June 7, 2022

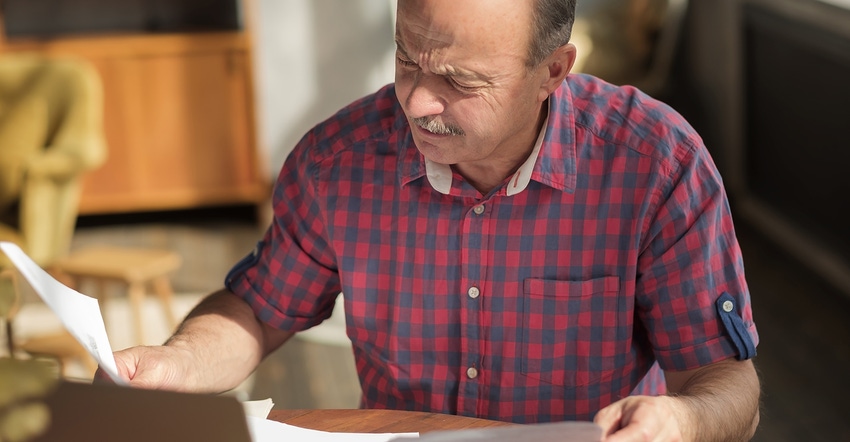

Despite strong commodity prices, producers are very concerned about their farms’ financial performance in 2022. The Purdue University-CME Group Ag Economy Barometer dipped in May to its lowest level since the early days of the pandemic in spring 2020.

The latest report indicates a rise in the percentage of respondents who feel their farm is worse off financially now than a year earlier, an indication that escalating production costs are troubling producers. When asked what their biggest concerns are for their farming operation, once again producers chose higher input costs as the biggest issue facing their farming operation in the upcoming year.

Financial outlook weakens

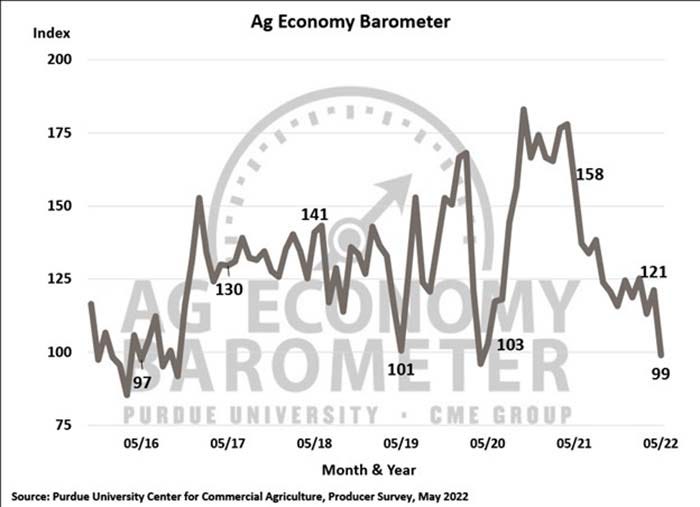

Producers exhibited a much more negative view of their farms’ financial situation this month as the Farm Financial Performance Index fell 14 points from April’s reading of 95 to 81 in May. The percentage of producers who expect their farm’s financial performance this year to worsen compared to last year rose from 29% in April to 38% in May.

Responses received to the financial performance question this May were nearly the polar opposite of responses received a year earlier. In May 2022, 38% of producers said they expect worse financial performance for their farms compared to a year earlier with just 19% of respondents expecting better financial performance.

This stands in contrast to a year earlier when 42 percent of survey respondents expected better financial performance while just 16% said they thought a worse financial performance was likely. Over the course of the last 13 months, the Index of Farm Financial Performance has fallen 41% below its life of survey high of 138 set in April 2021. The decline points to farmers’ lack of confidence in their farms’ financial outlook.

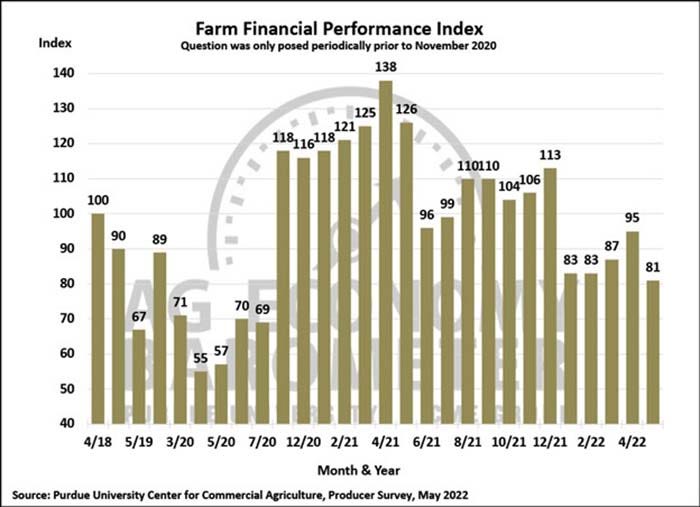

Postponing farm investments

Producers mostly agree now is not the best time to make large investments in their operations. The Farm Capital Investment Index drifted lower in May to 35, a new low for the index. In this month’s survey, only 13% of respondents said this is a good time to make large investments in their operation while 78% said they viewed it as a bad time to invest in things like machinery and buildings.

Half of the producers in this month’s survey said their machinery purchase plans were impacted by low farm machinery inventory levels, up from 41% in the April survey, suggesting that supply chain issues are at least partly responsible for the ongoing weakness in the capital investment index.

High production costs

Nearly 6 out of 10 producers said they expect prices paid for farm inputs in 2022 to rise 30% or more compared to prices paid in 2021. The percentage of producers expecting costs to increase this dramatically has risen sharply since the end of 2021, shifting from 38% of producers in December who expected costs to rise by 30% or more to this month’s 57% of all respondents.

For the second month in a row, the May survey asked producers about their expectations for input costs in 2023 compared to 2022. This month nearly 39% of producers said they expect costs next year to rise 10% or more compared to this year’s already inflated costs. Compared to the April survey, fewer producers this month said they expect to see input prices decline next year. In April, 18% of respondents were anticipating lower input prices in 2023, but in May just 12% of producers said they expect input prices to fall back in 2023.

Noticeably fewer producers this month reported having difficulty purchasing crop inputs for the 2022 crop season than in prior surveys. Among those producers who still reported difficulties, problems were apparent in all major input categories including herbicides, farm machinery parts, fertilizer and insecticides.

Farmland values hold strong

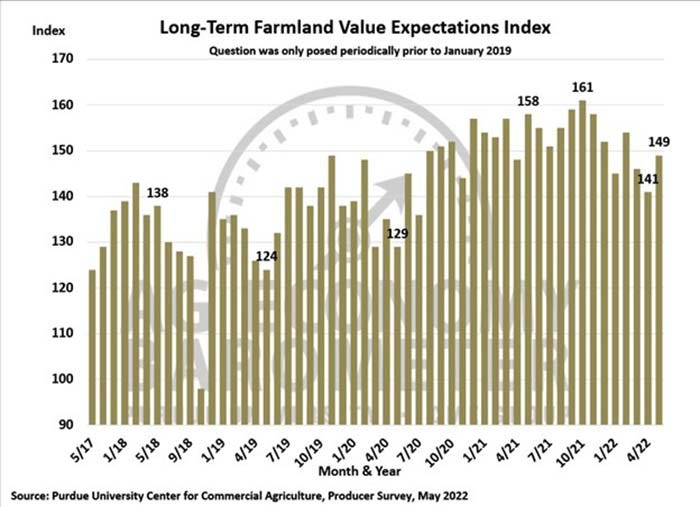

Overall, farmers remain relatively optimistic about farmland values. The Long-Term Farmland Value Expectations Index, based upon producers’ farmland outlook over the upcoming 5 years, rose 8 points in May to a reading of 149. This month’s reading takes the long-term index back to its pre-pandemic (February 2020) level.

The Short-Term Farmland Value Expectations Index, based upon producers’ 12-month outlook, at a reading of 145 was virtually unchanged from a month earlier. Both the short and long-term farmland indices in May were 7 to 8% below the peak levels attained last fall.

For the last several months, the monthly survey has included a follow-up question posed to respondents who expect farmland values to rise over the next 5 years, asking them about the main reason they expect values to rise. Respondents have consistently chosen non-farm investor demand as the top reason followed closely by inflation. Interestingly, few respondents chose strong farm cash flows or low interest rates as the main reason they expect farmland values to rise.

Wheat production

The war in Ukraine has disrupted food production and distribution leading to serious concerns about the availability of food supplies, especially in importing countries. Multiple policy proposals have been discussed in the U.S. as a means of encouraging more wheat production. This month’s survey included several questions focused on crop producers’ wheat production plans and how they might respond to policy proposals.

Approximately 30% of the respondents to this month’s survey said they have used a wheat/double-crop soybean crop rotation at some time in the past. Twenty-eight percent of the producers who have experience with a wheat/double-crop soybean rotation said they plan to increase the percentage of their farms’ cropland devoted to this rotation by planting more wheat in fall 2022. The shift towards increasing wheat acreage is likely the result of the expected profitability improvement of the wheat/double-crop soybean rotation.

One of the policy proposals discussed by the Biden administration is a $10/acre double-crop soybean crop insurance subsidy to make this crop rotation more attractive to producers. This month’s survey asked respondents if the subsidy would encourage them to plant more wheat in fall 2022 than would otherwise be the case. Among producers who have employed a wheat/double-crop soybean rotation in the past, just over one in five (22%) said it would encourage them to plant more wheat. Among producers who have not followed a wheat/double-crop soybean rotation in the past, just one out of ten producers said the insurance subsidy would encourage them to plant more wheat this fall.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from May 16-20, 2022.

Source: Purdue University-CME Group, which are solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like