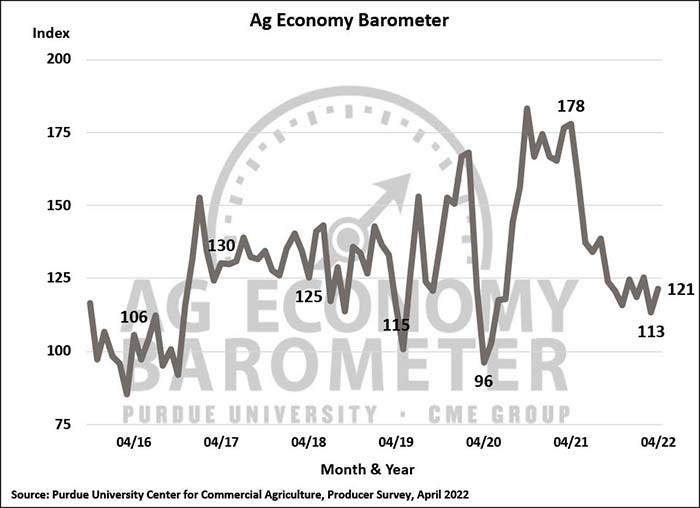

The Ag Economy Barometer improved in April to a reading of 121, up 8 points from the previous month. The modest rise in sentiment stems from improved commodity prices, contributing to a stronger financial outlook.

Eastern Corn Belt cash prices for corn in mid-April rose more than 10% above their mid-March. Bids for fall delivery of 2022 crop corn climbed 20% over the same period. Soybean prices rose as well, despite USDA’s planting intentions report highlighting surprisingly large 2022 soybean acreage. Near-term delivery prices for soybeans rose about 7% from mid-March to mid-April while bids for fall delivery of new crop soybeans climbed 5% over the one-month span.

Despite this month’s increase, the ag sentiment index remains 32% lower than the April 2021 reading.

Input prices still top-of-mind

Farmers say their top concern is still higher input costs. It’s hard to overstate the magnitude of the cost increases producers say they are facing. This month, 60% of survey respondents said they expect input prices to rise by 30% over the next 12 months.

When asked specifically for their expectations for 2023 crop input prices compared to prices paid for 2022 crop inputs, 36% of respondents said they expect prices to rise 10% or more and 21% of crop producers said input price rises of 20% or more are likely.

The war in Ukraine continues to present uncertainty for producers. The majority of farmers believe the biggest impact of the war on U.S. agriculture will be on input prices.

Looking ahead to 2023, over half of crop producers expect input prices to rise above 2022’s inflated level and one out of five crop producers expect input prices to rise 20% or more compared to this year.

Crop input challenges extend beyond their inflated cost. Availability is also a concern. Herbicide availability was the top problem reported by producers in April, followed closely by farm machinery parts and fertilizer.

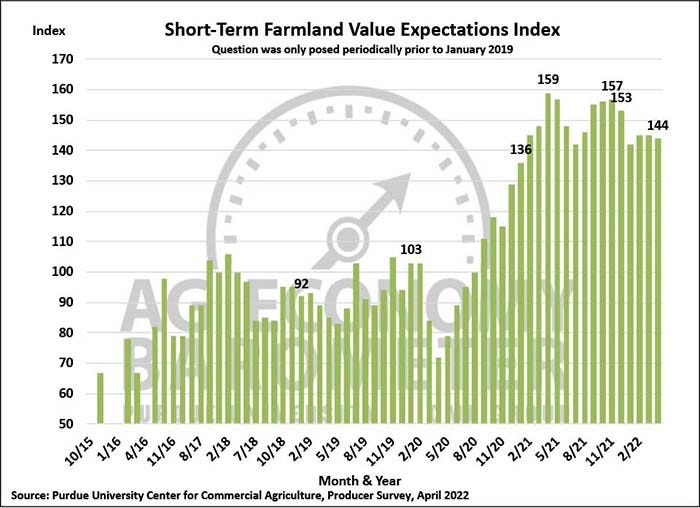

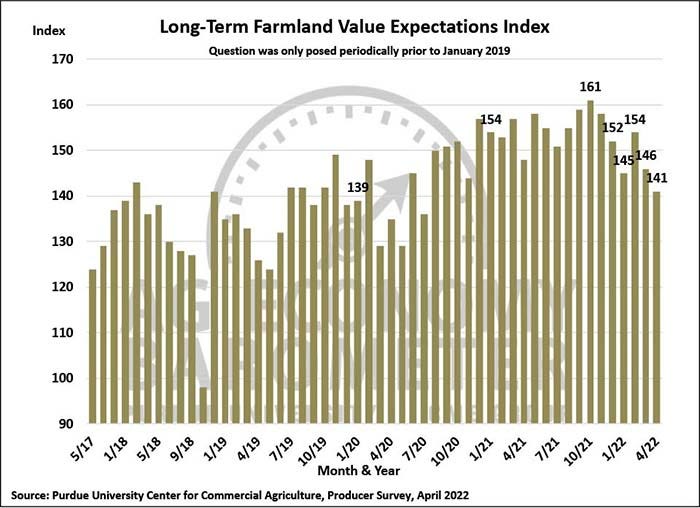

Farmland values peak

Both the short-term and long-term farmland value indices declined 5 points in April. Expectations for continued increases in farmland values appear to have peaked last fall. Three-month moving averages of both the short and long-term indices in April were 7-8% below the peak values reached in November.

Survey responses suggest a shift among producers from expecting values to increase to expecting farmland values to remain about the same.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from April 18-22, 2022.

About the Author(s)

You May Also Like