Reminders of Chinese tariffs on U.S. farm exports are rarely far from the mind of the market, and the latest news today underscores that point once again.

While weekly data on sales and shipments out today was disappointing, soybean futures surged more than 15 cents after President Trump tweeted he’d had a long discussion with Chinese President Xi on trade. The two will meet at the end of the month at the G-20 summit.

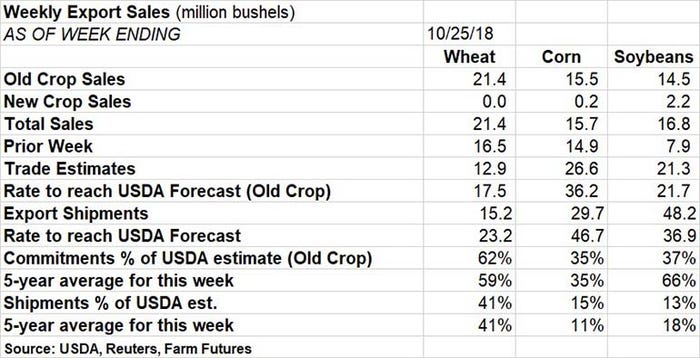

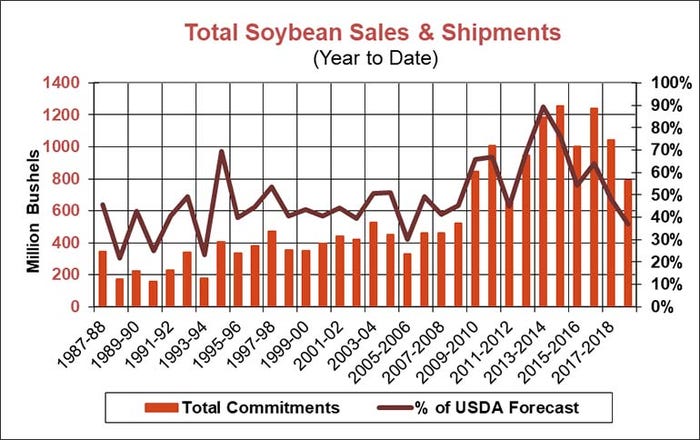

Weekly soybean bookings stayed sluggish, as loss of the crop’s biggest foreign market was painfully obvious. Net new sales came in at 16.8 million bushels, and 2.2 million of that was delivery during the 2019 marketing year. Total sales and shipments are running nearly 30% below year ago levels, two months into the selling season.

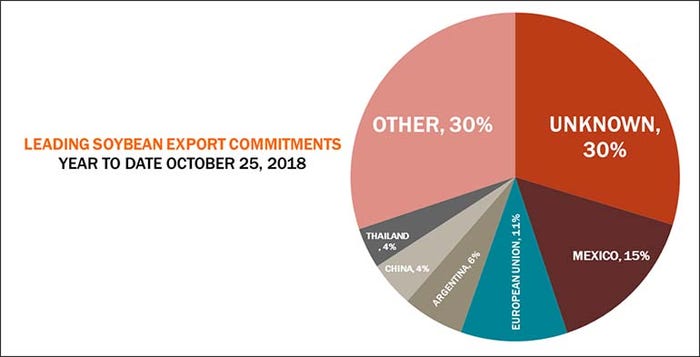

China shipped out four loads of U.S. soybeans in September and October, but the disposition of those cargos created more headwinds for soybeans today. Three of the ships changed destinations to other Asian countries and the fourth is still anchored well offshore of China weeks after arrival there. China still has 25 million bushels of unshipped sales on the books but one cargo was cancelled outright last week and another sale switched to the UK.

The biggest customers so far for U.S. soybeans? Unknown destinations and “other,” as a lot of little buyers pick up small amounts thanks to U.S. prices that are 25% cheaper than those out of Brazil.

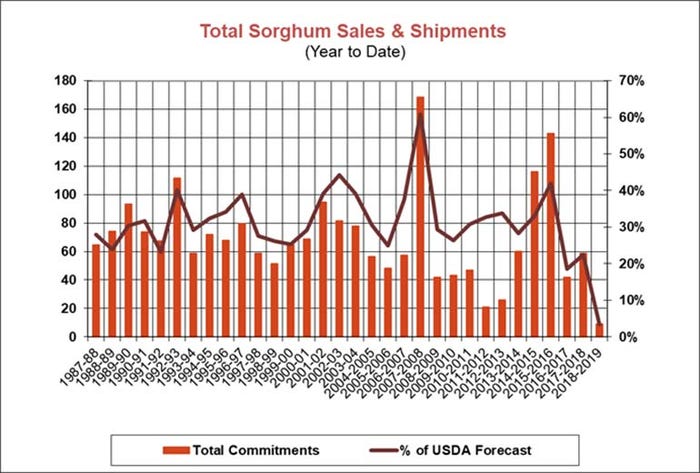

China wasn’t expected to buy a lot of U.S. corn before the tariffs hit, but sorghum sales were popping early in 2018. With that business for “milo” shut off, sales remain dismal. Mexico and South Africa bought a little of the feed grain, but year-to-date sales and shipments are the lowest in at least 30 years.

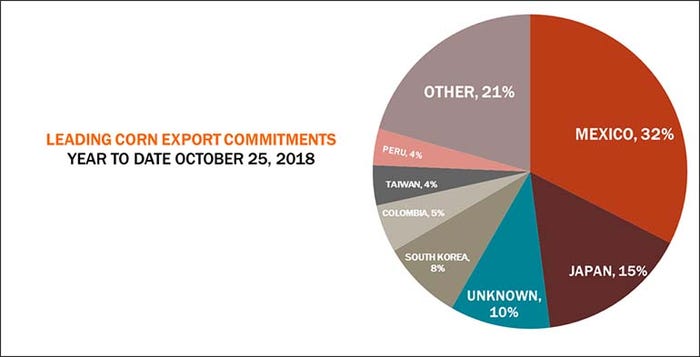

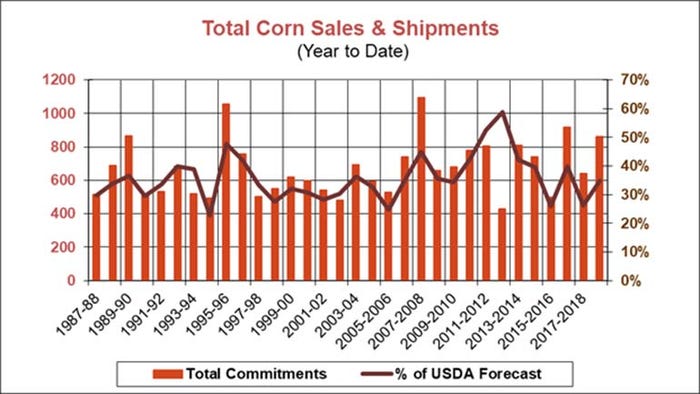

After a brisk start to the marketing year, corn sales have also tailed off. Net new bookings last week totaled 15.7 million bushels, most of it 2018 crop, more than 20 million bushels below the rate needed every week through August to reach USDA’s forecast for record shipments. Mexico, which accounts for a third of U.S. commitments so far, was again the biggest individual buyer, taking 7.6 million bushels.

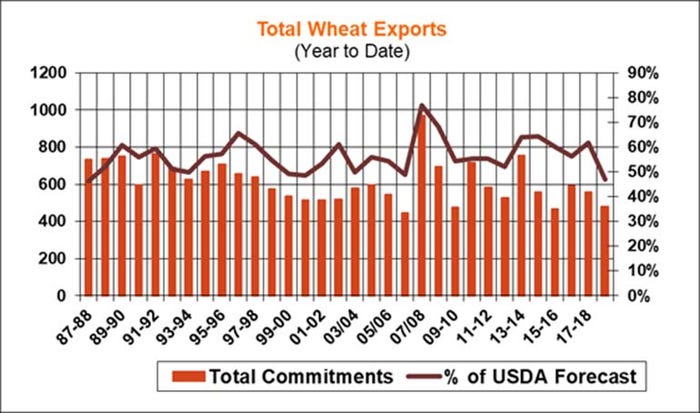

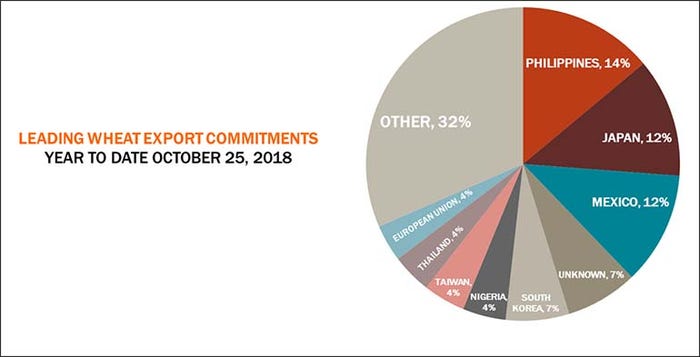

Traders had expected a pick up in corn and soybean exports with wheat lagging. But wheat turned out to be the only bright spot in today’s report. Net new bookings totaled 21.4 million bushels, the most in a month, with Japan taking 4.4 million bushels to lead all buyers. Total sales and shipments have reached 62% of USDA’s forecast for the 2018 crop, a little ahead of the normal pace.

The wheat market got some more potentially bullish news today as well. Reports out of Russia suggest authorities could halt shipments from two key Black Sea regions due to concerns over quality. These reports have emerged several times over the past couple of months but failed to halt aggressive Russian sales. Still, Egypt did purchase a load of U.S. soft red winter wheat last week, its first such purchase in more than a year.

Click the box in the upper left-hand corner of the interactive to bring up a list of crops, then mark the box of the crop to see complete country-by-country details for export sales and shipments.

About the Author(s)

You May Also Like