash rent bids. The survey took place July 14-27 via an email questionnaire.

About 39% of total survey responses favored using CFAP funds to pay down long-term debt over the other options. The finding correlates with another survey question as nearly half of survey respondents agreed with the statement, “I worry about paying back the debt I owe.”

This year’s farm balance sheets are forecast to show the highest debt-to-asset ratio for the farm sector since 2003. Farm sector debt is expected to increase by 2.3% from 2019 debt levels to $425.3 million in 2020, according to Economic Research Service (ERS) data released earlier this year.

This survey finding may be welcome news to bankers concerned about debt repayment capacity. Year-to-date family farm bankruptcies through June 2020 are 8% higher than the same period a year ago. Filings in the Midwest rose 23% during that time as low commodity prices cut profit margins across production agriculture.

CFAP payments will make up over a third of 2020 farm income according to a June report from the Food and Agricultural Policy Research Institute. The percentage could go higher if Congress is able to finalize a second stimulus package before 2021.

Combined with other government programs for farmers, including traditional farm safety nets (ARC/PLC), Market Facilitation Program (MFP) payments, and federally subsidized crop insurance, farmers will rely heavily on the government to help prop up net farm income. Farm income forecasts for 2020 are already slated to fall 15% lower from last year to $102.2 billion.

Farmers ranked investments into enhanced seed, fertilizer, and/or nutrient technology as the second most likely area of expenditure upon receipt of CFAP payments at 32%. Updating equipment (nearly 25%) was third while farmers were least likely to increase bids for land purchases or rentals (4%) after receiving CFAP relief.

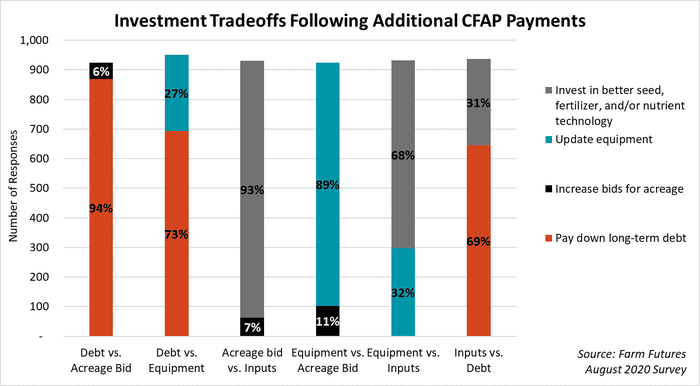

Growers in the Farm Futures survey were slightly mixed on their preferences between using CFAP aid to purchase higher-yielding inputs or update equipment. But when survey respondents were asked to choose between the two options, 68% of farmers preferred using relief money to purchase seed, fertilizer, and/or nutrient technologies that would increase yields.

Steady land, rent prices decrease incentive to raise bids

Farmers were least likely to increase bids for additional acreage with government relief money in the Farm Futures survey. In fact, only seven of 1,044 survey respondents specifically cited high cash rents as a reason for losing sleep at night. So what does that mean for land prices?

Updated 2020 farmland values released from USDA earlier this month found that on average, 2020 farmland and pasture values will likely remain unchanged from 2019 at $4,100/acre and $1,400/acre, respectively. More importantly, cash rents on non-irrigated cropland in the top 10 corn producing states stayed steady at $157/acre between 2019 and 2020.

Land owners have the most to gain from more government payments to growers. A 2016 University of Illinois study found landlords capture an extra $0.20-$0.28 of every additional dollar of government subsidies to agricultural producers.

But with stabilized land values and rents in addition to shrinking revenues, farmers have little incentive to increase cash rent bids. As commodity prices continue to trade below break-even levels, paying off debt will likely take precedence over most other investments as farmers receive additional stimulus relief.

Read more about:

Covid 19About the Author(s)

You May Also Like