Not everyone is going to be happy, but discussions about farm business transitions need to occur, and the sooner the better.

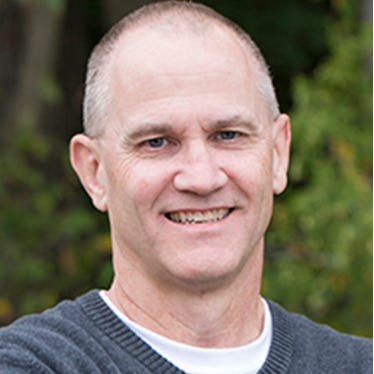

“The hugs will come later,” says Alan Hojer, from his eight years of experience working with farmers in estate planning and transitioning for the next generation. In his position as a certified estate planner with Keep Farmers Farming, a division of First Dakota National Bank, Hojer helps make these transitions as seamless and painless as possible.

He says it’s important to get the farm elders’ plans out in the open, especially if there is another generation looking to move into place. “No. 1, this is your decision, and always keep your decision under your control,” he tells the patriarch and matriarch of an operation. “But No. 2, your children are at the age where they are trying to plan for their children. All you’re doing is taking an unknown and making it a known. It will help them with their children.”

Having those discussions can be hard, but maybe the toughest part is simply getting started. Hojer suggests starting over a cup of coffee.

“But what if they get mad?” is often one of the first questions Hojer hears from the parents. “It’s your stuff; it’s not their stuff. You’re giving them gifts,” he says. “I don’t think it’s about being mad; I think it should be about discussion. That’s why I’m there to help you through this.”

Having those serious discussions lets everyone knows what is at stake. “And who knows, maybe after all the discussion, something will be said that actually gives you more peace than what you have today,” Hojer says. “Don’t expect it to be this great big ‘hug fest’ right away, because that never happens. People need time to digest the information.”

Part consultant, part psychologist

Even though Hojer is employed by a bank, he is not a lender, does not offer financial advice and is not selling anything.

“I sell me as a consultant to help them through,” he says. “I get into a lot of business management, because we are talking transition. And when you bring in the kids, we get into the numbers to make sure things work. Really, what we do is help with wealth transfer. Somebody has to help these operations transfer wealth from one generation to the next — instead of at the end and when somebody passes, we’ll get into this big family fight.”

Since he’s not selling anything, Hojer feels he can simply listen to clients and be an objective third party. He can also relate to the farmers, as his family’s beef farm near Lake Preston is currently transitioning to his son.

“So much of this is that I’m living it, too,” he says. “I get what these people are going through because I’ve gone through all those same thoughts. I’m not a psychologist, but I’m getting that degree today working with these farmers.”

In his role, Hojer stresses the importance of having a transition plan and sticking with it, as statistics show there’s a 94% to 96% failure rate without a plan.

“The reason for that failure rate is it [farm] just won’t stay in the form that it is today,” he says. “It’s generally because the people involved don’t know how to put in the structures. It’s just they don’t have the skills to deal with all the complexities you need to deal with.”

Fragmentation not failure

To some, the breaking up of a generations-old family farm is a failure.

“I don’t see it that way,” Hojer says, adding that for some operations breaking up the operation simply may be a different approach to finding success. “They didn’t get to choose their partners; we as parents chose it for them.”

Hojer says birth order presents different dynamics when talking farm transitions. “We were raised together, we fought together, and we’re supposed to be best friends,” he says. “The oldest was told to take care of the younger ones, and the younger ones were told to follow the oldest. … We’re in this business where you’ve got to count on this person to your left and to your right all the time, and you didn’t choose them. Think of the impact. So fragmentation in my mind can be a form of success.”

If fragmentation is the best option, Hojer suggests that multiple parties consider the efficiencies of the operations. “Do we need two combines, where we really only need one?” he asks. “If we can maintain the efficiencies, it can be a very successful path forward.”

Hojer acknowledges self-guided workbooks and systems are available to help producers work through transition planning and estate planning, but he feels he offers clients what those programs lack — accountability.

“Somebody needs to be there to hold people accountable, which is a good thing to help them get from point A to point B, because there’s plenty of good materials out there but people just don’t get it done. I’m going to hold people accountable, because that’s what they’re hiring me to do.”

Monitoring success

Hojer’s work is done when his client is at peace and confident in the developed estate plan.

When he starts working with farmers on developing a transition plan, Hojer needs to build trust with the farmer, just as he trusts that they will listen to him and heed his advice.

“If you’re willing to help yourself, I’ll be all in. But if you’re not, I’m out,” he says. “I neither have the time nor the energy to sit in these operations for years when you’re not committed to making the changes that need to be made. My goal is always to get fired. That’s not a bad thing. It’s a good thing because that means you don’t need me anymore.”

About the Author(s)

You May Also Like