Even though China continues to dominate sentiment in the soybean market as trade talks continue to progress, the actual delivery of the grain remains unimpressive, with another week of lower-than-expected soybean inspections for the week ending April 11, according to Farm Futures senior grain market analyst Bryce Knorr.

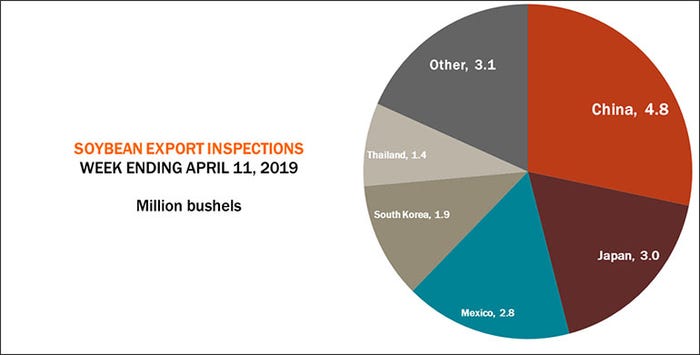

“With just 4.8 million bushels of last week, China has now accounted for just 18% of total U.S. shipments so far during the 2018/19 marketing year,” he says. “Normally, the world’s largest importer accounts for 60% of U.S. exports.”

China still has 292 million bushels of soybeans purchased from the U.S. on the books, but buyers may be waiting for a trade deal to be signed, Knorr notes.

“River terminals boosted bids last week, even though much of the Mississippi remains closed to navigation, likely anticipating very heavy movement for the rest of the spring and summer,” he adds. “But it may be difficult for a lot of new sales to be added for 2018 crop delivery because demand in China is down around 18% due to devastation to the hog herd caused by African swine flu.”

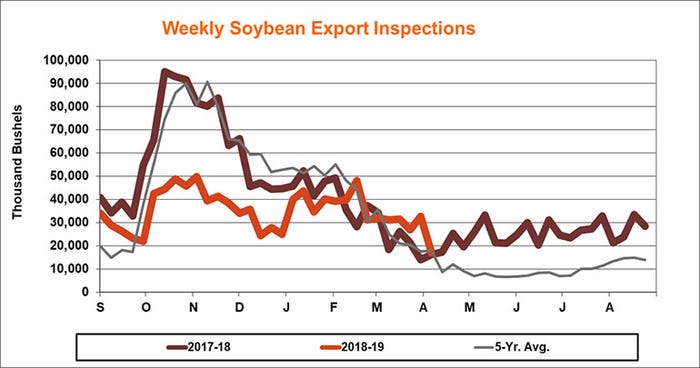

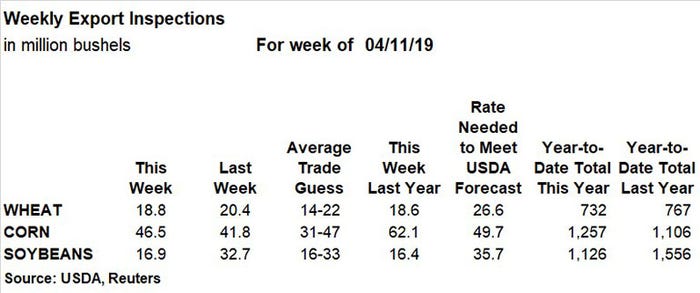

Last week, soybean export inspections reached just 16.9 million bushels, about half of the prior week’s tally of 32.7 million bushels and on the low end of trade guesses, which ranged between 16 million and 33 million bushels. The weekly rate needed to match USDA forecasts moved up to 35.7 million bushels, and cumulative totals for this marketing year remain 27% lower than a year ago, at 1.126 billion bushels.

China was the No. 1 destination for U.S. soybean export inspections last week, with 4.8 million bushels. Other leading destinations included Japan (3.0 million), Mexico (2.8 million), South Korea (1.9 million) and Thailand (1.4 million).

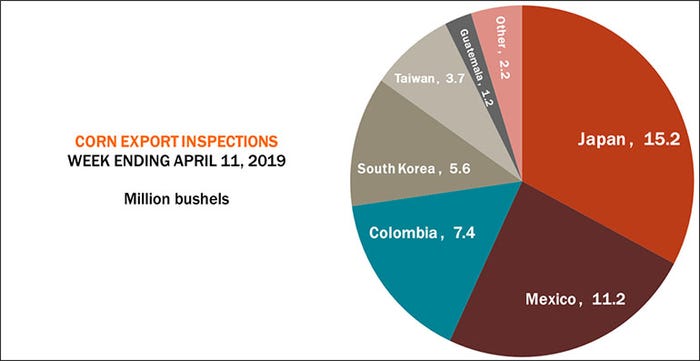

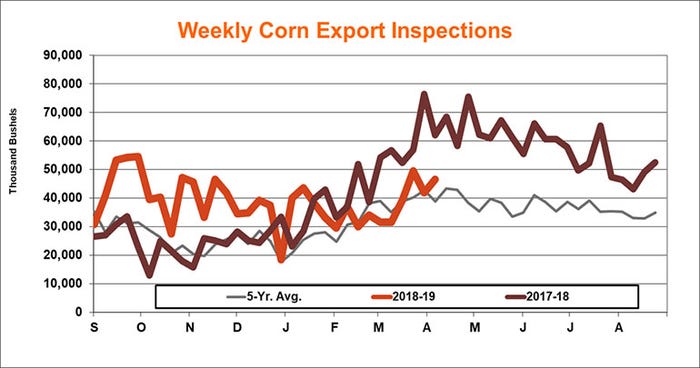

Corn export inspections fared much better last week after reaching 46.5 million bushels. That was slightly ahead of the prior week’s tally of 41.8 million bushels and on the high end of trade estimates that ranged between 31 million and 37 million bushels. Still, the weekly rate needed to match USDA forecasts inched higher to 49.7 million bushels. Cumulative totals for 2018/19 are now at 1.257 million bushels, trending 13% higher year-over-year.

Japan was the No. 1 destination for U.S. corn export inspections last week, with 15.2 million bushels. Other top destinations included Mexico (11.2 million), Colombia (7.4 million), South Korea (5.6 million) and Taiwan (3.7 million).

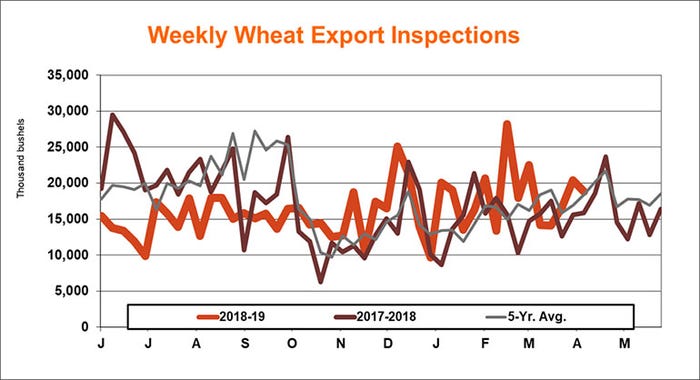

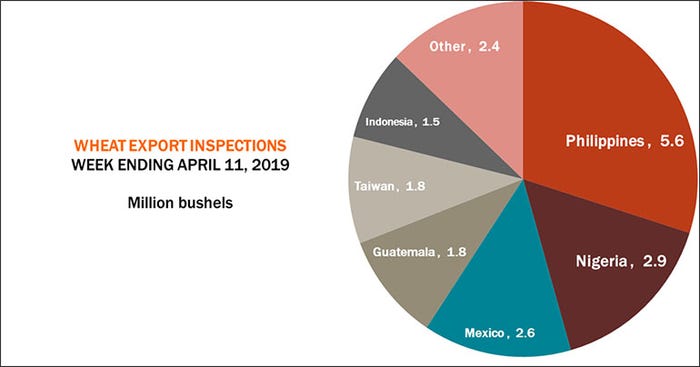

Wheat export inspections reached 18.8 million bushels last week, down slightly from the prior week’s total of 20.4 million bushels and in the middle of trade guesses, which ranged between 14 million and 22 million bushels. The weekly rate needed to meet USDA forecasts continues to drift higher, now at 26.6 million bushels. Cumulative totals this marketing year have reached 732 million bushels, which is 4.5% lower year-over-year so far.

The Philippines were the No. 1 destination for U.S. wheat export inspections last week, with 5.6 million bushels. Other top destinations included Nigeria (2.9 million), Mexico (2.6 million), Guatemala (1.8 million), Taiwan (1.8 million) and Indonesia (1.5 million).

About the Author(s)

You May Also Like